On a positive note for U.S. pork and other global competitors, European Union pork prices are finally strengthening.

August 15, 2016

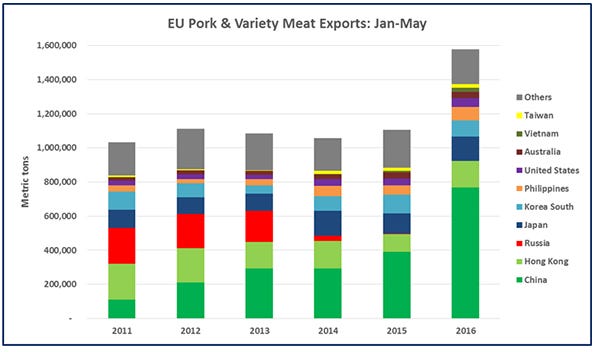

The European Union’s pork/pork variety meat exports have remained on a red-hot pace in 2016, setting a new monthly volume record in April at 355,469 metric tons, and nearly matching that total in May (340,904 mt). This pushed the January-May total to 1.577 million mt, up 43% from the same period last year.

However, on a positive note for U.S. pork and other global competitors, EU pork prices are finally strengthening.

The EU’s May exports to China set another record at 182,536 mt, up 132% year-over-year. Combined exports to China/Hong Kong made up 62% of the EU’s May export volume and 58% for the year.

January-May exports showed strong growth in other Asian markets, including Japan (141,713 mt, up 19%), the Philippines (80,785 mt, up 42%) and Vietnam (25,534 mt). Exports were also higher to the United States (50,631 mt, up 29%).

So despite the surge of pork entering China, the EU was also able to grow its exports to most other major markets — even as the euro was gaining strength in April and May, averaging $1.13 per euro. The euro took a post-Brexit dip in late-June, but recently recovered to be roughly steady year-over-year at $1.12 per euro.

One product that struggled to find a home following Russia’s 2014 suspension of EU pork is pig fat. European exporters finally found a way to ship that to China as well, with volume surging to 38,326 mt through May, up from just 4,000 mt during the same period last year. Fat exports to Ukraine, the Philippines and Georgia also increased, pushing the global total to 97,641 mt, up 45%.

This was still more than one-third lower than the 2013 pace, when Russia took the bulk of the EU’s pig fat exports, and per-unit value was down about 40% (in U.S. dollar terms) from 2013. The improvement over last year has still likely provided a boost for hog values and packer profitability.

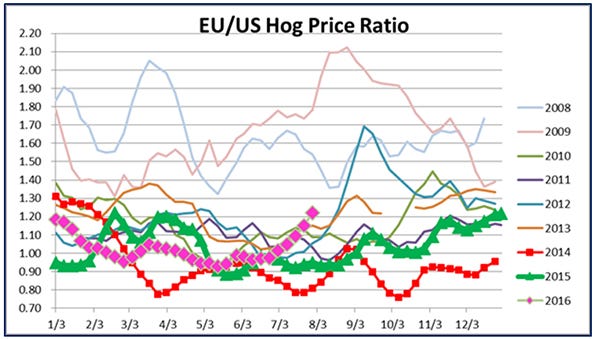

EU pig prices strengthened this summer and have been relatively steady for the past three weeks. At 163.06 euros per 100 kilograms, prices are up 13% from a year ago. In U.S. dollar terms, the stronger euro pushed prices up to $82.48 per hundredweight after holding near $81 over the past month.

Notably, EU prices gained 28% from April to mid-July, a significant appreciation, but still only got back to the 2010-14 average. The last time prices saw a significant upward move was from May to early September 2013, when prices climbed 19% and set a near-term record in early September (195 euros per 100 kilograms). In 2013, EU production declined and exports increased, supporting prices and setting the stage for expansion in 2014 and 2015.

EU prices have been above U.S. prices since early July, with the spread widening in early August to levels not seen in more than two years. Europe’s seasonal decline begins in September, but if its prices can maintain relatively higher levels in the second half of 2016, U.S. competitiveness will continue to improve.

EU piglet prices recently saw a modest decline after being steady-to-higher for most of the spring, then posting a solid increase from late-May to early July. At 43.85 euros per head, prices are up 25% from a year ago and up 8% from the 2010-14 average — suggesting strong demand and possibly tighter supplies from a sow inventory that is down from last year.

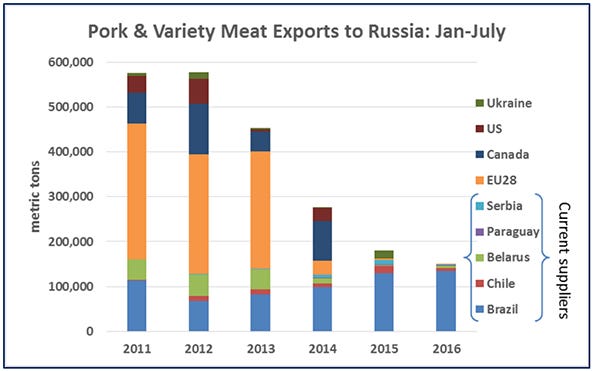

While some EU member states recently voiced support for softening or ending economic sanctions against Russia, there is little to suggest that EU-Russia pork trade will resume anytime soon. Even before the imposition of EU sanctions (related to the conflict in Ukraine) and Russia’s countersanctions, EU pork was blocked from entering Russia due to findings of African swine fever among EU member states in the Baltic region. With Russia enduring a surge of ASF cases this summer, any proposal to lift ASF-related restrictions is likely to meet considerable opposition.

Russia’s economy has continued to shrink, and low oil prices are also weighing on government reserves. Disposable income continues to decline, while at the same time food prices remain high. With limited eligible suppliers, shrinking demand and continued growth in domestic production, Russia’s demand for imported pork also continues to slow. Based on exporter data, January-July shipments of pork to Russia were about 150,000 mt, down 18% from last year. A slight increase from dominant supplier Brazil (134,000 mt, up 3%) and strong growth from Belarus were offset by smaller volumes from Ukraine and Chile.

For perspective, imports during the same period in 2011-12 were close to 580,000 mt.

Strong growth in Russia’s domestic pork production continues, with production through May totaling 1.02 million mt (slaughter weight) — up 15% year-over-year. The production increase intensified concerns that consumer demand in Russia cannot support current price levels, which in July were already down 18% from last year (in U.S. dollars: $0.86 per pound, down 11%) and moving closer to 2012 levels.

You May Also Like