What is your plan for 2020? Is it the hope-and-pray method that China is going to bail us out? I hope not.

Now that 2019 is in the books we can look back at what worked for 2019 and what didn't. Looking back on 2019, I can safely say it will go down as the most variable and one of the most frustrating years I have seen in my career. I will start with the variability.

Looking back at 2019 the obvious right decision would have been to hedge all your hogs in April. However, there was a general belief that African swine fever in China would bring the industry an opportunity of a lifetime. The only question at that time was, how high can hog prices go? Well, if you were a riverboat gambler, which you almost need to be if you are in this industry anyway, you listened to all the chatter about the bulls. Remember the talk that ASF will make porcine epidemic diarrhea virus look inconsequential? Well, that laid the foundation of the variability we saw in 2019.

We know this past year was frustrating for most of the industry, and definitely all the producers. Looking back now, locking everything in during April should have been the home run, but that wasn't necessarily the case. I saw situations where producers did the right thing and hedged hogs, only to see their projected income disappear to extremely wide basis.

One thing we failed to consider is the fact that we were slaughtering almost 500,000 head per day. So your individual agreement on price determination at the packer dictated if you made money, broke even or lost money in 2019. So far I have seen more than $40 variance in profitability for the year from operation to operation. The disheartening part of this is it wasn't driven by productivity but by revenue. Looking back over the past several years, it would be typical to see some variance, but not $40 per head. Plus, production and health issues drove that variance. This is not the case anymore.

Looking forward

Now that 2019 is in the books, what is your plan for 2020? Is it the hope-and-pray method that China is going to bail us out? I hope not. My recommendation is you absolutely need to look at your own individual operation and set your strategy accordingly. If you were on the right side of the variability last year and can take more financial risk, this opens up more opportunity.

Some simple guidelines I go by would be to look at the owner's equity and working capital of your operation. If you have 65-70% equity in your business and over $600 of working capital per sow equivalent, your tolerance for risk can be higher.

However, if you were looking for the homerun last year that didn't materialize and your operation is under some stress, I would recommend setting a strategy that makes certain you can remain in business. This strategy would include utilizing futures in place of options or looking at forward contracts with a packer and taking some of the risk off the table. I know it can be frustrating to be in this position, but you need to lay out an executable strategy that gives you the opportunity to participate in this industry in the future. Those operations of highest risk would have owners' equity of less than 30-35% and working capital equivalent of less than $400 per sow.

Whatever your strategy is, I would highly recommend discussing this with you lender to make sure they are on board in the event the markets do finally run, and you have someone who will work with you in the event you do have margin calls.

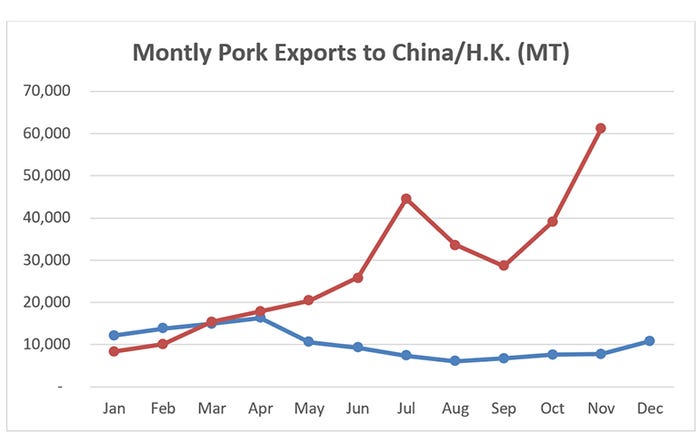

Now for the opportunity. The November export numbers came out last week and the United States exported 62,204 million metric tons of pork to China, which is a record. This amounts to almost 5.7% of our total pork according to the numbers published by the U.S. Meat Export Federation. As you can see on the chart below, this looks promising.

The entire world knows China is extremely short on protein with ASF, and I still believe this is a tremendous opportunity. Just make sure you manage your operation in a way that is commensurate with the level of risk you can withstand.

Steve Malakowsky is a vice president Swine Lending Specialist, with more than 22 years of experience at Compeer. For more insights from Malakowsky and the Compeer Swine Team, visit Compeer.com.

Source: Steve Malakowsky, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like