The USDA Quarterly Hogs and Pigs report register large numbers for the traders to mull over during the holiday weekend.

December 24, 2016

Across the board, the USDA reported huge numbers in its December Quarterly Hogs and Pigs report compare to the pre-report estimates – a spread between 1-3% differences. The USDA released the report earlier on Friday due to the holiday weekend while the markets were still open and Steve Meyer, vice president at Express Markets Inc. Analytics was shocked it did not rock the trade harder. At the close of markets Friday, lean hog futures for nearby was only down $1.5. Meyer says, “The question is, after three days of thinking about it, will there be more pressure on the market on Tuesday.”

Meyer explains the future market has had an impressive rally in the last six weeks, but he anticipates the market to be down on Tuesday and Wednesday especially for the summer futures as a result of large numbers in the report. He continues, “I expect there will be more pressure next week as people digest that size of the numbers.”

By the numbers

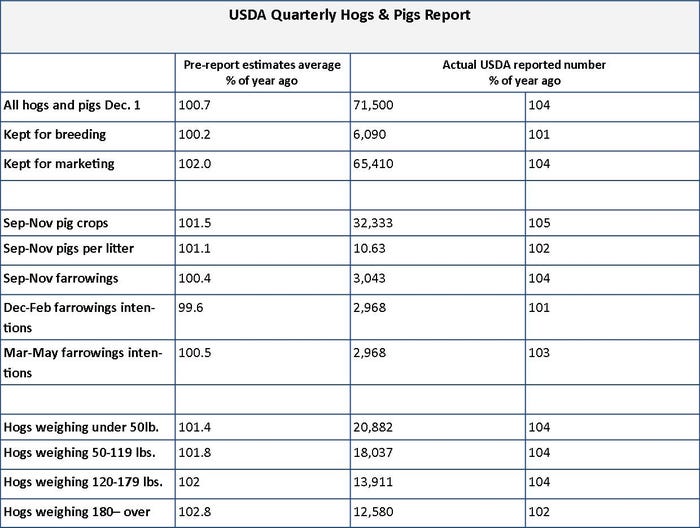

Once again, the U.S. inventory of hogs overall reached a record level of 71.5 million hogs and pigs on U.S. farms on Dec. 1, 2016. The total hog inventory is up 4% from December 2015 but only marginally increased from Sept. 1, 2016, according to the Quarterly Hogs and Pigs report published by the USDA’s National Agricultural Statistics Service.

Breaking down the numbers further, the total number of market hogs penciled in at 65.4 million head, climbing 4% from last year. Currently, there are 20.9 million head weighing less than 50 pounds, 18.0 million head weighing 50-119 pounds, 13.9 million head weighing 120-179 pounds and 12.6 million head 180 pounds and more.

On the breeding side, America’s pig farmers kept 6.09 million head for breeding, increasing the breeding inventory by 1% from last year and the previous quarter. Improving productivity is the name of the game for U.S. hog farmers. From September through November 2016, hog producers weaned a fresh new average of 10.63 pigs per litter.

Moreover, U.S. hog farmers intend to have 2.97 million sows farrow during the December-to-February 2017 quarter, up 1% from the actual farrowings during the same period in 2016, and up 3% from 2015. Intended farrowings for March-to-May 2017, at 3.00 million sows, are up 1% from 2016.

David Miller, Iowa Farm Bureau director of research and commodity services, says the looking at the last 10 years, America’s pig farmers are not just increasing pig numbers but making great strides in productivity. “We are seeing a total productivity gain of breeding herd of 2.9% since 2007,” Miller states.

Analyzing the breeding herd inventory, Meyers says the USDA seems to be in line with the reports from the industry. “I have been thinking for quite a while that USDA did not appear to be capturing as much as the breeding herd growth that we have heard about out there,” he comments.

Until now the USDA had only been reporting an increase of less than 1% year-over-year for the last year and a half. Meyers further explains, “This 1.5% growth is much more in line with my expectation, and we could go up another 1% or more in the next two years from what is in the pipeline.”

Looking down the road

The numbers in USDA’s Quarterly Hogs and Pigs report released Dec. 23 certainly show more pork coming than anticipated, explains Chris Hurt, professor of agricultural economics at Purdue University. For the first half of 2017, Hurt estimates an increase in pork production slightly over 4% and also near 4% for the second half 2017.

Looking at the heavy numbers for first half 2017, Hurt anticipates weekly slaughter will push U.S. packing capacity but not surpass the estimate 2.5 million weekly capacity. Doing the math, Hurt calculates a 4% growth in weekly slaughter for the first three months of 2017 to average 2.34 million.

Meyers says the massive weekly slaughter that exceeds current packing capacity is behind us. He calculates the weekly packing capacity at 2.453 million head on 5.4 work days and this fall for six weeks the total weekly slaughter has been above that. Still, Meyers says by the second week of January the weekly slaughter numbers will pull back sharply and he does not see the number close to capacity until the summer 2017. He says, “The worst of the fall numbers and the capacity is behind us.”

John Nalivka, president of Sterling Marketing, figures the producers’ farrow- to-finish margins from the last week of September to the first week of December at -$31 per head. He states this should discourage further expansion plans, but affordable feed costs, growth in the export market and new packer capacity will continue to provide an incentive to supply more hogs into 2018.

In those same weeks, the packer margins were $45 per head. Nalivka says, “That is pretty atypical to see the kind of pork processing margin.”

Hurt’s forecast price, based on national 51-52% lean hogs, $61 per head average for 2017 with a prediction of $56 for the first quarter, $66 for the second and third quarter and $56 for the final quarter.

You May Also Like