Not out of the question for the pork producer to have the upper hand in negotiations through the balance of 2022 and into the new year.

October 17, 2022

The weather is turning cooler, new crop corn is available and the proverbial clang of the Pax feeder echoes in your head. There is normally another triggering memory in the minds of pork producers – hanging on through the fourth quarter so we can participate in a spring rally.

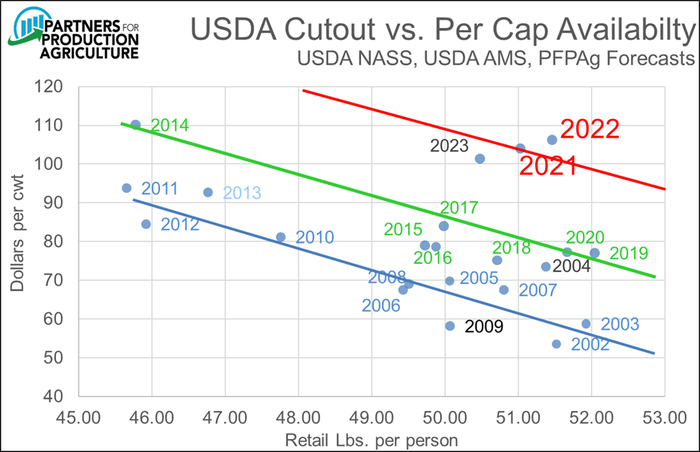

Steve Meyer has been on a campaign that would make any politician jealous as he pounds the table with a message of, "it is all about demand." And he is right. We would normally be holding our breath as we roll into the end of the year with the consideration of not the direction of the market – we just assume it is going lower, but just how low will we go before bids catch.

This year is ... different and I believe we need to adjust our thinking with the new criteria. Hint: we are not going to be in a supply crunch.

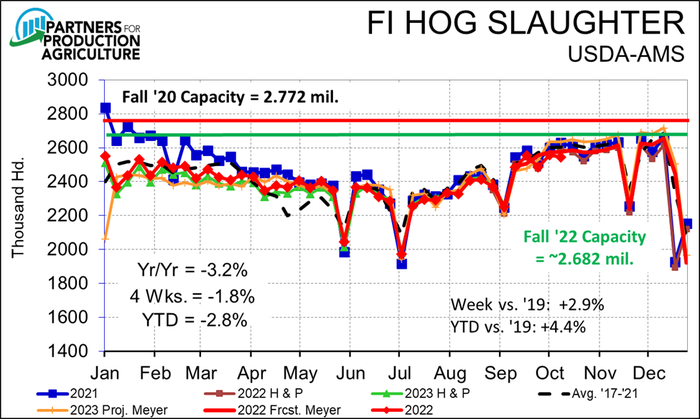

The attached chart (post the September Hogs and Pigs report) provides the "big picture." The solid red line (projected production) encroaches on but never touches the green line (packing capacity), even given consideration of the traditional holiday compression.

Christmas falls on a Sunday this year which means we will not have a huge disruption of the work schedule, I suspect we would have been ok even if Christmas fell in the middle of the week this year. This may be a bit on the aggressive side, but it is not out of the question for the pork producer to have the upper hand in negotiations through the balance of 2022 and into the new year. That would be a novel experience.

Now that we have established the "what," lets take a look at the "how" as this is where things get interesting. Normally, we would need big Saturday runs to accommodate the supply of hogs relative to shackle space. This is driven by margins at the packing plant and the available labor to make a net contribution to the packer – hence, our expectation of lower live hog prices to make that mathematical equation work.

Last week, we hit a mark of 491,000 head for a day, up from our normal range of 480,000+/-. This would appear to be a direct result of the reinstitution of line speed waivers that went away in July of last year. The extra head per hour at the approved plants is enough to add enough capacity during the week that we do not need to tap as hard into Saturday to keep everything in balance.

If we use round numbers and base our expectations around 2.6 million head per week as necessary to clear the supply of live animals (note: Meyer's biggest week this fall is projected at 2.653 million head) and assume we can run the 490,000+/- per day, that gives us a work week harvest of 2.450 which means we need another 150,000 on Saturday.

This is not an extreme stress on the system and this provides me the mathematical underpinnings of my optimism. Weights have not gotten out of control. We have not been inundated (yet?) with Canadian hogs. We are not going to domestically exceed animal production relative to shackle space.

It will be demand, not excessive supply, that will determine our fate. Which circles me back to evaluating what that component looks like.

The strength of the U.S. dollar is going to exacerbate the competition we have in moving product off our shores. This is poignant across all markets and is not confined to pork exports, but there are a few good things to tease out of the headwinds. The first is that the value of the Mexican peso has largely traded in tandem with the U.S. dollar. This has mitigated the detrimental impact of our currency appreciation to our largest volume customer. Also, the price of pork in China has taken a steady turn to the upside. Politics, tariffs and world tensions do not favor the U.S. supplying that market, but it likely means that someone will and the United States will be better situation to fill in the gaps.

Domestically, our pork demand has been robust (see chart) and our projections for 2023 maintain the momentum initiated by last year's outward shift of the demand curve. Throw in a constrained supply of beef (drought related) and some difficulty with highly pathogenic avian influenza impacting turkey (price scatter attached, courtesy of Leap Analytics) and egg production and suddenly what may have been a hold-my-breath moment becomes a realization that this is not so bad after all.

The bottom line is this: Yes, we are going to experience an increase in hog supplies into the fourth quarter, that trend is not going to be changed. However, the magnitude of the increase is not anticipated to tax packing capacity – thanks in large part to the higher line speeds – to a degree that we would normally expect. Think of this as an early Christmas present for pork producers.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Click here to contact the author.

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like