Industry now in position to benefit from consumers moving toward more retail purchases, at-home pork preparation.

October 13, 2022

Several pieces of Information have flowed into the pork markets over the past couple of weeks so let's catch up on the key ones.

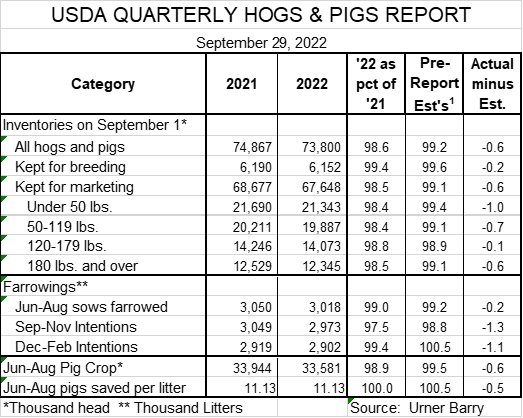

USDA's September Hogs and Pigs report is somewhat old news by now but is no less important to hog and pork markets. The report was very close to analysts' pre-report expectations (see Figure 1) and represents continued slow contraction of the U.S. hog herd and, consequently, pork output. I hope this report was as accurate as USDA"s last report whose market inventories agreed in with June-August slaughter almost perfectly in total. Some weeks were up and down but cumulative slaughter ended up less that 0.5% different from the level suggested by June's year-on-year market inventory changes and last year's actual slaughter levels.

The report's lower breeding herd was no surprise and the magnitude of the decline was not much larger than expected. But expect a larger drop between now and Dec. 1 as Smithfield liquidates a large number of sows from its Utah operations. This ongoing liquidation likely explains the sharply lower Sep-Nov farrowing intentions as well. Smithfield's Arizona sows have been sold and there is no information as to how many of those will continue in production but sow slaughter has already increased and will remain higher due to this liquidation, we understand, at least through October. We have heard of only a few new sows entering production though there is talk of some new projects. Actual market hogs from these will most likely not reach market until 2024.

The market inventory, at 1.5% lower than one year ago, indicates very manageable supplies. Those numbers plus a slight expansion of packing capacity due to line speed waivers under USDA's New Swine Inspection System mean that capacity will not be a challenge to efficient and timely marketings and harvest this fall. That should be supportive of the spot/negotiated hog market.

Finally, the average number of pigs save per litter was unchanged from one year ago, continuing its recent trend. We know for sure that the breeding animals in the herd today are, on average, capable of producing larger litters. The question remains "When will diseases and labor allow those litters to grow toward – and eventually to – that potential?" Both the disease and labor situations appear to be getting better but USDA's data show no impact – yet.

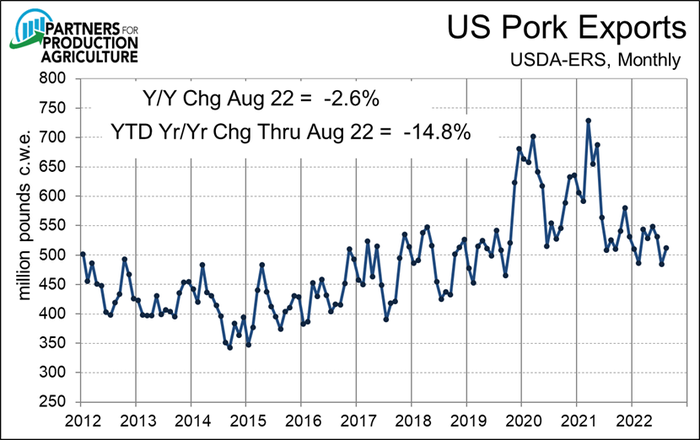

Last week's monthly export report from USDA's Foreign Agriculture Service once again showed, as expected, a year-on-year decline. But the decline was much smaller than earlier this year. You can see from Figure 2 that news is not as good as it might seem since the improvement in year-on-year change is driven primarily by a huge reduction in exports last year. But let's take what we can get! Monthly year-on-year changes for the remainder of 2022 will likely remain negative but will be much closer to zero, pulling the year to date figure up as we get to year's end. August's YTD change of -14.8% is the smallest we've seen in 2022. Our colleague Brett Stuart at Global Agritrends expects us to end up at -8.5%, yr/yr, at the end of the year.

The strongest U.S. dollar in 20 years (see Figure 3) will complicate U.S. pork exports (and exports of all goods for that matter) for the foreseeable future. The Euro, Yen and British Pound, all components of the U.S. Dollar Index (DX) shown in Figure 3, are all at or near historic lows versus the U.S. Dollar. Canadian Dollar, another DX component, has lost 5.5% the last five weeks and about 13% since June 2021. Those four currencies account for 91.3% of the DX. Does last week's small consolidation suggest a topping of DX futures? Let's hope so but there is still a lot of macroeconomic noise that can impact the dollar's value.

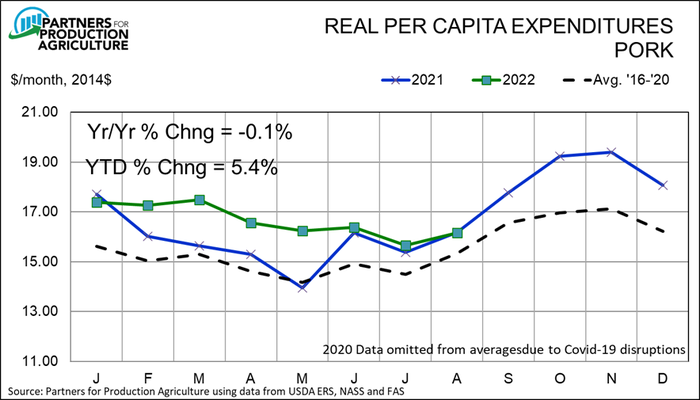

The good news remains domestic meat/poultry demand in general and domestic pork demand in particular. I know I've written about this ad nauseum this year but I cannot emphasize enough the importance of this stronger demand. High costs have not caused high hog and pork prices – High Demand Has and producers have been darn lucky (more on this later) they happened at the same time. August's real per capita expenditures (RPCE) for pork were 0.1% lower than last year but YTD RPCE remains 5.4% larger than in 2021 (see Figure 4). It will not surprise me to see monthly pork RPCE figures below last year's levels for at least some of the remaining four months in 2023. That is mainly a statement about the strength of demand last year, not some foreboding of demand this year. Something more akin to the seasonal patter of the five-year average in Figure 4 would not surprise me. And would still leave annual pork RPCE well above last year's record!

So what has happened to the LH futures since mid August? Or even just since Sept. 21? I don't believe it was anything to do with hog supply and pork demand. Neither of those would suggest an impending drop in market hog prices. Efficient markets are supposed to reflect all available information, so just what information drove this huge selloff? I'm not aware of any actual information to explain it but it appears there was plenty of fear to go with some negative macro information to set off a large liquidation of fund positions.

Those funds are critically important sources of liquidity in the LH futures market, providing hog sellers and buyers opportunities to make trades that otherwise might not be available. Any seller needs a buyer and any buyer needs a seller! But when a high proportion of them act in lockstep, the impact on prices can be severe. I am in no way suggesting that anyone colluded in this price move or any other price move. But the fund managers and programmed trading generally respond to the same stimuli and thus frequently take action at the same time. Expanded limits allow those actions to have large impacts.

So what about my "darn lucky" statement? Well, serendipity plays a role in everything we do. But it has been said that luck is where preparation meets opportunity. Producers may be lucky in the timing of this demand improvement to match the surge in costs, but I think the industry has done things for years that put itself in a position to capitalize on changes in consumer behavior. Leaner pork products, recent emphasis on muscle quality (though it still needs improvement!), the move of Pork Board resources from advertising to online marketing – the list goes on and on – all put the industry in a position to benefit from consumers' moving toward more retail purchases and at-home pork preparation. Where would we be if we hadn't done all those things? I don't know the exact answer to that but I think it is safe to say we would be MUCH worse off here in late 2022.

What preparations must we now make for the next time that opportunity knocks and some say "Wow, are they lucky or what?"

Source: Steve Meyer, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like