Variety meats are in high demand, meaning that shipments of things that the collective “we” do not want are finding success on foreign shores.

January 8, 2018

Those of you old enough to remember the movie “The Graduate” will recall the free advice that Dustin Hoffman received regarding his career opportunities: Plastics. It seems to me that the future of the pork industry can be similarly boiled down to one word: Exports.

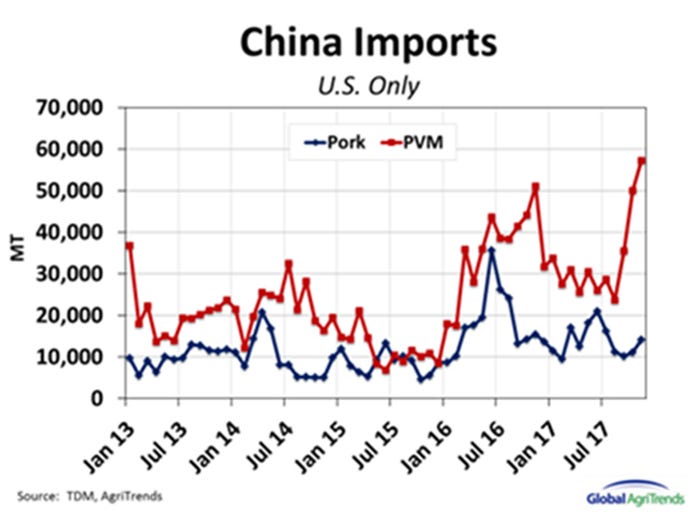

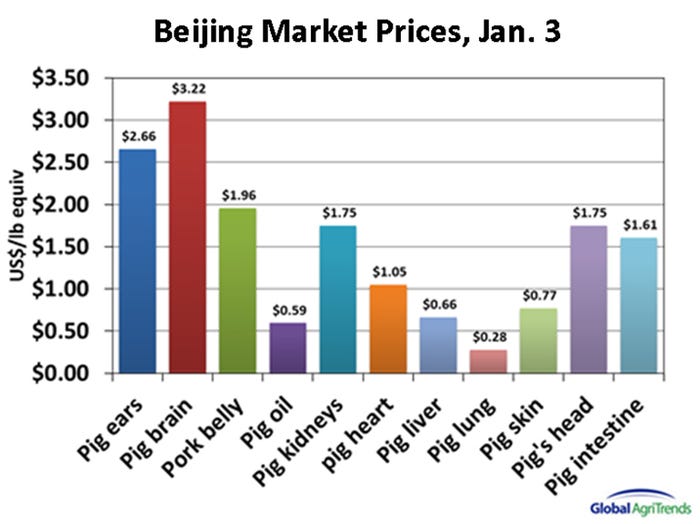

Attached is a graph, courtesy of Brett Stuart from Global AgriTrends, regarding the unprecedented shipments of variety meats to China. This is from the official China import statistics and does not necessarily correlate one-to-one with USDA export data from the same period — there are often monthly discrepancies that iron themselves out over time. Look at the red line that represents pork variety meats (more on that in a bit). Record imports from the United States in November. This is great news on many fronts, not the least of which is represented on the second chart which depicts the subcategories and the prices they are trading at in China.

Are you (or anyone you know) willing to pay more than $3 per pound for pig brains? Me neither. The bottom line is that shipments of things that the collective “we” do not want are finding success on foreign shores. These items are not represented in the printed cutout values (IE, PK_602) that we use for price discovery, these are kickers that enhance the value of the hog and allow the packer and, ostensibly, the producer to garner more money from the animal. We can argue all day over who should get the lion’s share, I am just happy there are benefits on the table for division.

Byproduct values, which include these variety meats, are items that allow packers to pay producers a higher percentage of the total cutout.

The success story is not limited to China. The USDA just released their November data showing a new record for export volumes out of the United States. Mexico was the key driver, shipments there were up 13% year-to-date, and Korea up 29%. Our collective interest in maintaining favorable trading relationships across the globe is paramount to the sustained success of the U.S. pork industry. Now is anyone else a little queasy about the future of the North American Free Trade Agreement or the Korean-U.S. free trade agreement?

I shared in my column last month the projections for world incomes to rise and the positive correlation of rising earnings and demand for protein. With 95% of the world living outside of the United States we are in a fantastic position to serve this wave of opportunity.

The U.S. Department of Commerce just released the October values. Imports of all goods were up 2.5%, exports were up 2.3%. The balance of trade went in the wrong direction, but this is a rising tide that raises all ships. This bump in world gross domestic product is the stuff that demand markets are made of.

And now, on to the grains …

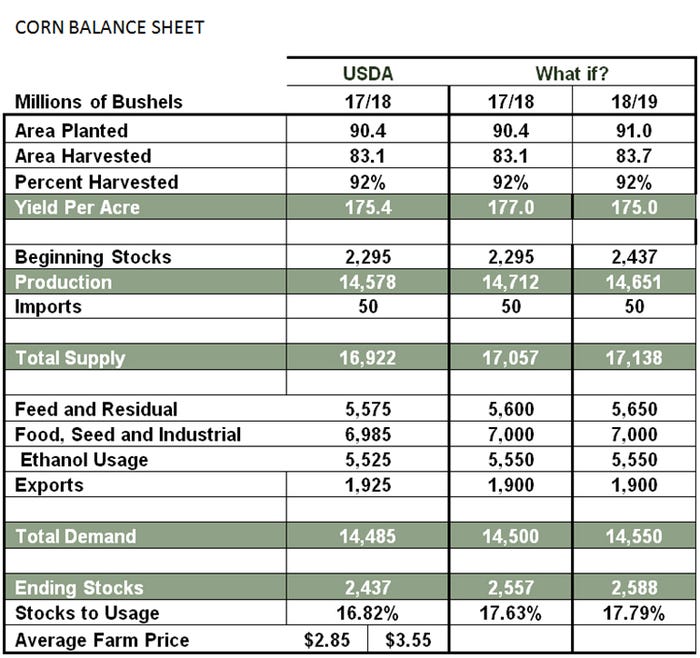

We will have a grain Supply and Demand update from the USDA on Friday. This report will represent the final production numbers of 2017 and could contain some surprises.

What if the USDA follows the trend of taking corn yields higher on each report and publishes a final yield for 2017 of 177 bushels per acre? Adding to burdensome ending stocks may not only be possible, it may be likely with this report.

Exports have been anemic and will probably have to be reduced on the January numbers. Ethanol grind has been on a torrid pace and probably tacks to the demand ledger whatever exports back off. I just do not see too many bullish opportunities for old crop corn. The market seems to think the same thing with volatility trading at low levels in the options pit.

That brings us to the “what if” for the 2018-19 crop. If we plant 91 million acres (sane) and post a 175 yield (sane), we are back in the same carryout/use ratio that we have this year and it would appear to be another year in the quagmire of prices well below the cost of production. Great news for animal ag, bad news for the corn farmer.

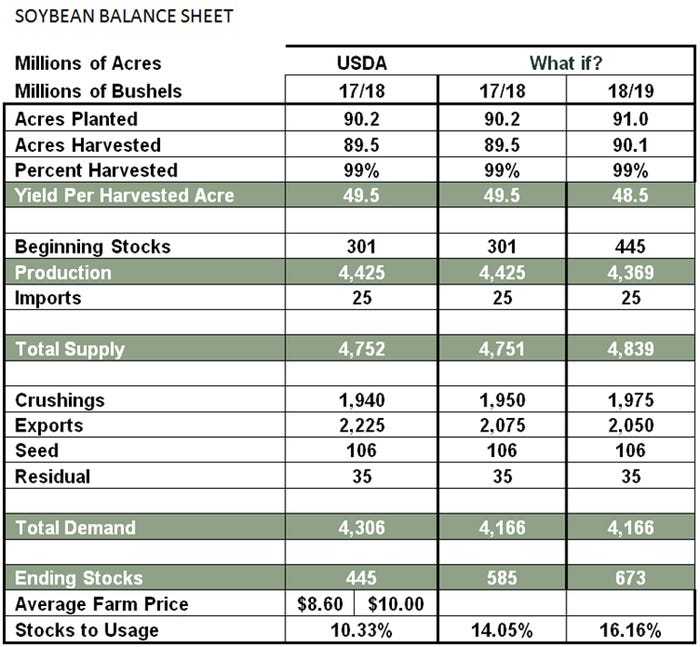

The soy side is not much different in that the projected solid yield numbers coming out of South America and the heavy carryouts in the United States will lead to a similar situation — prices below the cost of production. The United States has had a very skinny export window to China with big South American crops dominating the shipping lanes and indifference demonstrated by Chinese buyers toward U.S. product — evidenced by the 1% maximum foreign material requirement. This means a whopping 150 million bushels may have to come off our export projections and fall to the bottom line carryout.

That is a complete reversal of the past 10 years of exports exceeding expectations year-over-year. The worm has seemingly turned. We normally use our best guess at production and usage to create these balance sheets in a linear order. The soy complex for next year is nearing the point where you simply acknowledge that supplies are heavy and the only question is, “how low do prices need to get to encourage exports?” Again, good for the livestock guy, bad for the bean farmer.

So what is a guy to do in this scenario? In my opinion, you take some coverage in the form of options after the report. I realize that line is in contrast to my expressed views of the market — that is why I would own some coverage. The futures markets rarely allow layups.

The bearishness is so pronounced in its direction and sustained timeframe that any aberration can trigger us higher. Managed money is the first thing that comes to mind. If funds want in (they are skinny right now with participation) then we will likely move sharply higher in the face of bearish fundamentals.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

About the Author(s)

You May Also Like