Even with the growth in U.S. pork production, exports account for a larger share in 2017. May exports equated to 29.4% of total production and just under 25% for muscle cuts only — up from 28.4% and 24.3%, respectively, last year.

July 10, 2017

Source: U.S. Meat Export Federation

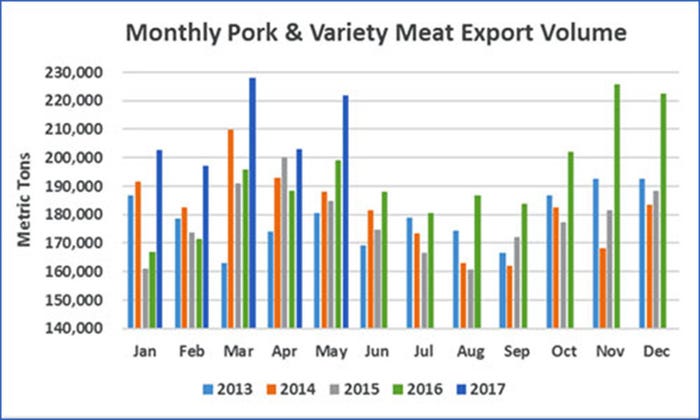

U.S. pork and beef exports posted a strong May performance, increasing significantly from the previous month and from year-ago levels, according to statistics released by USDA and compiled by the U.S. Meat Export Federation.

Pork exports reached 222,015 metric tons in May, up 11% year-over-year and the fourth-largest monthly volume on record. Pork export value was $583.2 million, up 16%. For January through May, exports increased 14% from a year ago in volume (1.05 million mt, a record pace) and 18% in value ($2.68 billion).

Even with the growth in U.S. pork production, exports account for a larger share in 2017. May exports equated to 29.4% of total production and just under 25% for muscle cuts only — up from 28.4% and 24.3%, respectively, last year. Through the first five months of 2017, exports accounted for 27.9% of total production and 23.2% for muscle cuts (up from 25.2% and 21.3%). Exports are also commanding higher prices, indicative of strong demand across a wide range of international markets. Export value per head slaughtered averaged $58.61 in May, up 7% from a year ago. The January-May average was $54.23, up 14%.

May was a particularly strong month for variety meat exports, with pork variety meat volume climbing 16% to 47,766 mt (a record high for May), and value up 33% to $102.7 million. Beef variety meat exports reached 2017 highs in both volume (30,173 mt, up 12%) and value ($77.7 million, up 10%).

“2017 is shaping up as a very solid year for U.S. pork and beef exports, but we remain in an extremely competitive situation in each of our key markets,” says Philip Seng, USMEF president and CEO. “That’s why it is so important to capitalize on every opportunity to increase carcass value, and this is where variety meat plays an important role. USMEF has been working with our industry partners to expand the range of variety meat product offerings and diversify their destinations, and those efforts are paying important dividends for producers.”

May beef exports totaled 105,321 mt, up 6% from a year ago, valued at $582.6 million, up 9%. For January through May, beef exports were up 12% in volume (497,322 mt) and 16% in value ($2.75 billion) compared to the same period last year.

Exports accounted for 13% of total U.S. beef production in May and 10% for muscle cuts only — each down one percentage point from a year ago. Through May, these ratios were steady with last year’s pace — 12.8% for total production and 10% for muscle cuts. Export value per head of fed slaughter averaged $265.55 in May, matching the average from a year ago. Through May, per-head export value averaged $270.27, up 8%. Beef export prices are also increasing, especially in key Asian markets, with double-digit increases in Japan and Korea in May illustrating the strong demand for U.S. beef.

Pork exports solid throughout Western Hemisphere and in key Asian markets

Pork exports to leading volume market Mexico showed no signs of slowing from their torrid pace, as May volume climbed 21% from a year ago to 68,763 mt and export value jumped 24% to $130 million. Through May, exports to Mexico were up 23% from a year ago in volume (333,853 mt) and 32% in value ($606.6 million). In addition to strong demand for hams and other muscle cuts, Mexico is also competing with China for U.S. pork variety meat. January-May variety meat exports to Mexico were up 14% to 62,328 mt and value increased by one-third to $96.4 million.

Fueled by exceptional growth in Colombia and Chile, pork exports to Central and South America were up 66% in volume (14,899 mt) in May and climbed 78% in value ($37.4 million). Through the first five months of the year, exports to this region were up 49% in volume to 68,640 mt and 53% in value to $165.2 million. Chile’s imports are running 49% ahead of last year’s record pace, with the United States as its largest supplier (U.S. share climbed from 19% to 32%, gaining in competitiveness versus Brazil). Colombia’s domestic pork production has not kept pace with demand and imports are up 55%, with the United States as the dominant supplier (U.S. share is 83%, up from 76% last year).

Led by the Dominican Republic, demand for U.S. pork is also strong in the Caribbean, where May exports increased 64% from a year ago in volume (5,843 mt) and 58% in value ($13.4 million). For January through May, exports jumped 32% from a year ago in both volume (22,726 mt) and value ($53.2 million).

Turning to the Asian markets, pork exports to leading value destination Japan were significantly higher in May, climbing 11% in volume (35,641 mt) and 20% in value ($145.5 million). Through May, exports to Japan increased 6% in volume (169,774 mt) and 12% in value ($686.3 million). This includes a 2% increase in chilled pork to 91,236 mt, valued at $425 million (up 11%). U.S. market share in Japan has increased slightly from last year, reaching 36%. Competition remains fierce, with the European Union dominating frozen pork imports and Canada continuing to make gains in the high-value chilled sector.

South Korea is a top performer for U.S. pork with January-May exports increasing 31% from a year ago in volume (81,313 mt) and 40% in value ($221.6 million). Although Korea’s pork production is running slightly higher than last year, demand for pork is very strong and U.S. pork is an increasingly attractive option. With online shopping especially popular in Korea and home meal replacement products and other convenience items offered both online and in stores, the USMEF continues to introduce new U.S. processed pork items. The U.S. dominates Korea’s processed pork market, with imports from the U.S. valued at $24 million through May, up 3%.

Corresponding with the decline in China’s hog prices, pork muscle cut demand in China/Hong Kong continues to soften compared to last year’s record imports, but variety meat demand remains strong. Through May, combined pork and pork variety meat exports to the region fell 2% below last year’s pace in volume (228,827 mt) but remained 5% higher in value ($461.9 million). January-May variety meat exports were up 20% in volume (143,767 mt) and 29% in value ($304.2 million, accounting for 64% of the global total). Pork variety meat exports to China/Hong Kong equated to $6.15 for every U.S. hog harvested in the first five months of this year, up 25% from last year.

Japan, Korea and Taiwan shine for U.S. beef

Beef exports to leading market Japan maintained their strong momentum in May, with volume up 9% to 25,340 mt and value up 24% to $160.8 million. Through May, exports to Japan exceeded last year’s pace by 28% in volume (123,291 mt) and 32% in value ($731.4 million). This included a 45% increase in chilled beef exports to 58,000 mt, valued at $414 million (up 42%). U.S. beef now accounts for 51% of Japan’s chilled beef imports, surpassing Australia, and climbing from 40% last year.

May beef exports to South Korea fell below last year’s large volume (14,268 mt, down 8%) but still increased 2% in value to $89.2 million. Chilled exports were the largest of the year at 3,700 mt, up 89%. For January through May, exports to Korea were up 12% in volume (68,656 mt) and 21% in value ($435.3 million). This included an 85% increase in chilled exports (to 15,700 mt) with value up 88% to $138.5 million. The United States is now Korea’s largest supplier of chilled beef, with market share climbing from 36.5% last year to 52% in 2017, surpassing Australia.

Beef exports to Taiwan posted a solid May performance with volume up 24% to 3,426 mt and value up 20% to $28.6 million. Through May, exports to Taiwan totaled 16,925 mt (up 24%) valued at $147.1 million (up 27%). This included chilled exports of 6,650 mt (up 16%) valued at $76 million (up 19%). The United States is the largest supplier of beef to Taiwan and holds 70% of the chilled beef market.

After a slow start to the year, exports to Hong Kong continued to gain momentum in May with exports increasing 29% in volume (10,290 mt) and 36% in value ($66.4 million). Through May, exports to Hong Kong totaled 47,683 mt (up 7%) valued at $300.3 million (up 14%).

Beef exports within North America declined in May, with volumes below year-ago levels for both Mexico (20,797 mt, down 7%) and Canada (8,700 mt, down 21%). Through May, exports to Mexico were still up 4% year-over-year in volume (95,379 mt) but fell 5% in value ($379.1 million). January-May exports to Canada remained ahead of last year’s pace in both volume (47,405 mt, up 3%) and value ($319.7 million, up 6%).

Lamb exports rebound in May

After slumping in April, U.S. lamb exports showed signs of a rebound as May volume reached 634 mt, up 14% from a year ago, while value increased 5% to $1.62 million. Through May, lamb exports were still down 20% from a year ago in volume (3,113 mt) but increased 3% in value to $7.9 million. For lamb muscle cuts only, January-May exports were up 12% from a year ago in volume (867 mt) and 14% in value ($5.4 million), including growth in Mexico, the Caribbean and Central America.

Notes

• Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

• One metric ton equals 2,204.622 pounds.

You May Also Like