Hold your breath just a bit longer until we have these large runs behind us, and the promise of 2020 can materialize into your pocket.

December 9, 2019

Amidst the rhetoric of political chatter of Phase One with China, the on-again, off-again nature of the U.S.-Mexico-Canada Agreement and — of course — the merits of a presidential impeachment, it is easy to get lost in what is blaring from the media versus what is not said. Any parent knows to listen to what is absent in a story explaining how the lamp got broken rather than the excuse. I think we may be at the same place in our markets right now. Consider this:

China recently announced: "a three-year plan to speed recovery of pig production after the world's largest hog herd was ravaged by disease". The article goes on to share an ambitious plan to obtain 70% self-sufficiency in the next three years.

(Note: China generally declares itself self-sufficient if it achieves a 95% level of production relative to consumption. To date, they have largely kept this ratio intact for most major commodities, soybeans being the pronounced exception. They gave up self-sufficiency in beans in the early '90s and quickly became the world's largest importer by a large margin. Consider the impact to pork in a similar scenario) Given this, the 70% accomplishment is probably worthy of a round of applause. Wait. Let's do some math assuming this comes to pass. China produced roughly 55 million tons of pork before the African swine fever outbreak. If they are deficit 30%, that equates to over 16 million tons of potential imports to meet the then-current demand.

Keep in mind that the entire world trade is about 9 million tons — that means China would potentially not only take nearly twice as much as the world trade, but the existing destinations that constitute the current trade would get zero. How practical is that? Not at all. So while the headline may insinuate major progress in rebuilding the herd, the three-plus-year runway for an unprecedented increase in world trade is, perhaps, the more important component.

A vaccine for ASF is being developed. Of course, this is an item that will be in great demand given the economic devastation. I am not a veterinarian, but I understand this disease is known as "an envelope virus" that requires a much more complicated approach than a traditional viral vaccine.

Per the U.S. National Library of Medicine, another difficulty in the path to vaccine generation could be the impossibility of production because of the lack of a cell line supporting the replication of attenuated vaccine viruses without modifying the virus virulence. (Citations contained herein)

Our conversation with people knowledgeable about the virus indicates that — even if it were possible — it would take a few years to have something commercially available using U.S. standards. Of course, accelerated production could occur outside of our borders, but the veterinarians warn me that the unintended consequences of a bad vaccine are reason for caution given the virus' complicated nature. Best guess: even if there is an "aha" moment, the commercial availability of a viable vaccine is probably several years away.

Cash markets stink. I know that is not a news flash to anyone reading this column. Negotiated hogs are trading in the mid-$40s, the index is hovering around $60, and all of this is happening when China is taking roughly 8% of our production and potentially looking for more.

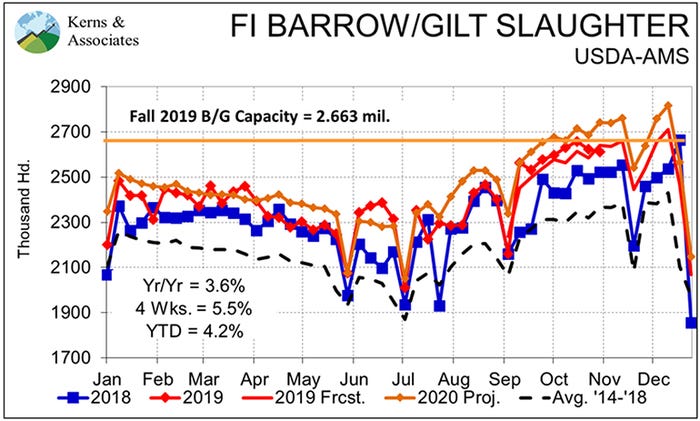

The "problem" is not demand. Exports are robust, domestic demand (as measured by sales values and volume — remember, demand is disappearance at a price) indicates a nice 5% bump year-over-year. Our issue is slaughter numbers simply overwhelming shackle space, even though we have had nice growth in shackle space over the past couple of years. Productivity on the live side is the reason, about 7% more versus 2018 over the past four weeks. That is a big number, about twice the growth relative to previous expectations.

Packers have had pigs fall in their laps and have been the recipients of the financial largesse. The money is flowing, it is just not making it down to the producer level. It is here that I will admit that I am rooting the Home Team — the pork producer. If I were a packer, I would likely do the same as they are, taking a huge and unexpected margin and putting it in my pocket in preparation for the scenario to change.

And change it will. Per the attached chart, note how the supply of market-ready hogs takes a pronounced downturn after the first of the year, the orange line represents expected slaughter for 2020. It is then that I expect the worm will turn and packers will be forced to increase their bids to obtain hogs, thus passing along the extra monies.

Consider this. We just harvested nearly 2.8 million (a new world record) hogs last week and the cutout is trading $82. The money is out there, it is just not making its way to you.

Here is the bottom line. Pork producers have had their head held under water for several months. We are not generally accustomed to making money in the fourth quarter, so this is nothing new. The shock to our system is two-fold: The previous promise of higher markets that made us all giddy and the money that is now flowing that we can see but not touch. I am going to encourage you to hold your breath for just a bit longer until we have these large runs behind us, and the promise of 2020 can materialize into your pocket.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Joseph Kerns

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like