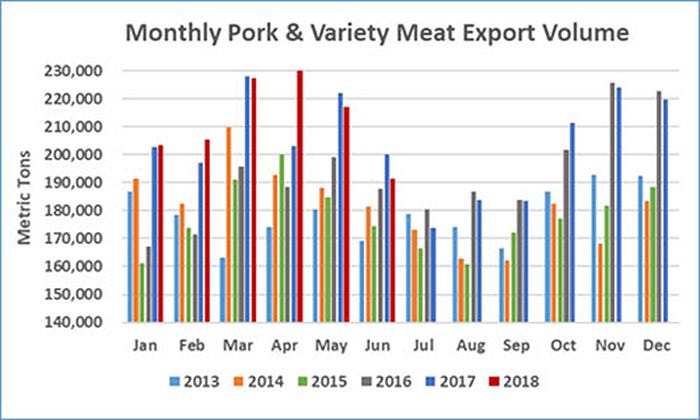

After setting a record in April, pork export volume has trended lower the past two months, mainly due to lower exports to the China/Hong Kong region.

August 7, 2018

Source: U.S. Meat Export Federation

June pork exports were lower than a year ago for the second consecutive month, but first-half volume and value remained ahead of last year’s pace, according to data released by USDA and compiled by USMEF. Strong June results capped a huge first half of 2018 for U.S. beef exports.

After setting a record in April, pork export volume has trended lower the past two months, mainly due to lower exports to the China/Hong Kong region. June exports totaled 191,303 metric tons, down 4.5% from a year ago, despite a slight increase in muscle cut exports (to 153,083 mt). June export value was $510.4 million, down 3%. For the first half of 2018, pork export volume was still 2% ahead of last year’s record pace at 1.27 million mt, while value increased 5% to $3.36 billion. For pork muscle cuts only, first-half exports were up 6% year-over-year in both volume (1.02 million mt) and value ($2.78 million).

“Pork exports — and especially variety meats — face a very challenging environment in China/Hong Kong due not only to retaliatory duties but also because of increasing domestic production in China,” notes Dan Halstrom, USMEF president and CEO. “On the positive side, exports are achieving solid growth in most other markets and reached new heights in destinations such as Korea and Latin America. So, there is no time to dwell on factors the U.S. industry cannot control — we must continue to find new opportunities in both established and emerging markets.”

On April 2, the import duty on U.S. pork and pork variety meats entering China increased from 12% to 37%. On July 6, the rate increased to 62%. Mexico imposed a 10% retaliatory duty on U.S. pork muscle cuts (variety meats are excluded) on June 5 and increased the rate to 20% on July 5. Pork sausages and prepared hams entering Mexico are subject to duties of 15% and 20%, respectively, which took effect June 5. First-half export results reflect the first round of duties imposed by China and Mexico, but not the higher rates that took effect in July.

June pork exports accounted for 26.4% of total production, down from 27.1% a year ago, but the percentage of muscle cuts exported increased from 22.2% to 22.8%. First-half exports equaled 27.3% of total pork production (down from 27.8% a year ago) and 23.6% for muscle cuts (up from 23.1%). Pork export value averaged $53.13 per head slaughtered in June, down slightly from a year ago, while the first-half per-head average increased 2% to $55.18.

Beef muscle cut exports set a new volume record in June of 90,745 mt, up 15% from a year ago. When adding variety meat, total beef export volume was 115,718 mt, up 6%, valued at $718.4 million — up 19% year-over-year and only slightly below the record total ($722.1 million) reached in May. First-half exports set a record pace in both volume and value as international customers bought a larger share of U.S. beef production at higher prices, indicating strong demand. Export volume was up 9% from a year ago to 662,875 mt while export value was just over $4 billion, up 21%. In previous years, export value never topped the $4 billion mark before August.

“It’s remarkable to think that as recently as 2010, beef exports for the entire year totaled $4 billion, and now that milestone has been reached in just six months,” Halstrom explains. “This should be a source of great pride for the beef industry, which has remained committed to expanding exports even when facing numerous obstacles. And with global demand hitting on all cylinders, there is plenty of room for further growth.”

June exports accounted for 13.4% of total beef production, up from 12.8% a year ago. For muscle cuts only, the percentage exported was 11.3%, up from just under 10% last year. First-half exports accounted for 13.5% of total beef production and 11% for muscle cuts — up from 12.8% and 10%, respectively, last year. Beef export value averaged $313.56 per head of fed slaughter in June, up 19% from a year ago. The first-half average was $316.94 per head, up 18%.

Tariffs, uncertainty challenge U.S. pork in mainstay markets, while Korea, Latin America and ASEAN drive first-half export growth

As noted above, a 10% duty on most U.S. pork entering Mexico took effect June 5, contributing to a slowdown in June volume (59,967 mt, down 7% last June’s record-large total). Export value fell 16% to $105.1 million. First half export volume to Mexico was still 4% ahead of last year’s record pace at 413,231 mt, but value slipped 1% below a year ago to $726.1 million.

“USMEF is working closely with Mexico’s major processors and other key customers to reemphasize the advantages of fresh U.S. pork, as we work to assist U.S. suppliers in solidifying as much business as possible in this critical market,” Halstrom says. “USMEF feels strongly that exports to Mexico could set another new volume record in 2018, though export value will likely be lower due to the retaliatory duties. We remain hopeful that duty-free access to Mexico will be restored soon, as competitors are now targeting a market that U.S. pork has dominated for many years, and the duties are contributing to lower prices for U.S. producers and adding costs for customers in Mexico.”

Pork exports to the China/Hong Kong region were already projected to be lower in 2018 due to China’s higher hog production, but the additional 25% tariff imposed on April 2 (imported pork still enters Hong Kong duty-free) intensified this trend. First-half exports to China/Hong Kong were 21% below last year’s pace in volume (216,008 mt) and down 9% in value to $507.2 million. June exports were hit especially hard, declining 37% from a year ago in volume (28,569 mt) and 19% in value ($70.7 million).

January-June highlights for U.S. pork exports include:

• June exports to leading value market Japan were 5% higher than a year ago in volume (31,773) and increased 6% in value ($131.9 million). In the first half, export volume was down 1% to 199,067 mt but value still edged 1% higher to $821.4 million. This included a 2% decrease in chilled pork to 104,365 mt, valued at $504.2 million (up slightly year-over-year).

• Exports to South Korea posted an outstanding first half, climbing 42% in volume (134,190 mt) and 49% in value ($386.5 million). Korea’s per capita pork consumption continues to expand rapidly, and U.S. pork is capturing a larger share of Korea’s imports while Korea’s domestic production is modestly increasing.

• Fueled by strong growth in Colombia and Peru, first-half exports to South America jumped 29% from a year ago in volume (62,314 mt) and 26% in value ($153.5 million). Plant and product registration requirements for exporting pork to Argentina were finalized in late-June, so the Argentine market could add further momentum for U.S. pork in the second half of the year.

• Following a record performance in 2017, pork exports to Central America surged 20% higher in both volume (40,210 mt) and value ($95.5 million). While Honduras and Guatemala are this region’s mainstay markets, exports to all seven Central American nations achieved double-digit growth in the first half of 2018.

• Exports to the Dominican Republic, which were also record-large in 2017, increased 16% in both volume (22,267 mt) and value ($49.5 million) in the first half of the year. For the Caribbean region, exports were up 11% in both volume (29,960 mt) and value ($71 million).

• Led by the Philippines and Vietnam, first-half exports to the ASEAN region increased 16% in volume (26,952 mt) and 21% in value ($71.2 million). The Philippines is an especially important destination for pork variety meat exports when shipments to China are declining, and first-half variety meat volume to the Philippines climbed 64% from a year ago to 8,680 mt, while value jumped 70% to ($15.3 million).

• With the tariff situation in Mexico, Oceania, is an increasingly important destination for U.S. hams and other cuts destined for further processing. First-half exports to Australia were 7% higher than a year ago in volume (39,031 mt) and increased 9% in value ($113.7 million). Exports to New Zealand increased 15% in volume (3,903 mt) and 17% in value ($12.5 million).

Asian markets lead the way, but U.S. beef accelerating in nearly every region

Beef exports to leading market Japan continued to climb in June, totaling 31,147 mt (up 13% from a year ago) valued at $193.1 million (up 11%). First-half exports to Japan were up 6% from a year ago in volume at 159,354 mt while value increased 12% to $1.02 billion. This included a 4% increase in chilled beef to 73,968 mt, valued at $590.1 million (up 15%).

June exports to South Korea were up 46% from a year ago in volume (21,408 mt) and set another new value record at $154.8 million (up 68%). First-half exports to Korea climbed 36% to 113,283 mt, valued at $802.1 million — up 52% from last year’s record pace. Chilled beef exports to Korea totaled 25,400 mt (up 35%) valued at $244.8 million (up 47%).

For January through June, other highlights for U.S. beef exports include:

• Despite trending lower in June, first-half exports to Mexico were up 2% from a year ago in volume (117,524 mt) and up 10% in value ($506.7 million). Mexico is the leading destination for U.S. beef variety meat exports, which increased 8% from a year ago in value ($114.8 million) despite a 6% decline in volume (50,209 mt).

• Exports to China/Hong Kong increased 15% in volume (65,345 mt) and 43% in value ($510.8 million. First-half exports to China, which reopened to U.S. beef in June of last year, were 3,655 mt valued at $33 million. Although China’s duty rate increase on U.S. beef (from 12% to 37%) didn’t take effect until July 6, June exports slowed in part because of rising uncertainty as China’s proposed retaliatory tariff list that included U.S. beef was published in April.

• Beef exports to Taiwan continue to soar, as first-half volume increased 32% from a year ago 26,865 mt) and value was up 39% $249.7 million). Chilled exports to Taiwan were up 34% in volume (10,974 mt) and 46% in value ($136.2 million), as the United States captured 74% of Taiwan’s chilled beef market — the highest market share of any Asian destination.

• Strong growth in Colombia helped push first-half exports to South America higher than a year ago — up 2% in volume (14,030 mt) and climbing 20% in value ($63.9 million). Export value to Chile and Peru also increased, despite volumes dipping below last year. Although still a small market, exports to Ecuador (600 mt) were the largest since 2013.

• Beef exports to the ASEAN region slowed in June but still posted year-over-year gains in the first half — up 6% in volume (21,802 mt) and 24% in value ($122.8 million). This region — especially Indonesia and the Philippines — is an important destination for beef variety meat exports, which climbed 27% in value ($13.1 million) despite a slight decline in volume (6,212 mt).

• Fueled by sharply higher exports to Guatemala, Costa Rica and Panama, first-half volume to Central America increased 27% from a year ago to 6,942 mt, valued at $38.8 million (up 26%).

Lamb exports continue to climb

June exports of U.S. lamb were the largest of 2018 in both volume (1,016 mt, up 58% from a year ago) and value ($2.2 million, up 26%), pushing first-half exports 46% ahead of last year’s pace in volume (5,471 mt) and 17% higher in value ($11.3 million).

Stronger variety meat demand in Mexico accounted for much of this growth, but muscle cut exports trended higher to the Caribbean, the United Arab Emirates, Canada, Singapore, the Philippines and Taiwan. Exports should receive an additional boost in the second half of the year from Japan, which reopened to U.S. lamb on July 11.

You May Also Like