You may want to stay awake for the June Hogs and Pigs Report, released on June 25. The past several have been yawners.

June 22, 2020

Whether we like it or not, we are all creatures of habit who need and want predictable items in life to help us throughout our day. Where we put the car keys every night, what kind of coffee we prefer each morning, the dependability of a good dog and the solidarity of loving relationships are all examples of structure we seek and desire.

The same mantra holds true when we are navigating hog markets — we seek something as a solid known from which to base our opinions and adjust from there. Unfortunately, recently knowns are proving to be something less than reliable, but I think we have a reset coming in the form of this week's Hogs and Pigs Report.

Here is one thing I think I know for sure — there will be numerous utterances of, "no way", in the wake of the report, regardless of how the numbers play out on paper. There are simply too many moving variables and too many differing opinions to reach any consensus that we can all agree upon. Regardless of the feather-ruffling that will be in the wake of the report, they represent the best numbers we have as an industry and I believe it is prudent to not simply dismiss the data as irrelevant just because it does not fit my bias.

Let's take a look at some of our biases and how they may or may not serve us in this environment.

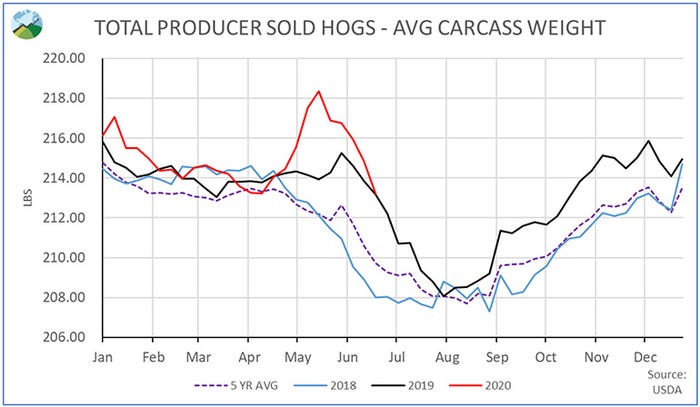

Hog weights: We have a nice, predictable seasonality of hog weights that, in normal times, are a pretty good indicator of how current our marketings are and give a key to how the available supply of market-ready hogs may look. Note in the chart below, we have seen a sharp spike lower in weights that is seemingly in contrast to the increase in weights that occurred in the wake of the COVID-related shutdown of packing plants.

Does this mean we have worked through the backlog of animals and are now current? We actually had decent packer interest in open market hogs last week. Are we in a better position than previously thought? I think this one falls in the head fake arena. Numerous conversations with several production systems would indicate that a combination of warm temperatures and the implementation of slow/no growth diets may have more to do with the shape of this graph rather than the industry being current.

Give our nutritionists credit: We asked them to mitigate growth, they responded with vigor. In my opinion, the 2.5(ish) million hogs that were backed up earlier in the year did not just go away, we have temporarily masked the reality of the situation and the hogs backed up in the barns will have to be dealt with, via marketings or other means.

Euthanasia: The dreaded word for my polite use of "or other means" in the last paragraph. Iowa did an excellent job, recently, by responding to the outcry from producers to do something, anything, to provide assistance in this tough economic environment.

The state responded with a reasonable and measured response by offering $40 per head for up to 600,000 animals that were believed to be backed up in the state. The subscription to this program has been underwhelming, to say the least. Roughly 10% of the gross volume has been nominated — could it be that there are not as many animals in distress to trigger more participation? I don't think that is the case, I think there is something else going on.

Namely, we call you pork producers because that is your chosen profession, the thought of euthanizing an otherwise healthy animal is beyond the scope of comprehension for most. This genetically-imprinted mindset of animal husbandry and combined with the heinous behavior of the activist crowd is enough tip the scale, in my opinion. To wit, the groups that are breaking civil laws (and disregarding the respect of fellow humans) with their illegal acts is working in one sense in that it is making the painful decision of market animal euthanizing even more difficult. That is the rationale behind the lack of more participation, not a flaw in the program or the lack of backed up animals. Our COVID environment means that those who break the laws are not arrested and detained for fear of human-health repercussions. Justice is not being done when the owners of operations are targeted, and their property rights violated. The animals are there, the motivation to hold onto them is more than the perceived pain of elimination.

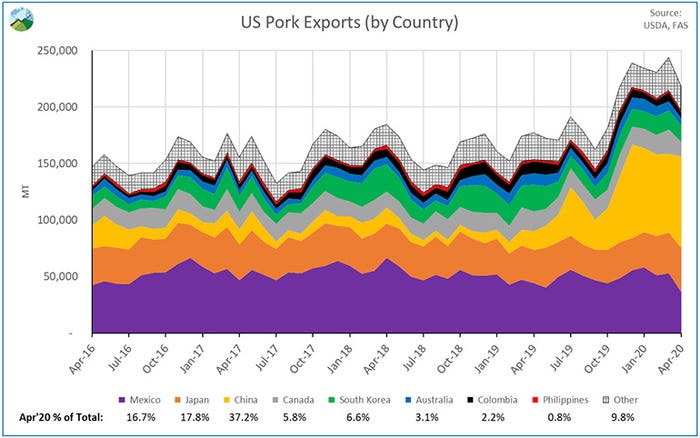

Exports: Our one bright spot in an otherwise bleak environment. Exports have been fantastic with the great promise of China getting a lot of press, and for good reason. China is taking fully 12% of our production — not 12% of our exports. China, the growing yellow chunk in the graph below, is nearly 40% of our export volume. Will the trend continue, and can we count on China to sponsor the U.S. market? Maybe not.

Aside from the significant geopolitical tensions in U.S.-Sino relations, we recently had another marker that should be ominous to market observers. The suspension of a large German pork plant due to COVID concerns might lead you to believe that the misfortune of the Germans portends to largesse for the U.S. producer. Careful with that one. The non-scientific implementation of trade barriers is, first, nothing new to the Chinese negotiation techniques and, second, not confined to Europe.

Along with the German suspension, Tyson's chicken plant in Arkansas was also targeted because of employee exposure to COVID — not because there was any meat contamination or any other rational cause. This should catch the attention of everyone as the arbitrary declaration in this manner is both fickle and unjustified. The fact that COVID originated in China and they cite the potential for exposure as their reason for suspension would be funny if it were not so sad. Bottom line: the current lift in exports we are experiencing is subject to baseless vacillation and should not be used as a permanent marker.

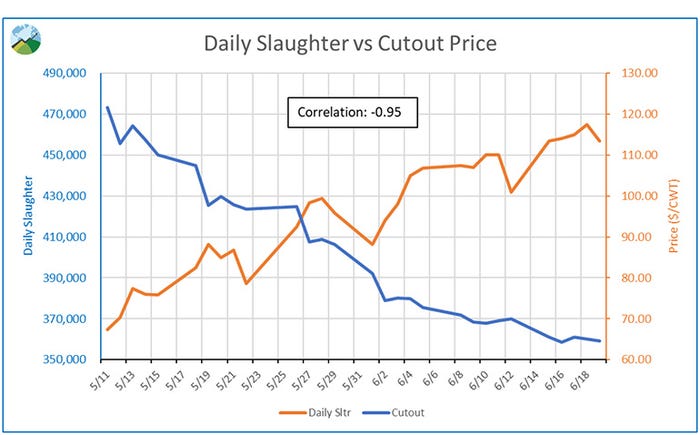

Amidst all of this unreliability, how about something that does make sense? Below is a chart that depicts the cutout value and the harvest rate. As you might expect, the more animals we move through the processing plants, the lower the price goes. This one makes logical sense and holds true to a correlation value of -0.95 — an almost perfectly inverted relationship. While predictable, this is not good news. If you subscribe to the theory that the backed up animals did not disappear, we will have more than enough to sustain demand and further experiences of margin compression for pork producers are on queue. There is a difference between predictable and good.

As mentioned at the top of this column, the June Hogs and Pigs Report will be released after the close on the June 25. This will likely be one that you want to stay awake for — the past several have been yawners. In my opinion, the sow numbers will come in at values (+/-100%) that do not equate to liquidation or a right-sizing of the breeding herd to meet the compressed shackle space constraint. The real wild card may be in the weight categories and whether this data are properly obtained. If you think there are somewhere in the neighborhood of 2.5 million animals backed up — and — they are put in the appropriate weight category, we could see a 180+ segment somewhere close to 120% of last year's numbers.

Additionally, the work we have done in the farrowing house to only put the best animals on feed could show up in the 50-pounds-and-under category by indicating compressed values. All of these moving parts will make the job of the market very complicated as we adjust our models of flow versus demand and available shackle space in relationship to price. My bias coming into the report is one of caution that the current negative economic environment could endure longer than we want.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like