February 15, 2016

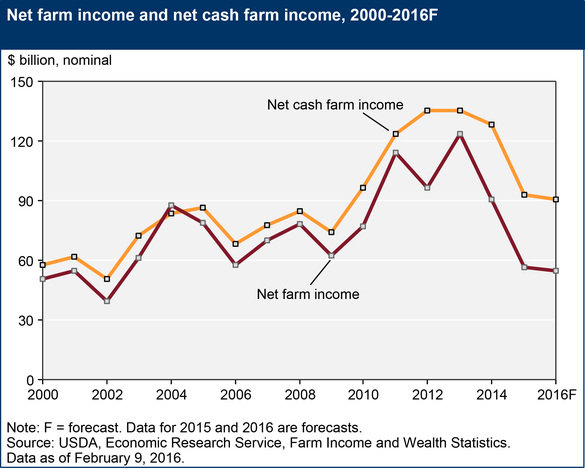

Net farm income is estimated to drop 3 percent in 2016 to $54.8 billion according to USDA’s Economic Research Service’s (ERS) annual income projections. This would be the lowest since 2002 and the third straight year of decreased net farm income.

Net cash farm income is forecast at $90.9 billion, down 2.5 percent from 2015. ERS projects cash receipts to fall $9.6 billion (2.5 percent) in 2016 with a $7.9 billion (4.3 percent) drop in animal/animal product receipts and a $1.6 billion (0.9 percent) decline in crop receipts. Direct government farm program payments are projected to rise $3.3 billion (31.4 percent) to $13.9 billion in 2016 due to lower commodity prices. Farm asset values are forecast to decline by 1.6 percent in 2016, and farm debt is forecast to increase by 2.3 percent.

Highlights

Cash receipts are forecast to fall $9.6 billion (2.5 percent), led by a $7.9-billion, or 4.3-percent, drop in animal/animal product cash receipts, and a smaller ($1.6 billion or 0.9 percent) decline in crop receipts.

The expected drop in 2016 cash receipts is led by declines in nearly all major animal/product categories (including dairy, meat animals, and poultry/eggs), as well as vegetables and melons. Feed crop cash receipts are also expected to fall.

While overall cash receipts are expected to decline, receipts for several commodities— including turkeys, cotton, rice, sorghum, oil crops, dry beans, potatoes, and sugarcane/sugar beets are forecast to rise by at least 1 percent in 2016.

Direct government farm program payments are forecast to increase in 2016 by $3.3 billion, or 31.4 percent.

A drop in overall production expenses is forecast for 2016, cushioning the decline in cash receipts. Notably, expenses for inputs that typically are produced by the farm sector itself, including feed, as well as livestock/poultry purchases, are expected down. Also, expenses for fuels and oils are forecast down by 14.5 percent in 2016. If realized, the expenses across each of these three categories will have fallen for 3 straight years. In contrast, hired labor costs and interest expenses are forecast to increase by $1.5 billion (5 percent) and $1.3 billion (6.8 percent), respectively, over 2015.

The value of total farm sector equity is forecast down by $54.9 billion (2.2 percent) in 2016, as farm sector assets are seen declining and debt levels increasing relative to 2015. In particular, the value of real estate is forecast down by $28.8 billion (1.2 percent) and the (inventory) value of crops, animals/animal products, and purchased inputs down by $12.9 billion (6.7 percent) relative to 2015.

The balance sheet changes result in a worsening of farm solvency measures, which nevertheless remain near historic lows. Liquidity positions have likewise deteriorated, on average.

Read the entire USDA ERS report.

You May Also Like