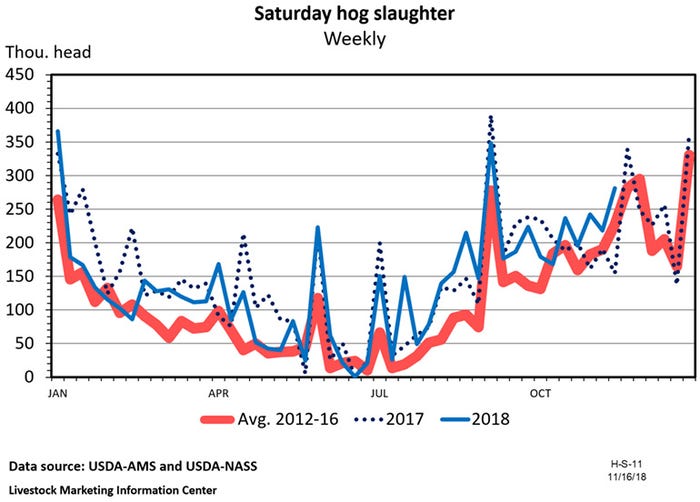

The largest Saturday slaughter of the year usually comes the Saturday after one of three holidays — Labor Day, Thanksgiving or Christmas.

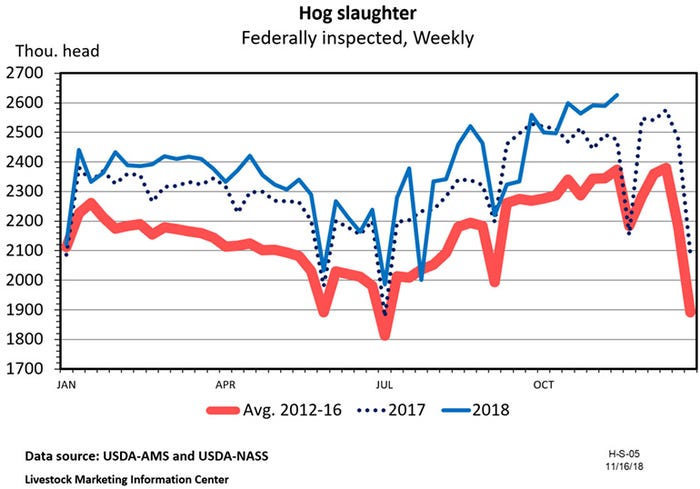

Last week, hog slaughter exceeded 2.6 million head for the first week ever. USDA’s preliminary estimate of federally inspected hog slaughter for the week ending Nov. 17 is 2,626,000 head.

That is nearly 27,000 head above the record of 2,599,061 set during the week ending Oct. 20. Hog slaughter during the week ending Nov. 3 totaled 2,591,128 head.

Prior to this fall, the record for federally inspected hog slaughter in a week was 2,575,541 head for the week ending Dec. 16, 2017. That now shapes up to be the fifth largest week after the three weeks mentioned above and the week of Nov. 10, which had a preliminary slaughter estimate of 2,587,000 head. The sixth and seventh largest slaughter weeks were also this fall. I expect the Nov. 17 record to be surpassed before the end of the year. The week following Thanksgiving and the week preceding Christmas are both reasonable candidates for new slaughter records.

Because this coming Thursday is Thanksgiving Day, slaughter in the week ahead will be down sharply from last week’s record; but Saturday slaughter will be very large.

The largest Saturday slaughter of the year usually comes the Saturday after one of three holidays — Labor Day, Thanksgiving or Christmas. The record for hog slaughter on a Saturday is 389,808 head on Sept. 8, 2017. That record could fall later this week.

Federally inspected hog slaughter on Oct. 16 was 479,328 head, which, I believe, is the most ever for a single day. I expect that record to be surpassed before the end of the year.

The largest hog slaughter for the months of January, February, March, May, July, August and October have come in 2018. I expect November and December to be added to that list by the end of the year. It looks like every month in 2018 will set a new record for slaughter during that month with the exception of April, June and September.

Despite all these records, hog slaughter since Sept. 1 has been lower than indicated by the market hog inventory in the September Hogs and Pigs report. This shortfall is due in large part to the disruption Hurricane Florence caused for East Coast hog slaughter during September. The Hogs and Pigs report said inventory of market hogs weighing 180 pounds or more was up 3.5% at the start of September, but daily hog slaughter during September was down 1.5%.

Thus far in 2018, hog slaughter has been up 2.4% and, because of heavier weights, pork production has been up 2.8%.

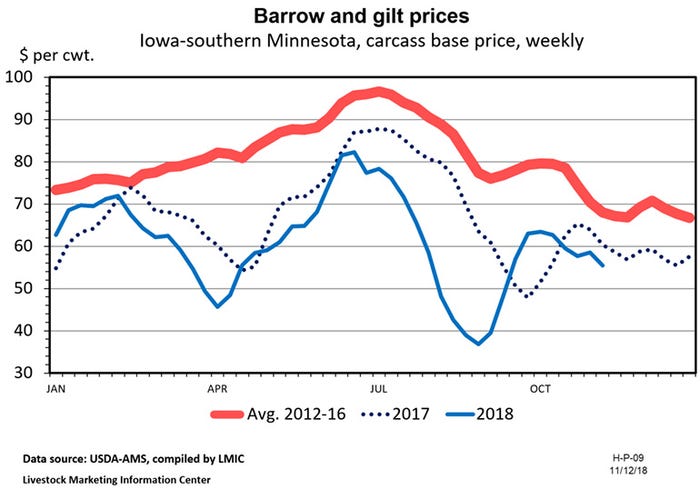

Due to some extremely low prices during September, fourth quarter hog prices are likely to average $3-4 per hundredweight lower than last year’s level.

USDA is forecasting an average liveweight price for barrows and gilts of roughly $45.50 per hundredweight this year and between $40 per hundredweight and $43 per hundredweight for next year. The average liveweight price for 51-52% lean hogs in October was $47.54 per hundredweight, up $9.10 per hundredweight from September and up $3.79 per hundredweight from a year earlier.

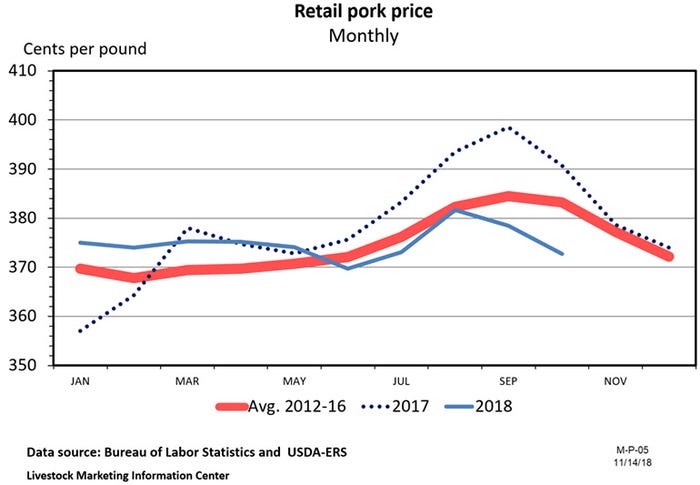

Hog prices jumped up in October, but retail prices were down. The average retail price of pork in grocery stores during October was $3.727 per pound, down 5.8 cents from the month before and down 18.0 cents from a year ago.

Margins for middlemen shrank in October. The farm-to-wholesale price spread was down 3.3 cents from September and the wholesale-retail spread was down 18.7 cents per pound.

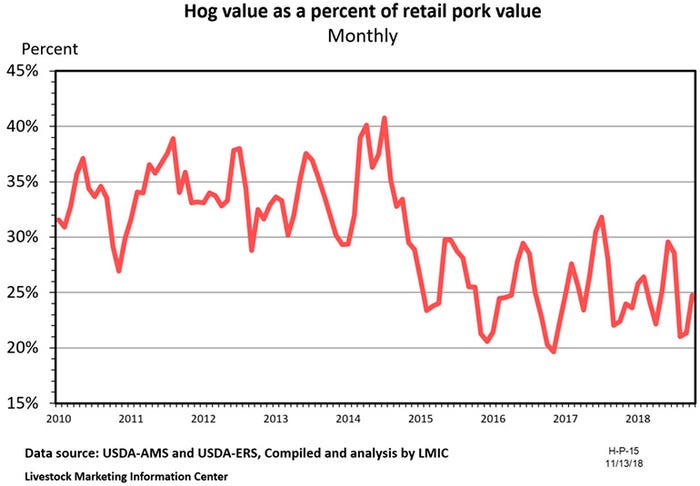

As typically happens when hog slaughter is high, hog prices are declining as a share of the retail price of pork. For the years 2010 through 2014, hog value was roughly 34% of retail pork value. For 2015 through 2018 hog value has been closer to 25% of the retail value of pork. The farmer’s share of the consumer pork dollar is likely to remain low until hog numbers decline.

USDA’s November World Agricultural Supply and Demand Estimates trimmed estimated pork production for 2019 a bit, but they are still forecasting 5.3% more pork than this year.

On Wednesday afternoon of this week, USDA will release their monthly Livestock Slaughter report. Preliminary data indicate October hog slaughter was up 5.9%, year-over-year. October 2018 had one extra slaughter day than last year so daily slaughter was up 1.3% in October. The November Cattle on Feed report also will be released on Wednesday afternoon as will the monthly Cold Storage numbers.

About the Author(s)

You May Also Like