The whole protein industry is in the same boat to some degree or another, it is not just you.

July 20, 2020

Pork production economics have not been profitable for almost a complete calendar year and the prospects for that changing sometime soon do not look probable. Steve Meyer put forth an excellent effort last week in articulating the dire supply backup and the lack of shackle space availability to handle the inventory. We know that the beef guys are backed up, too, but what about other areas of production agriculture? Are we all in the same boat or is ours taking on more water than our brethren?

Let's take a walk through what is happening in additional areas for perspective.

Ethanol

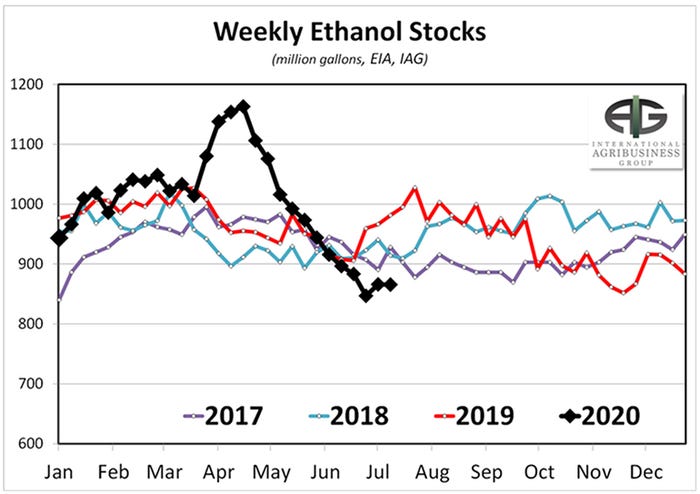

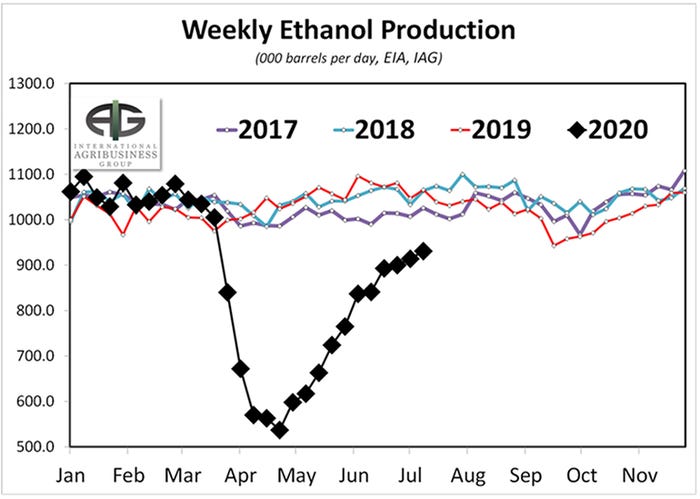

The whole COVID scenario has not been kind to this industry. Their economics are indexed closely to miles driven which plummeted sharply this spring and have slowly increased through the summer, but are still at roughly 80% of where we were at this time last year. Inventories reached record levels, plant shutdowns were motivated by both economic circumstances and physical parameters. We just plain ran out of space to put the production and had to shut down facilities.

Since then, we have reduced the glut to more manageable levels and slight profits have returned. Not enough profit to allow the industry to resume to normal levels and this is a very fragile situation. A few more plants coming back online will break the back of profit. We likely needed to right-size this industry a bit as in the go-go days of the mid-2000s. We constructed plants in areas that were probably not geographically sustainable with corn supply and basis. During that era, profits from corn production were massive and a farmer's incentive to invest in their new-found demand vehicle in their proximity was equally as robust — almost regardless of long-term sustainability.

Since then, plants have changed hands and the maturity of the industry has brought some sanity to the decisions. COVID accelerated what was largely seen as a steady to slowly decreasing demand scenario for domestic gasoline use (fuel economy, electric cars, consumer habits) into a compressed timeframe. The ethanol industry is not experiencing the extreme misery of the livestock industry, but their forward prospects of profits look slim for as far as the eye can see.

Dairy

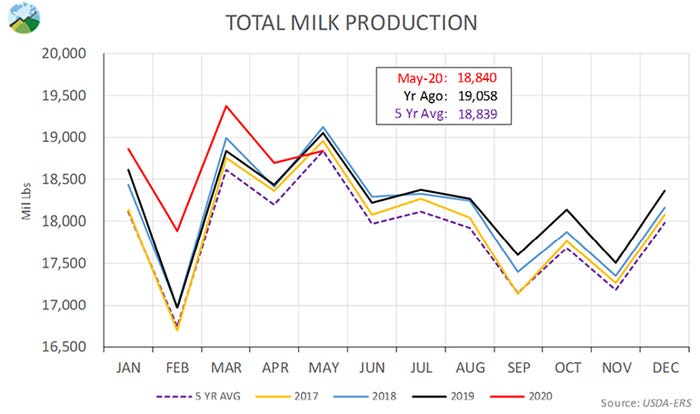

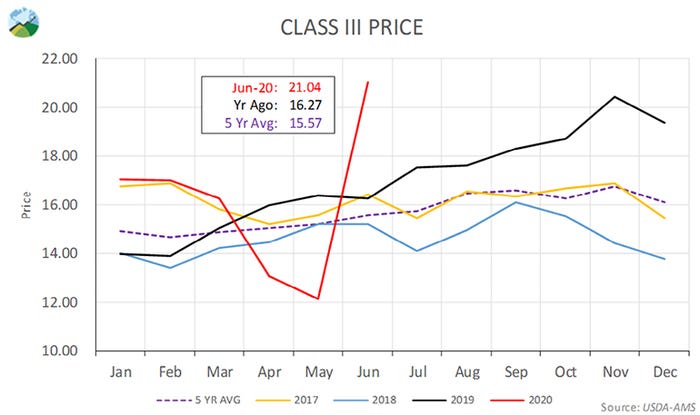

This might be the most interesting industry from an outside observer's position. The COVID scenario sent shockwaves through the supply chain with a severe disruption between the demand for fluid milk and milk products.

When we shut down foodservice, we killed the demand for cheese (roughly 60% of milk is converted to cheese, think pizza). The short-term result was the dumping of milk tankers of product intended to go to further processing as the news cameras rolled. For sure, this was a waste of resources that resonated with the consuming public.

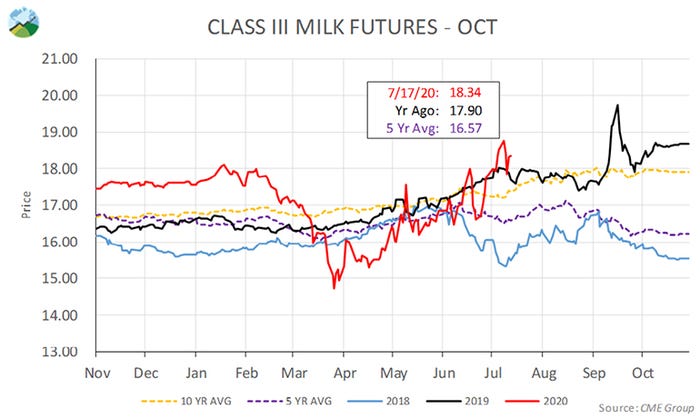

Milk is one of two items (the other is eggs) in animal agriculture where the host is not sacrificed for the benefit of production. Ergo, this is not an animal welfare item, it was and is an unfortunate economic circumstance of the crisis. The following charts depict what I was referencing as an interesting scenario.

Note that the nearby market for milk has rebounded nicely and actually represents profits for the industry while the forward curve flattens out at levels that represent break-even. The prospects — or lack thereof — of schools opening up in the fall is weighing on this market as the futures markets is attempting to direct behavior.

Eggs

Similar to dairy, the egg market had a severe shock in the flow of whole eggs for table consumption relative to liquid eggs for foodservice. Staying at home created a temporary price shock to the upside for egg prices (which led to some very frivolous lawsuits of price fixing) and has since settled into a tranquil period of back-to-losses for the industry. Roughly 30% of eggs go into a liquid form, primarily for use in foodservice.

The same shutdown of the economy that impacted milk was also felt in eggs, perhaps even in a more permanent state. Consider this: if and when we get back to "normal," do you think you will be scooping eggs onto your plate at the Holiday Inn buffet breakfast? Probably not. Packaging and portions will be a big conversion post-COVID across all of the food sector, the egg industry might be the one that is most pronounced. The egg industry is hurting, too.

Broilers

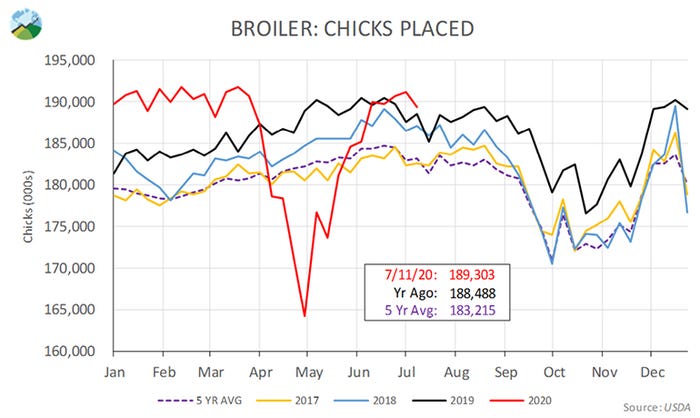

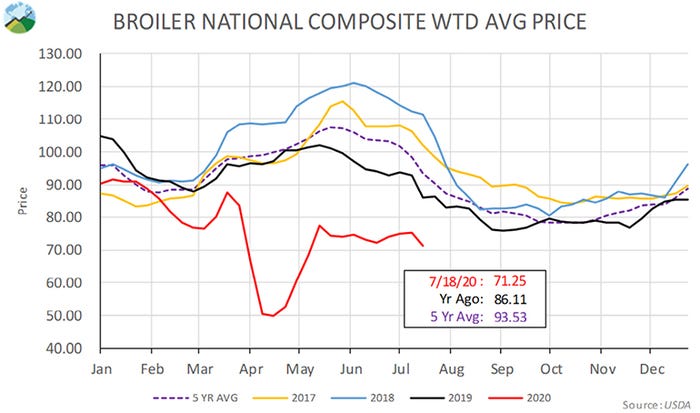

Within the meat sector, the broiler industry has the most convenient means to supply management for two reasons. The first is the six-ish week grow out timeframe. Any decision you make has a short shelf life in the broiler industry. The second is the euthanasia of animals prior to entry to a growing facility is relatively easy and unobtrusive — you simply break eggs. This is a much less graphic situation relative to what we would experience in the pork sector.

The attached charts show this scenario demonstrated in a vivid form. Also note, the chicken guys are not having any fun. The price they receive for their product is under compression while egg sets and birds placed run above average trends. They may be losing money on each bird, but they make up for it in volume.

Here is the bottom line: We are hurting in the pork production sector and we are not alone. Until we get a U.S. economy rolling again (as of this writing, the mayor of Chicago has suspended the operation at restaurants. Again.) we are likely to be in an oversupply situation that will not yield happy returns. I am confident that better days are ahead because it would be difficult to get much worse. The whole protein industry is in the same boat to some degree or another, it is not just you.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like