It appears highly likely we're going to experience a V-shaped recovery, a hard and fast recovery that will be beneficial to hog prices moving forward.

June 8, 2020

Friday's release of the May employment report was a shocker that merits some discussion. One thing, admittedly, that I've learned from the pandemic and resulting near total shut down of the foodservice industry was how important this demand sector is to the pork market. Sure, I knew it was important, but I did not realize how important. What better way to measure than by simply shutting down the demand sector and see what happens?

My perception going into shelter-in-place was that the high-end restaurant industry was much more important to beef that it was to pork. This perception proved to be misguided. Indeed, ham and belly prices are highly driven by foodservice demand with hams also highly driven by exports.

On June 5, something surprised nearly everyone and most notably the pundits, the economists. The U.S. economy created 2.5 million jobs in May while the average guess on this report was calling for a loss of over 8 million jobs. Talk about swinging at a ball in the dirt. I've touched on this subject several times in my daily livestock wire.

Going into the pandemic the economy was strong. The order of shelter-in-place was driven by healthcare concerns. There is/was no major problem with the economy. No housing crisis, no banking bubble, no inflation, no major budget crisis in Europe, nothing but a temporary shutdown of the economy.

New home sales surged by 21% in May. Interest rates are very low, the Central bank has flooded the market with liquidity. There have been 3 million permanent jobs lost in this pandemic. For comparison, in the last recession (2007-09) the United States lost 9 million jobs. Leisure and hospitality lost 75 million jobs during shelter-in-place, they added back 12 million in May, or 16% of those lost.

My point is simple, it appears highly likely we're going to experience a V-shaped recovery, a hard and fast recovery that will be beneficial to hog prices moving forward.

So, what about hog prices? Where do we go from here? In a nutshell, in my opinion, higher and most likely sharply higher. Given the fundamental circumstances facing the hog market it's my opinion that every hog contract is currently undervalued. Consider the following bullets.

It's highly likely that up to 3 million fat hogs will have to be put down this summer. This pork will simply disappear from the supply-demand table (654 mm pounds).

As stated above, it appears a V-shaped economic recovery is already underway.

Slaughter data indicate that aggressive herd culling is underway.

USDA data project a sharp downward shift in pork, beef and poultry production this year.

In addition to improving domestic demand, export demand is record high.

While not being reported, African swine fever continues to spread in China, and it continues to kill pigs.

Looking back, last year at this time hog futures had soared upward during late-February, March and early April. But that was it, the market topped. As for myself, I did not realize a top was in place for several weeks.

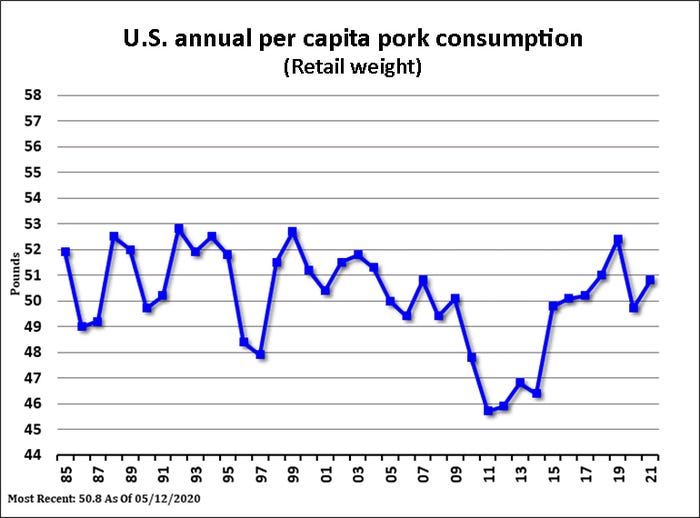

We now know several things contributed to this top. One was panic selling of pigs in China, temporarily flooding their market with pork. Another was the on-set of tariffs and trade war with China. Tariffs and a dispute with Mexico were also a negative factor. But the most important factor I missed was the fact that per capita pork supply in the United States remained unchanged.

As exports began to ramp up to China, the aggressive expansion in U.S. pork production kept pace with the rising level of exports. The net result was the amount of pork left available to the U.S. domestic market was unchanged. So, there was no lasting hog price rally in the face of these fundamental circumstances. I missed it.

This year is different in my opinion. The USDA numbers suggest it will be vastly different. The May supply-demand report posted a downward revision in pork production by 1.6 billion pounds. This is a 5% decline from the previous report.

In addition, production for the first quarter of 2021 is projected to decline 5% from the first quarter of 2020. More importantly, per capita pork supplies are now projected to decline by 2.6 pounds, a huge decline historically. This is the major change from last year, the amount of pork available to the U.S. consumer is going to be vastly lower going into 2021 than it was in 2019.

According to the USDA, the per capita supply of beef will decline this year by 3 pounds and the broiler per capita supply will decline by 3.8 pounds. The USDA projects that total red meat and poultry per capita supplies, at the end of 2020, will decline by 9.6 pounds compared to 2019. In tandem with what could be a V-shaped economic recovery, we're setting the stage for a major move upward in meat prices.

Pork packers continue to recover from the devastating impact of COVID-19. The closure of some pork plants and the slowing of the chain speed in all plants was a disaster for the pork industry. Hog prices went one direction — lower — and pork prices went another direction — higher. At least initially. Currently the pork has dropped down from the sharp gains. The cutout is beginning to stabilize. Cash hog prices are starting to stabilize as packers slowly gear-up the chain speed. Most believe the slaughter capacity under the new rules of safety for employees will be reduced. It's also highly likely that the large integrators know this better than anyone and the industry is conforming to the new and reduced slaughter capacity.

This means lower production, not larger production in the months ahead. I expect this to be documented in the upcoming quarterly Hogs and Pigs Report, scheduled for release on June 25.

Source: Dennis Smith, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like