May 22, 2015

As U.S. pork producers, we could very well look back at this period of time and say that legislative efforts paved our way to continued world competitiveness. There are two current issues that pork producers should have a vested interest in supporting.

First, is granting President Obama Trade Promotion Authority to allow the administration to negotiate the Trans Pacific Partnership free trade agreement. Granting this authority does not bind the United States to the agreement. Congress will still have a vote on the agreement. What it will do is show that the United States is serious about negotiating a deal that will be good for free trade and the U.S. pork industry.

The TPP is the most significant free trade agreement for the United States since the North American Free Trade Agreement was implemented in 1994. The opportunity to implement a new agreement with 12 nations, including Japan, Vietnam and Australia, represents 40% of global gross domestic product.

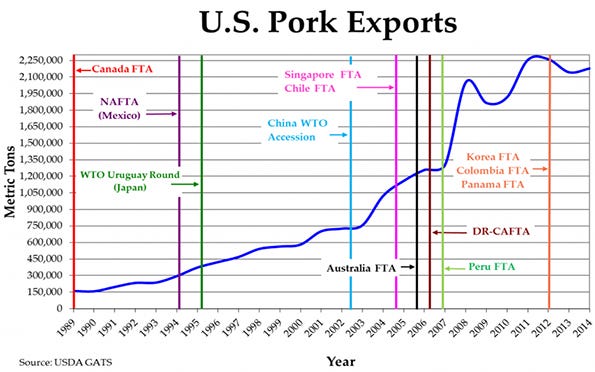

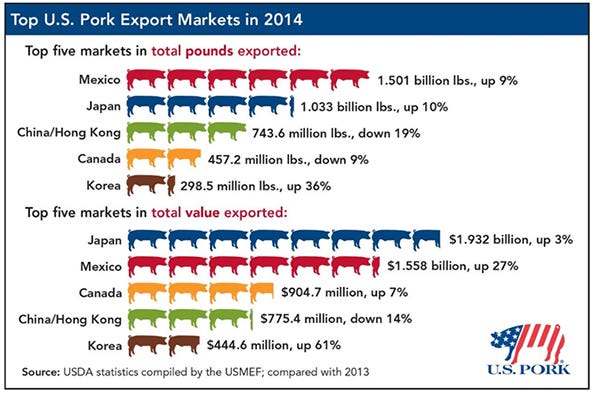

The agreement will also reduce or remove tariffs and gate prices over time that make U.S. pork less competitive globally. As the chart below illustrates, trade has helped drive growth in the U.S. pork industry. As of year-end 2014, the United States exported 26.5% of all pork and pork variety meats. For 2014, the United States exported a total of 2.18 million metric tons of pork valued at $6.67 billion. It is estimated that this added an additional $62 per head in value. Mandatory Country of Origin Labeling is another potential export challenge for U.S. pork producers. MCOOL was found to be in violation of a World Trade Organization ruling, and the WTO rejected a subsequent appeal by the administration on May 18. This ruling authorizes Canada and Mexico to impose billions of dollars of tariffs against U.S. exports, including pork and beef. Canada and Mexico can start these tariffs by late-summer if MCOOL is not fixed according to the WTO standards or repealed. As the chart below shows, Canada and Mexico are in the top five export partners of the United States for both pounds sold and in value of product sold. Failing to fix or fully repealing this legislation will have a devastating impact for U.S. pork producers. This has added pressure to Congress as most Congressional districts will be targeted for this retaliation.

Mandatory Country of Origin Labeling is another potential export challenge for U.S. pork producers. MCOOL was found to be in violation of a World Trade Organization ruling, and the WTO rejected a subsequent appeal by the administration on May 18. This ruling authorizes Canada and Mexico to impose billions of dollars of tariffs against U.S. exports, including pork and beef. Canada and Mexico can start these tariffs by late-summer if MCOOL is not fixed according to the WTO standards or repealed. As the chart below shows, Canada and Mexico are in the top five export partners of the United States for both pounds sold and in value of product sold. Failing to fix or fully repealing this legislation will have a devastating impact for U.S. pork producers. This has added pressure to Congress as most Congressional districts will be targeted for this retaliation. Value of pork

Value of pork

Although exports are important, domestic demand also continues to be strong and U.S. consumers are still willing to pay more for pork. According to the Oklahoma State University’s Rood Demand Survey ending in mid-May, consumers were willing to pay more per pound for hamburgers and pork chops while the amount they were willing to pay for steaks and chicken breasts fell compared to the period ended mid-April.

Willingness to pay | May 2014 | April 2015 | May 2015 | % change April/May |

Steak | $6.35 | $8.02 | $7.45 | down 7.12% |

Chicken breast | $4.63 | $5.59 | $5.36 | down 4.11% |

Hamburger | $4.06 | $4.46 | $4.70 | up 5.38% |

Pork chop | $3.51 | $3.97 | $4.19 | up 5.54% |

The short supplies and high prices of beef give the pork industry an opportunity to gain market share long term. Producers can help achieve this by supporting the National Pork Board’s Pork Be Inspired campaign.

Hog slaughter numbers

I use 2013 when comparing slaughter numbers. Because of the impact of porcine epidemic diarrhea virus in 2014, I feel 2013 numbers give me a more-accurate view of supply in the United States. From the week ending Jan. 28 through April 18, we averaged 4.51% more hogs weekly than in 2013. However, over the past four weeks this has decreased to 2.4% more hogs. Accordingly, the national average hog price has gone from $61.18 on April 17 to $79.88 as of May 19, or $39.83 per head in additional revenue.

During the same period, weights have come down by 2 pounds per carcass weight although that is still 6 pounds per carcass heavier than 2013. The most telling number to me, is the total pounds of pork produced YTD for 2015 versus the same period in 2013. The pork industry put on an additional 7 pounds per carcass in 2014 versus 2013, and have held those weights this year. Even though the total number of head slaughtered YTD versus 2013 is up only 3.23%, total pounds are up 6.78% over the same period.

Malakowsky has over 17 years of experience with AgStar Financial Services. For more insights from Malakowsky and the AgStar swine team, including their weekly video Hog Blog, visit AgStar.com.

You May Also Like