Although the pace of increase is likely to slow, the odds are good that there are a few more weeks of price increases ahead.

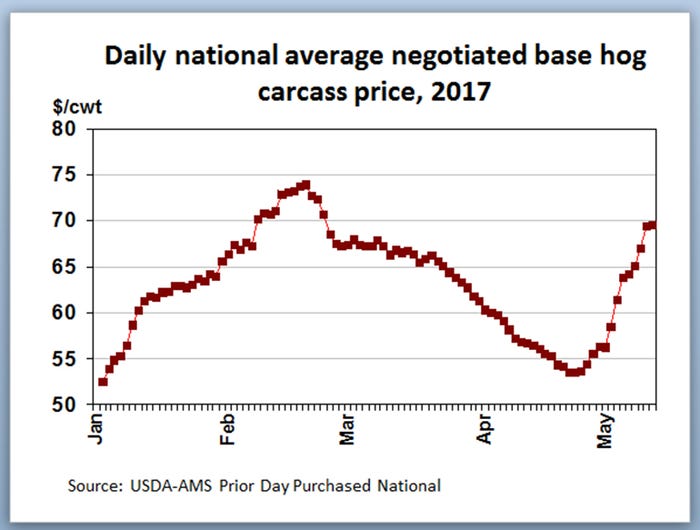

Hog prices have been on a roller coaster ride thus far in 2017. There have been long stretches of up or down with not many bumps. The national average barrow and gilt base carcass price started the year at $52.51 per hundredweight and climbed for 26 of the next 34 market days reaching $73.95 per hundredweight on Feb. 20. From there it declined on 38 of the next 45 market days to a low of $53.45 per hundredweight on April 24.

Since then, prices have moved rapidly higher. Although the pace of increase is likely to slow, the odds are good that there are a few more weeks of price increases ahead. Will prices be able to surpass the Feb. 20 peak? Probably.

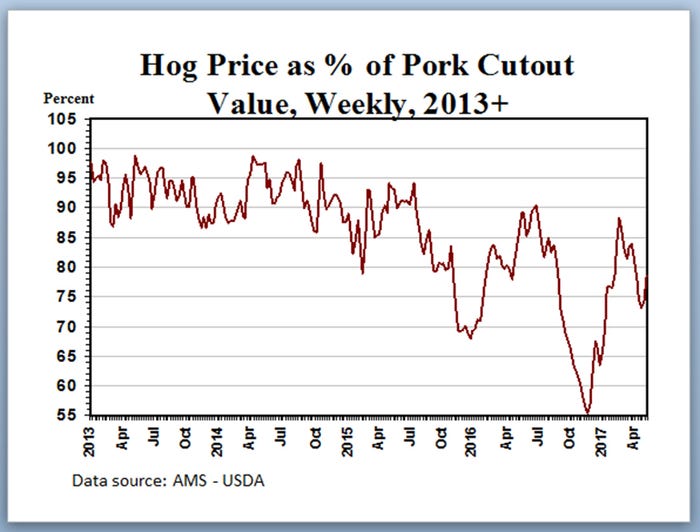

The current ratio between hog prices and pork cutout value leaves room for higher hog prices. Historically, carcass hog prices have averaged 92% of the pork cutout value. Hog prices dropped to 55.4% of pork cutout value the week of Thanksgiving. Lots of hogs and stressed slaughter capacity were the causes of the low percentages in the fourth quarter of 2016. Last week’s hog prices were 79% of cutout value. The current cutout value would support $10 per hundredweight higher hog prices at the 92% level.

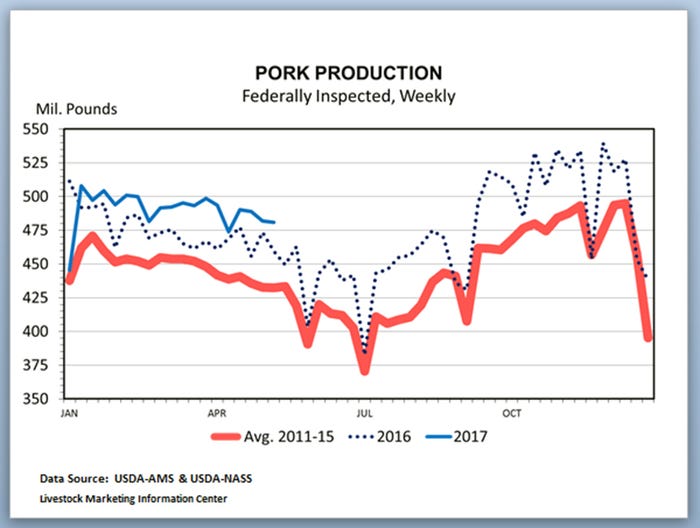

Year-to-date pork production is up 3% compared to the same period in 2016. Pork production has been above the year-ago level each week since the first week of the year. Based on the March hog inventory report, hog slaughter should stay above the year-ago level through the fall. This would produce a price disaster were it not for the two new slaughter plants (Sioux City, Iowa, and Coldwater, Mich.) coming on line this summer. As it is, the challenge for packers will be to move the record amount of pork coming out of slaughter plants at a price that will keep hog producers at least close to being profitable.

A big chunk of this year’s record pork supply will need to move to international markets. U.S. pork exports were up 17.1% during the first three months of 2017. The weekly data on muscle meat exports indicates April pork exports were close to April 2016. Thus far in 2017, export demand has been strong, yielding mostly reasonable hog prices in the face of record slaughter.

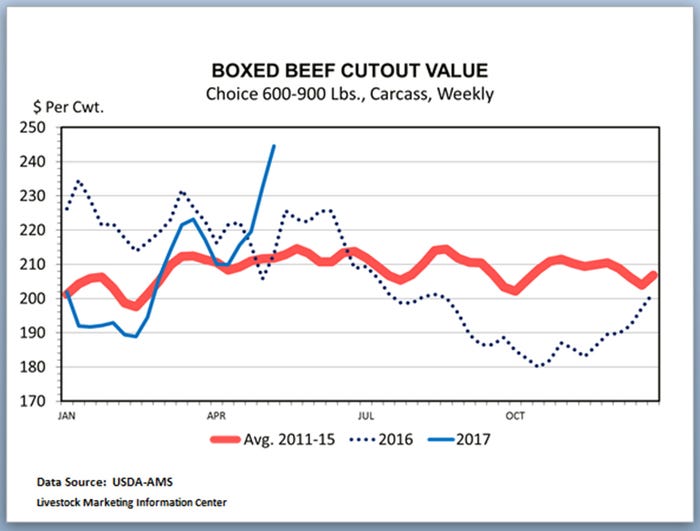

Unexpectedly high beef prices have been supporting pork prices. Friday’s choice boxed beef cutout value was the highest since July 2, 2015.

There is a strong seasonal pattern to spring and summer hog prices. June and July typically have the highest hog prices and the lowest daily pork production of the year. Over the last 10 years, the average negotiated base carcass price on the first weekday of April was $72.45 per hundredweight; at the start of May it was $78.85 per hundredweight, up $6.40 from a month earlier; at the beginning of June it was $80.24 per hundredweight, up $1.39 from the month before; at the start of July it was $83.92 per hundredweight, up $3.67; at the start of August it was $82.99, down $0.93 from a month earlier.

Of course, every year is somewhat different. This year the May 1 average negotiated hog price was only $56.25 per hundredweight, down $4.07 from the first marketing day in April.

The futures market is predicting stable hog prices for the next three months. Last Friday the June lean hog futures contract closed at $77.95 per hundredweight, $6.05 above the May contract. July settled at $78.60 per hundredweight, 65 cents above June. August closed at $77.90 per hundredweight, 70 cents below July.

Hog slaughter has been tracking close to the market hog inventory numbers in the quarterly Hogs and Pigs reports. There will be a record number of hogs to process this year. The key to profitable hog prices is pork demand, both domestic and export.

About the Author(s)

You May Also Like