In my opinion, this is a bump in the road with a wake-up call embedded in the message.

March 12, 2018

Hog futures have taken a beating in the past few sessions. An obvious question in the wake of the activity would be to question whether this is a temporary aberration or the initiation of a new reality. In my opinion, this is a bump in the road with a wake-up call embedded in the message.

Consider this:

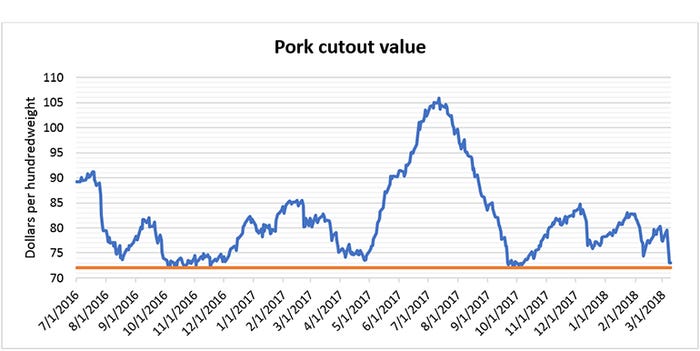

• The pork cutout currently stands at about $72, an area where we have discovered good disappearance in the past. We are in the throes of Lent and we should see a tightening of animal numbers in the coming weeks. Hang in there. See chart.

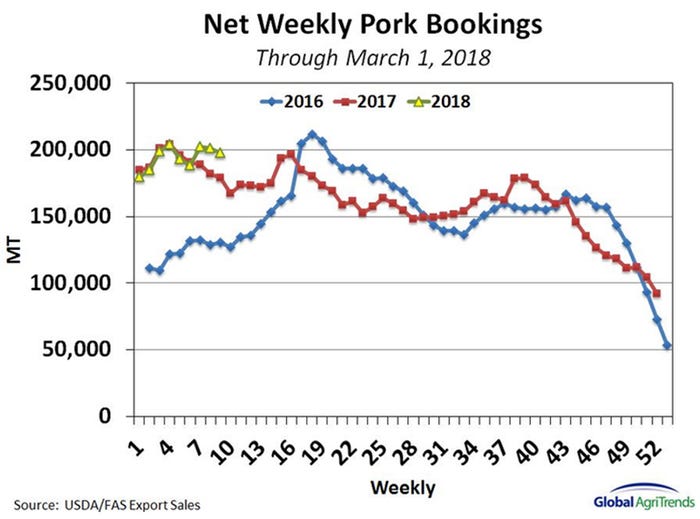

• Exports are pretty good. Per Brett Stuart from Global AgriTrends, “Pork exports to Mexico were up 1% from year-ago levels. That may not sound like much, but note that January 2017 shipments were up 30% from the prior year. The hog market held the big 2017 gains. That is important considering that Mexico is the key determinant of export growth this year.” That is good stuff. President Trump seemingly pulled the fat out of the fire — for now — with the exemption of Mexico and Canada from the steel and aluminum spat. Chart below.

• Belly values, the crux of summer hog carcass value, have reached levels that sponsor freezer bids. I am not on a bandwagon that calls for a repeat of last year’s $2.00-plus belly values. This is a healthy dynamic allowing product to move and establish a reasonable base of the price pyramid.

• The spread of pork to beef is still favorable. From a value proposition, we are well placed in the matrix of opportunity.

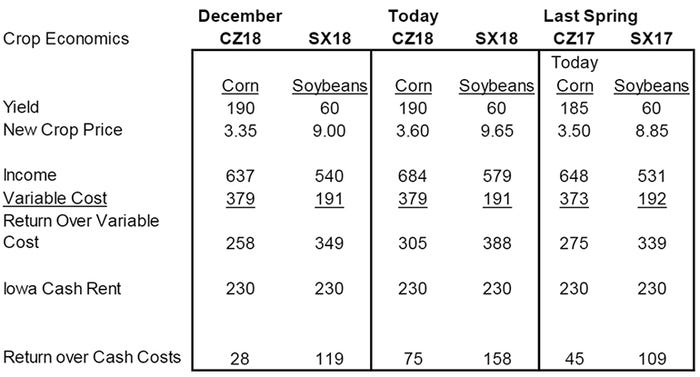

The USDA provided us some fodder this past week in the form of their monthly grain supply and demand estimates. Soybeans have been the darling of the grain complex for the past couple of months; that may be on the cusp of changing. Our biggest take away from the report was the bump up in U.S. corn exports. That may be a bit of a stretch. It is understandable that the USDA believes the United States will take a larger part in world shipments given the production troubles in South America, but the United States was already running behind schedule on corn shipments and adding to the projection would appear to be aggressive. The USDA also increased corn use for ethanol — sane given the grind pace so far this year. Old crop carryout was trimmed by nearly 200 million bushels. To be sure, we are not running out of corn in the United States or in the world. Sometimes the direction is more important than the absolute numbers and we are absolutely tightening the corn balance sheet which likely justifies the price activity we have witnessed.

The soy market was a different story. A less-than-expected drop in Argentina production and a comfortable world bean balance sheet took some air out of the bullish balloon, sending soybean futures down nearly 40 cents for the week. This puts the new crop corn/soy relationship back to a level of “reasonable” and should allow the acreage allocation equation to mirror reality a bit closer. Beans were out in front of corn by a wider margin than economics would have indicated as appropriate, the world is closer to being back in balance.

In my column last month, I conducted a mini-survey, asking readers to respond to their best guess of four different scenarios for summer month hogs — options ranging from the mid-$70s to over $100. The results of this non-scientific poll revealed a symmetrical curve with few on the edges and the herd concentrated toward the middle, anticipating summer hogs to trade in the mid- to upper-$80s. That column was written when summer hogs were in the $82 range and folks were hoping for just a little more.

Perhaps if we were to conduct a similar evaluation today things might not be quite so rosy. My point is this: as humans, we tend to gravitate toward the mean and think the then-normal is going to perpetuate into the future. To me, the mid-$80s would now appear to be the goal, not the mid-point of fair market value. Let’s use this current setback as a reminder that if we get back to those levels, we send the market a proverbial Thank You card and protect the profits.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

About the Author(s)

You May Also Like