Producers will continue to face higher input prices to produce pork while being subject to a retail sector that is loathe to pass along price increases.

February 20, 2023

A widely held belief in most Western societies is that, "we do not negotiate with terrorists." This is a consistent policy that probably makes sense in most hostage crisis situations, it may ring closer to home if you have had your business systems hijacked by a rogue group that demands ransom money to turn your systems back on – sometimes you have to deal with the reality rather than the official policy.

Dr. Meyer has done a wonderful job in this forum by articulating the changes in demand and the impact on our prices. In essence, we have shifted back to our pre-COVID demand curve and that is not a tenable situation when the cost of production is running either side of $100/carcass cwt. He has stopped short of declaring a villain in this scenario, but it seems that we can find at least one lurking in the alley as the retail prices for pork have remained stubbornly high while the wholesale price – the values that impact the producer and the packer – remain under pressure. Yes, the retailer (the same group that has recently accused the packer of price gouging and is litigating the same) is taking a larger share of the consumer dollar and not passing along the lower wholesale values to at the store level.

To be fair, they have been under margin compression in the past two years as inflationary pressures from their supply side have eroded overall margins. Consider that Coca Cola recently announced that they would pass on higher prices in 2023 and that Nestle, the world's largest food company, has announced the same and you may be able to sympathize a bit with the retailer's plight. He is being hit with price increases across the whole spectrum of his cost of goods and is motivated to find some place – any place – where he can recapture some margin to aid his bottom line. Unfortunately for us, pork seems to be one of those areas where passing along the savings has been ignored and we are suffering at the hands of the retailer.

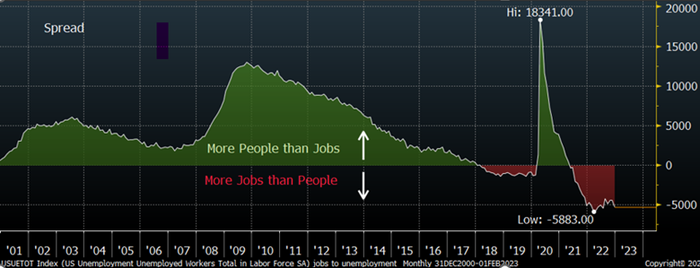

While the author of this article takes no joy in articulating a forward-look that may be consistent with our current doldrums, I suspect this environment of high inflation is going to be with us for quite some time. It is easy to criticize Jerome Powell for being slow to internalize that inflationary pressures were present and something other than transitory, he has seemingly learned from his mistake and has set a clear directive to keep raising interest rates until inflation is under control, even if it causes a deleterious impact to the U.S. economy. It is against this backdrop of a steely-eyed path to rein in inflation and a stubbornly low unemployment rate that likely lead to a protracted condition of inflationary pressure.

The chart below depicts this scenario; I have put a red box around where we are right now – still more jobs than people to fill them. In short, I believe that we will be held hostage to higher input prices to produce pork and will be subject to a retail sector that is loathe to pass along the price increases because they have learned they can 1) get away with higher margins and 2) will continue to exploit the opportunity.

The most unfortunate part about this situation is that it does not change quickly from a structural perspective. Our supply chain and distribution system means that we are "stuck" with the current margin pressure until something changes internally (the lowering of retail margins in the meat case) or externally (we develop a way to avoid the retailer). Neither of these two solutions are on the short-term horizon.

Unless we see an uptick in wholesale demand, we are likely to be in a quagmire for the better part of 2023. This is not just my opinion, a recent release from Seaboard reflected the same as they wrote that they are "unable to predict market prices for pork products or biodiesel or the costs of feed or third-party hogs for future periods" and "anticipates this segment will not be profitable in 2023."

So what is a pork producer to do? While not representing profits, futures prices for the thrid and fourth quarter are substantially higher than where our model predicts values given current demand and projected supply. We have rallied summer futures to over $120/cwt for the past two years and we are certainly hoping we can see a repeat of the same. In the absence of such, it may be prudent to secure coverage to hold on for better times.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Click here to contact the author.

About the Author(s)

You May Also Like