So what does all of this mean to pork producers? In a word, volatility.

January 16, 2023

The estimates coming in to last week's USDA report were generally of the benign variety, expecting a polite, mild revision to the November numbers (the December report is just a disappearance revision for the U.S. balance sheet) and a straightening of the deck heading into the new year. What the USDA delivered was a complete tilt of the table – not in the favor of livestock producers – that will set the stage for a dynamic spring planting season.

If you were looking at the headlines when the report was released, you would have been really confused with all of the subsequent frenzy. Corn yield went up 1 bu/acre from 172.3 to 173.3, this was just a mathematical reality of a changing denominator in losing drought impacted acres in the west. The shock to the system was not that we lost some harvested acres in tough production areas, it was the magnitude of the change – almost 1.6 million acres. To put that in perspective, this is the largest change in acres since the USDA began publishing data in 1974.

In the past 10 years, our biggest shift has been less than a half-million acres, last week's report is more than a factor of 3x that level. To say that "this changes things" may be a subtle understatement to the task that lies ahead of us in the corn market.

Corn has to buy acres to keep a balance sheet intact. This is against a backdrop of input concerns of both price and logistics, while new crop corn is currently trading at nearly identical levels to this time last year. In fact, our numbers would indicate that we need to add in excess of 2.5 million acres to the corn acreage column and have record yields just to hold serve. Hmm, seems to me that corn has some work to do to become the more attractive option to U.S. farmers.

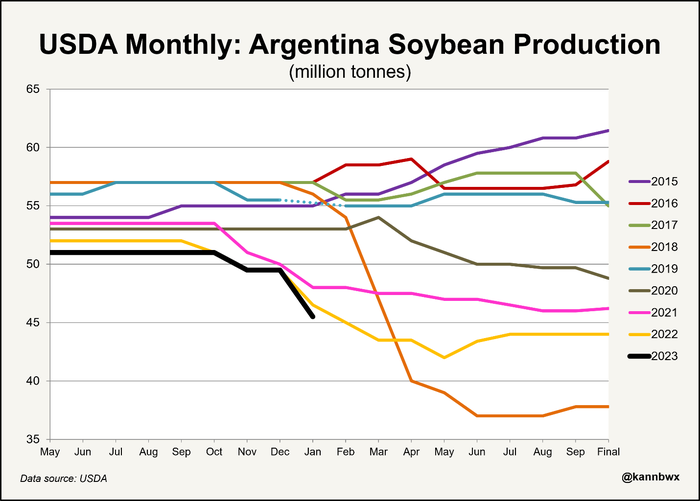

The USDA began to recognize the production difficulties in Argentina, lowering production 3 mmt while the trade is implying that the USDA needs to get more aggressive and mirror the 2018 debacle when production was sub-40 mmt. This story is not yet fully written and I anticipate further tightening of the world balance sheet as the USDA plays catchup to the drought impact and the Russian/Ukranian war drags on.

Beans were not left out of the fun. The reduction in Argentina production in soy has led to the importation of beans from Brazil to supply the Argentinean crush capacity (recall, Argentina traditionally supplies roughly 40% of the world trade in soybean meal) which means that Brazilian production is reduced to traditional world buyers ... and by the way, the USDA posted Chinese imports of beans for the month of December as the highest on record. There are a lot of moving parts in the soy complex, too, with the easing of COVID restrictions generally anticipated to provide a boost to Chinese economic activity. The U.S. soy balance sheet will not be ignored coming into the spring with an additional 1 million acres needed and near-record yields just to remain out of rationing mode.

So what does all of this mean to pork producers? In a word, volatility. We have essentially lost any buffer that we may have had in both the corn and soybean balance sheet. I have written previously in this space about the long-term battle for acres associated with Renewable Diesel and Sustainable Aviation Fuel production, both of those items are alive and well and lurking in the future to be addressed as the infrastructure is being constructed currently and will come online over the next couple of years.

Throw in some weather shifts as we transition from La Nina to El Nino (anyone noticed what is happening weatherwise in California?) and you have a recipe for confusion. Appropriately so given the number of moving parts. All of this uncertainty prices itself into the futures market in the form of volatility, the cost of such will be borne by the end-users of the product (sorry, that is you). We do not see the cost of production agriculture getting much, if any, relief in calendar year 2023, we still need the revenue side of the business to provide us the path to profitability.

As a sidebar, this changing weather scenario, the impact of storms on populated regions and other aberrations across the globe have wreaked havoc on the overall insurance industry – they had a terrible year last year. Expect your premiums on everything to go up substantially as that industry scrambles for any place to generate revenue. Your barns, your equipment, you vehicles – premiums on everything will be moving higher. This one will require some effort on your part to tease out the most favorable path. It is easy to check the box of "just do what we did last year." You may have to seek alternatives and options to secure the best rotten deal. Happy New Year(?)

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Click here to contact the author.

About the Author(s)

You May Also Like