April 11, 2016

Hope and change.

No, not that kind. I am talking for real.

Various analysts writing in this forum have documented the potential danger facing the pork producer in the fourth quarter of this year and drifting into the first quarter of next year. We at Kerns and Associates generally agree with the warning bells and advise caution for these timeframes.

The recent Hogs and Pigs report would not indicate the same level of warning, but there is reason to believe that this report may be understating the magnitude of marketings for those upcoming time slots. To wit, the 50,000 sows “lost” in Iowa may be an accounting error, as the Christensen sale of assets to Seaboard occurred at roughly the same time that the survey was being conducted. It is not too far of a stretch to consider that the selling party took them off the books while the buying party did not recognize them on the report. We will watch the June numbers closely in anticipation that these animals return to the ledger.

Secondly, the June-to-August farrowing adjustments simply do not make sense. Steve Meyer did a good job of articulating this point, and we have corroborated this opinion at an industry gathering earlier this month. It is significantly more likely that a larger pigs-per-litter number is a better explanation of the greater marketing levels rather than farrowing intensity. There had to be an adjustment in either the number of sows, the farrowing rate or the pigs per litter. I believe an upward adjustment in the number of pigs per litter is the best explanation to reconcile last year’s June-to-August pig crop variance.

Bottom line: the futures market is allowing the pork producer to hedge values in the October-to-March period that represent break-even or modest losses. This is a timeframe that could be miserable for the pork producer if our analysis is anywhere close to accurate.

What's in the cards?

With that grim prognosis recognized, let us look at what could be in the cards for the second quarter of 2017 (this is the Hope arena) and beyond on account of the upcoming Change.

There are five new pork-processing facilities on queue. The first two are smaller, specialized facilities that are slated to begin operating later this year, while two large plants are on schedule for 2017 and one for 2018. The addition of these three larger plants is the impetus of the changing landscape.

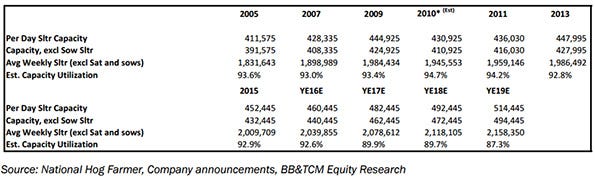

The table, courtesy of BB&T Capital, shows packing capacity for the past several years. Note that we have been operating in the mid-90s percentile of capacity utilization. This number is projected to move into the upper 80s when the two big plants come online in the summer of 2017. We have been trading at a high rate of harvest relative to capacity — we have taxed capacity and the spread between the price of a live animal and the cutout has widened over time, the live market “losing”.

The upcoming shifting sands are going to create a situation where this reality also changes. It may be tough to internalize the magnitude of the forthcoming Change. We will go from a metaphorical situation characterized by rain (recent reality) to a potential torrential downpour (the October-to-March period described earlier) to blissful sunshine (packing capacity coming online in the second quarter 2017).

Soybean meal parallel

I liken this to what we have experienced in the soybean meal market the past few years. In 2012, 2013 and 2014 a pork producer was likely to pay in excess of $500 per ton for product at some time each summer. When the supply-demand situation rolled over with back-to-back record crops, the prospect of owning $350ish cash soybean meal seemed like a dream come true. Equilibrium reality is closer to $250 per ton — thus rewarding those who were patient and recognized that the world had changed.

I see the same thing coming to the hog industry in the second quarter of 2017. Our cloudy skies are going to give way to abundant sunshine and the balance of power is likely to shift away from the packing community and back into the hands of the pork producer. There are other cards at play; let’s unfold a few of them.

Beginning in January 2017, we will be faced with compliance to Guidance 209 and 213 as well as the implementation of the Food Safety and Modernization Act. We have had many discussions where the producer plans to have his Veterinary Feed Directive feeds manufactured at a location that is ill prepared to handle the responsibility or the volume. This one concerns me. If we are under margin compression around this time and those on the edge are faced with massive changes, is it reasonable to expect some will reach a tipping point and throw in the towel? Possibly.

Related to the VFD guidances referenced, it appears we will be losing one of the most effective enteric drugs at our avail — Carbadox. Is it reasonable to expect that the cessation of this useful tool will hamper nursery performance? Possibly.

There are a few rumblings that the planned plant for Mason City may be more smoke screen than intention and its likelihood of completion is less than 50:50. Poppycock. This plant is a part of the long-term strategic vision for the Prestage family. Finances are in order and — absent of an unforeseen community rejection — the plant will be built. Count on it.

So what is a pork producer to do?

Negotiate like you’re Donald Trump. You need to do what you need to do to get to the second quarter of 2017, but keeping packing agreements truncated to as short of a timeframe as possible will put the keys to your future in your hands. Ask for the moon if you are going to enter into a long-term relationship.

Plan to move animals on the open market. We have, perhaps, been appropriately hiding from the open market in the era of compressed packing capacity. Your fortunes will be enhanced in the era of Change via marketing hogs to support the western Corn Belt or your regional index. Dust off your Rolodex and negotiate on hogs or hire someone to do it for you.

Pay attention to the June Hogs and Pigs report. If the data does not fit into the box I presented above, we will have to re-evaluate our strategy.

In closing, pork producers are in a favorable position with forward values on the CME at higher levels than I anticipate will be present when we get there. Take advantage of the opportunity and lock-in acceptable margins while keeping an eye on the bouncing ball of packer capacity.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

About the Author(s)

You May Also Like