It does not appear that the increased slaughter has come from pulling ahead on marketings.

On average, hog prices creep slowly higher at this time of year. This year, higher-than-expected hog slaughter has been dragging prices down. Friday afternoon’s hog carcass prices were $4.12 per hundredweight lower than seven days earlier and $7.56 per hundredweight lower than a month ago.

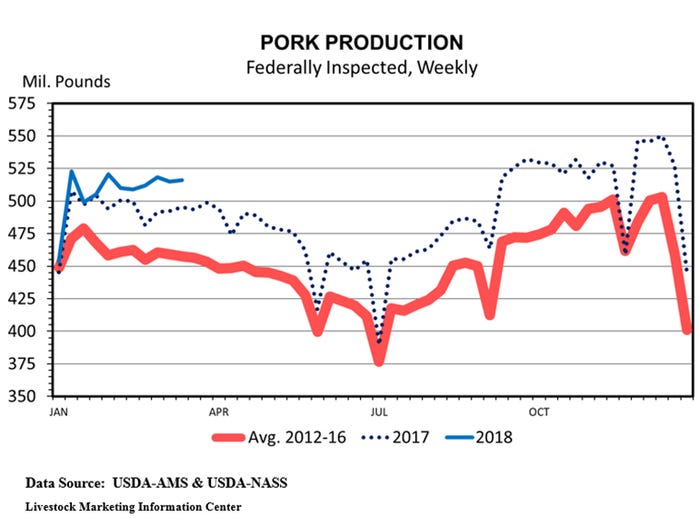

Last week federally inspected hog slaughter totaled 2.413 million head. That was up 0.4% from the week before, up 3.5% from the same week last year, and the seventh week in a row with slaughter higher than last year.

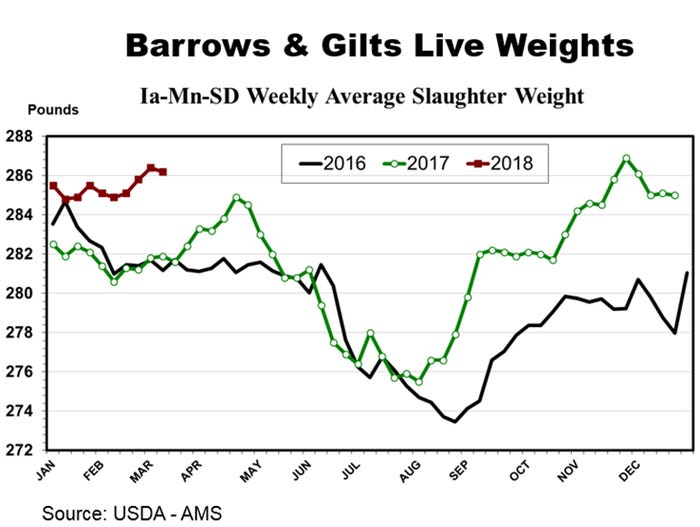

It does not appear that the increased slaughter has come from pulling ahead on marketings. The average barrow and gilt slaughter weight in Iowa-Minnesota-South Dakota for the week ending March 10 was 286.2 pounds. That was up 4.3 pounds from the same week in 2017. It was the seventh consecutive week with weights above the year-ago level by more than 3.0 pounds and the 20th consecutive week with live weights above the year-ago level.

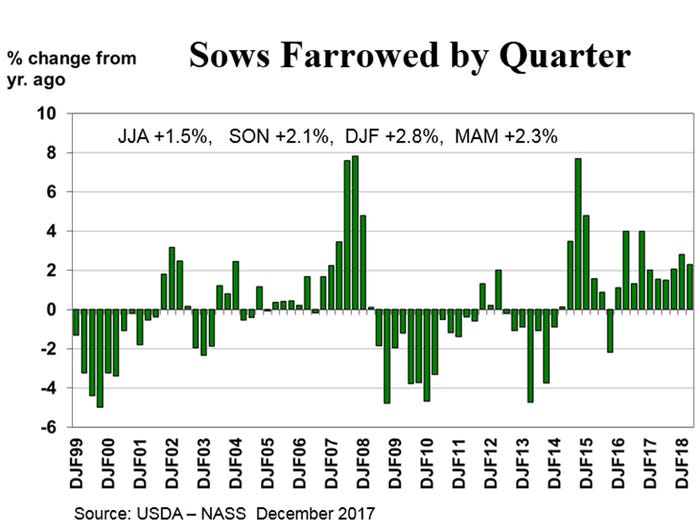

Since the first of December, hog slaughter has been nearly 1% higher than implied by the December market hog inventory. The USDA is likely to revise upward their estimate of last summer’s pig crop and litters farrowed in the March Hogs and Pigs report, which is scheduled to be released on March 29.

Hog production has been just profitable enough that farrowings are likely to continue to increase. The number of litters farrowed have been above the year-earlier level each quarter since December-February 2016. Fall 2017 farrowings were estimated to be up 2.1%, winter farrowings up 2.8% and spring 2018 litters farrowed up 2.3%.

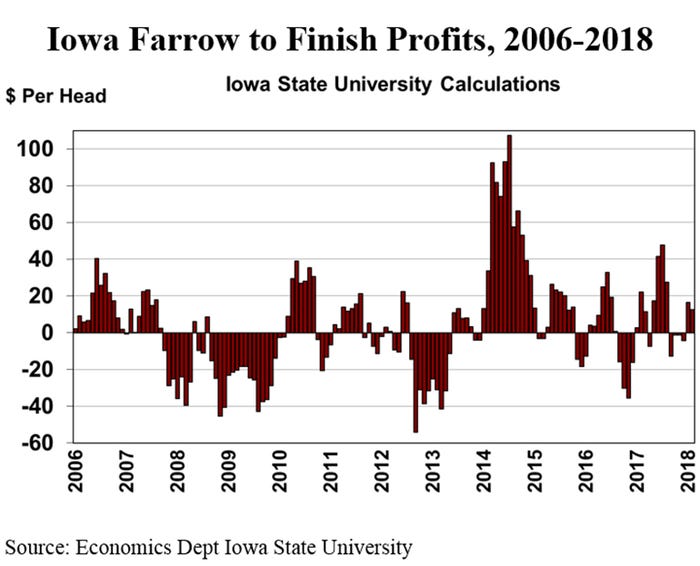

Iowa State University calculations estimate the typical Iowa farrow-to-finish operation lost roughly $2.33 per head on hogs sold in the fourth quarter of 2017, but was in the black by more than $10 per head during the first two months of 2018.

Rising corn prices and declining hog prices are eating away at hog farm profits. Corn futures moved steadily higher in January and February. March futures price movements have been a lot of up and down with a small net change. The May corn futures contract ended last week at $3.8275 per bushel, down 3.5 cents from the start of March, but up 21.5 cents since the start of 2018.

Hog futures have been trending lower since the end of 2017. The April lean hog futures contract ended last week at $65.45 per hundredweight, down $1.52 from the start of March and down $9.40 from the start of the year.

USDA’s forecast is for 2018 pork production to be up 5.2% from last year. That would be the largest yearly increase since 2015. Year-to-date pork production is up only 3.2%, so the rate of increase will need to accelerate for their forecast to be accurate.

USDA is predicting that 2018 per capita pork consumption will average 52.0 pounds per American. That is up 1.9 pounds from last year and the highest per capita level since 1999.

USDA expects 2018 hog prices to be down roughly 4% with 51-52% lean live hog prices in the $47-50 per hundredweight range. That will be a modest decline if pork production really is up 5.2%.

Retail pork prices averaged $3.74 per pound in February. That was down 1.0 cent from January, but up 9.7 cents from February 2017. The higher retail price translated into better margins for retailers, but not better margins for packers or higher hog prices. The wholesale-retail price spread was up 20.3 cents year-over-year, but the farm-wholesale price spread was down 7.1 cents from February 2017. The average live price of 51-52% lean market hogs was $51.49 per hundredweight in February, up $1.09 from January, but down $1.53 from last February.

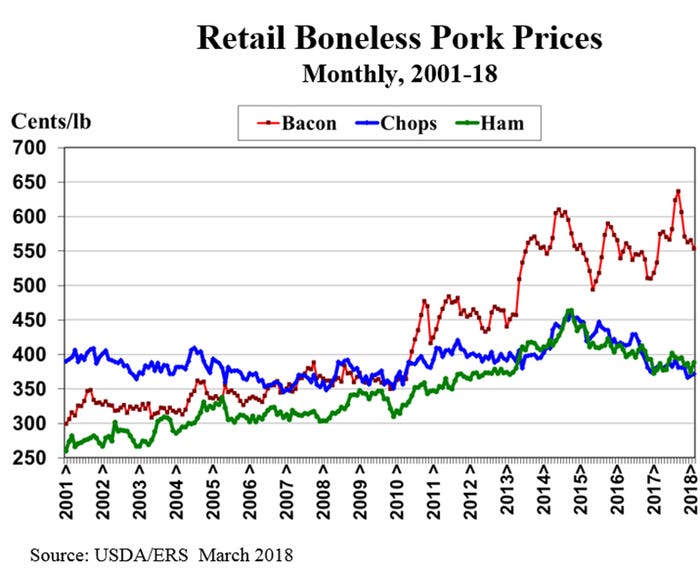

Domestic pork demand was up between 2% and 3% in January. January export demand for pork was up 4% year-over-year. Packer demand for live hogs was up 3.8% in January. Much of the strength in domestic pork demand in recent years has been due to growing demand for bacon. As the chart shows, bacon prices have done very well. Pork loin prices have not. The average grocery store price of boneless pork loin has been lower than boneless ham for each of the last nine months.

The University of Michigan’s monthly index of consumer confidence has reached the highest level since January 2004. That is good news for economic growth which is good news for meat demand. The preliminary March confidence index was 5.3% above the year-earlier level.

January pork exports were up 6.2% year-over-year, with strong increases in shipments to Japan, South Korea and China. Pork imports were up 12.6% in January because of a big jump in pork coming in from Poland.

On Thursday afternoon of this week, USDA-NASS will release the monthly Cold Storage report and the monthly Livestock Slaughter report. The amount of pork in cold storage was up 8% year-over-year at the end of January. I expect the Feb. 28 stocks of frozen pork will also be higher than last year. Preliminary data indicates February hog slaughter was up 2.8% on both a daily and a monthly basis. The March Cattle on Feed report will be released on Friday afternoon.

About the Author(s)

You May Also Like