You can book profits. I am not talking about squinting and barely eeking out a shekel; I am talking about good profits for summer.

October 9, 2017

Sometimes, life gives you layups. Other times, Shaquille O’Neal is waiting for you at the rim. As I take a look at the prospects of pork production profitability in the coming year, I can’t help but think our clear path to the basket looks like a better option than shooting the long ball. In plain language, it seems to me that the profits offered on the forward curve need to be accepted rather than waiting for higher values – i.e., sell hogs. In some form. Cash, futures, options. I think it is important to participate. Let’s unfold this one a bit further.

We have all kinds of questions on the horizon. I am not talking about the normal considerations of health and other productivity concerns; I am referencing the macro environment and just how we fit into the Big Picture. What happens if President Trump fails in his Dale Carnegie effort to make friends and influence people? In the pork industry, we need Mexico. Period. Any disruption of trade will lead to significant red ink.

First, the good news. Pork exports out of the US are up 9% year-to-date. Impressive. Perhaps the most positive arena is Mexico where shipments are up 21%, and sales (unshipped) are similarly higher. Product is moving both domestically and via export channels to keep us in a competitive position without a burden of significant stocks building. Bellies have reached a level where freezing them as a potential profit in the summer of 2018 is providing enough motivation to stabilize prices. I do not expect bellies to perform a repeat of 2017 and it seems buyers have learned from the past and are putting them away at favorable levels. This is all good. The two new plants are operational and seem to be running as well as could be expected, absorbing the increase in production that was planned with their startup. We have experienced a pleasant surprise in the cash market as a temporary bottoming action

On the flip side of the coin, exports to China are down 29% and don’t look to be reversing that course anytime soon. This is not such a big deal to the U.S. as we were a role player in that market, but it will influence us as pork from the EU will be displaced and likely compete with our product in different markets. You can’t squeeze the balloon in the middle without it bulging elsewhere. Global pork production expansion is evident in many places – notably, China. The recent Hogs and Pigs report evidence that the steady gain in sow numbers and productivity of the U.S. herd. We are not running out of hogs anytime soon. My biggest concern for the U.S. market is not on the domestic side. We seem to be doing a pretty good job of putting bacon on everything. I am worried about the export side with the rift in NAFTA, the slow process to institute an agreement with Japan, and the general tenor of the world regarding our diplomatic relationships. Recent strength in the U.S. dollar does nothing to help with our competitiveness in world markets, even if I am supportive of a revised tax plan and more austere budgetary guidelines.

The recent Hogs and Pigs report evidence that the steady gain in sow numbers and productivity of the U.S. herd. We are not running out of hogs anytime soon. My biggest concern for the U.S. market is not on the domestic side. We seem to be doing a pretty good job of putting bacon on everything. I am worried about the export side with the rift in NAFTA, the slow process to institute an agreement with Japan, and the general tenor of the world regarding our diplomatic relationships. Recent strength in the U.S. dollar does nothing to help with our competitiveness in world markets, even if I am supportive of a revised tax plan and more austere budgetary guidelines.

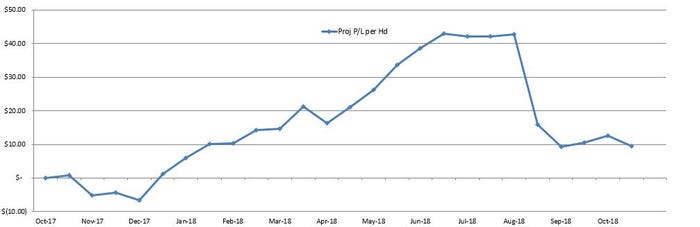

Against this backdrop, the graph below provides the most compelling argument for a pork producer in the face of considerations for 2018. You can book profits. I am not talking about squinting and barely eeking out a shekel; I am talking about good profits for the summer, and holding serve in the first quarter. When the collective “we” can break even in the fall and winter and make good money in the summer, life is ok. That is what you have in front of you right now; you just have to decide whether or not you take the opportunity to say “thank you” and book the gains. This data is generated with a cost of production in the 64 cent range and a historical basis for the Western Corn Belt, you can adjust the curve to fit your operation.

Figure 1: Projected profit/loss per head

Source: Kerns and Associates

The grain markets are a blasé affair. The logistical nightmare from low water levels should be easing up a bit as rain in the Mississippi basin will allow draft levels to improve. Hurricane Nate is anticipated to dump a chunk of rain in the south, but should not significantly interrupt Gulf operations. Basis remains wide in the interior which is allowing the domestic consumer to enjoy favorable pricing – not so great for the grain producer.

Bottom Line: Profit opportunities are good, inputs are cheap, lots of uncertainty abounds. Looks like a good time to take some chips off the table.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

About the Author(s)

You May Also Like