You have options to protect your future revenue whether you are a hog producer, or your livelihood depends on the pork market.

April 8, 2019

The elephant in the room for the entire protein industry is, of course, African swine fever and its impact on prices. Much has been written and postulated in this forum about how high and when prices peak.

The truth is simply this: nobody knows. We can identify the parameters and make our best guesses, but they are little more than that (guesses) at this point. It is against this backdrop of the unknown that I would like to encourage all market participants — producers and allied industry — to consider the largesse the market has provided and act judiciously as we roll forward. To that end, I have a couple observations and thoughts to share.

First, as producers, we need to change our concept of “normal.” This is anything but a normal market. Historical references of spread values or seasonal tendencies should be thrown out the window. We are not in Ordinary Time, we are in Special Time and need to recognize the landscape as different than what the rear-view mirror may have hinted for future events. I understand the desire to establish hedges at today’s favorable levels and your banker is likely to encourage the same if your balance sheet can tolerate the potential margin calls. I am encouraged by the willingness of our primary lenders to assure producers that we-got-your-back when it comes to margin money. I do not see a financial crisis on the immediate horizon given the attitude and commitment of our industry bankers.

Second, I am a huge fan of options in this environment. Volatility had gone sky high, settled down for a week, and is now back on an incline. I like giving the market some discovery room and options allow that to occur. This is no time to get clever by selling multiple calls for every put purchased. Historical comparisons may indicate we are in favorable conditions for such — we are not. We simply cannot artificially impose our will on the market; we need to let it breathe and morph before we get too cute.

Next, I want to encourage those who derive a significant stream of earnings from the industry to consider what happens to your cash flow in the event we have a catastrophic event that impacts the United States. If, for instance, you are vending a product to pork producers that has a good margin associated with the sale and little cross-species application, you may want to think hard about what actions you can initiate to protect your revenue if a downturn were to occur. There are some relatively simple exercises and assumptions to identify, after that it is a risk-reward evaluation. We can help if this is of interest, I think it is important to have an allied industry on the backside of any financial turmoil to be along side producers as we rebuild an industry should we experience a devastating event. The ASF insurance product offered by ONI Risk Partners may provide you a structure and coverage that works for you, too.

My point to all of this is that you have options to protect your future revenue whether you are a producer, or your livelihood depends on the pork market. Call us if you want more detail on these items.

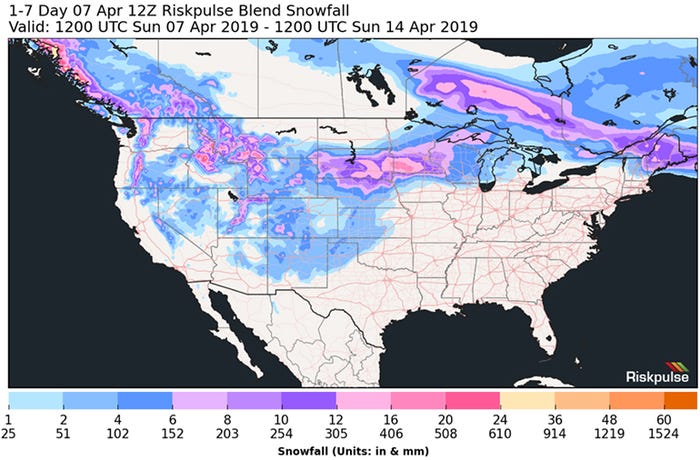

Perhaps lost in the shuffle of ASF talk was the recent grain report that rocked the price of corn and the soy complex. Corn stocks were the big surprise, indicating that feeding levels are less than anticipated, the crop last year was bigger than reported, and/or the December report was not recorded properly given the government shutdown. Regardless of the “why” behind the “what,” the disposition of the corn market shifted from just “OK” to that of “no problem.” The soy market is bloated, and no wiggling of a parameter is going to change that fact. A further peek into the report unveils that roughly 1.7 million of the expected 3.6-million-acre increase in corn planted acres are in North Dakota, South Dakota and Minnesota — areas that have experienced some tough winter and spring conditions. The map below shows the next even days of weather will not help in goal of getting fields into planting condition.

We will get the first look at the 2019-20 balance sheet in the May USDA report. The stocks number in corn should offer a buffer while the soy scenario is likely to be heavy regardless of any alterations to the balance sheet. We simply have too many beans in the United States and across the world for any fiddling to make an impact.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Joseph Kerns, 515-268-8888.

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like