The most bullish USDA number is fall farrowings, calculated to be 4.8% lower than last year.

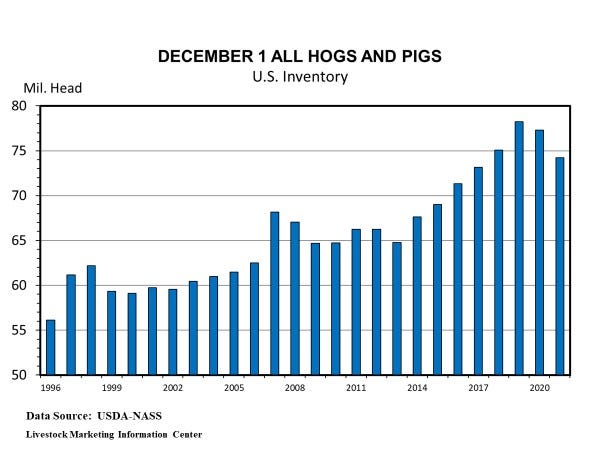

USDA's December Hogs and Pigs report was bullish. The report said the U.S. swine herd on Dec. 1 totaled 74.201 million head. That is 4.0% smaller than a year earlier and the smallest December inventory since 2017. The hog inventory is 1.2 percentage points smaller than the average of pre-release trade expectations. The most bullish USDA number is fall farrowings, calculated to be 4.8% lower than last year.

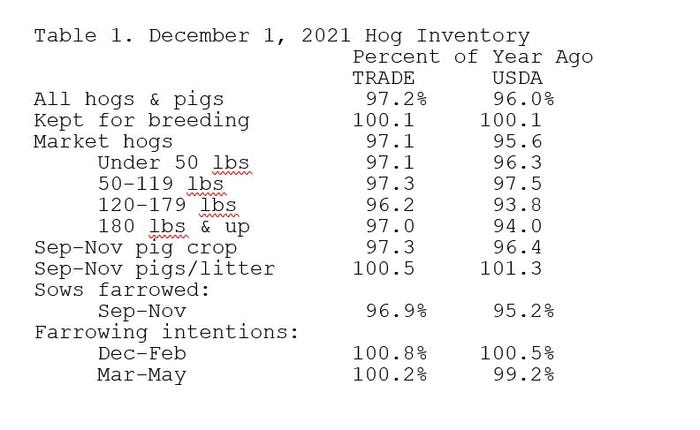

Table 1 shows this year's December hog inventory as a percent of a year earlier for both the average of pre-release trade forecasts and for the USDA Hogs and Pigs survey. The inventory numbers indicate hog slaughter during the next two quarters should be below the year-ago level.

The most bearish numbers in the pig report were the December-February farrowing intentions (up 0.5%) and September-November pigs per litter (up 1.3%).

Revisions

An unusually large number of revisions to past estimates were included in this report.

Farrowings and Pig Crop Revisions

The number of sows farrowed in December-February 2020 was increased by 3.7% and the December-February 2020 pig crop was increased by 3.8%. Both the number of sows farrowed in March-May 2020 and the March-May 2020 pig crop were decreased by 0.1%. Both the number of sows farrowed in September-November 2020 and the September-November 2020 pig crop were increased by 1.1%.

The number of sows farrowed in December-February 2021 was increased by 0.2% and the December-February 2021 pig crop was increased by 0.3%. The number of sows farrowed in March-May 2021 was decreased by 1.1% and the March-May pig crop was decreased by 1.0%.

The number of sows farrowed in September-November 2021 was increased by 0.4% over the September farrowing intentions estimate and the number of sows to be farrowed in December-February 2022 was decreased by 0.6% relative to the intentions in the September report.

Inventory revisions

The March 1, 2020 market hog inventory was decreased by 1.5%, the breeding herd increased by 0.8% and the total herd decreased by 1.3%. The June 1, 2020 market hog inventory was increased by 0.3%, the breeding herd increased by 1.6% and the total herd increased by 0.4%.

The Sept. 1, 2020 market hog inventory was decreased by 0.5% and total herd decreased by 0.4%. The Dec. 1, 2020 market hog inventory was increased by 0.7% and the total herd increased by 0.6%.

The March 1, 2021 market hog inventory was increased by 0.2% and the total herd increased by 0.1%. The June 1, 2021 market hog inventory was decreased by 1.8% and the total herd decreased by 1.7%. The Sept. 1, 2021 market hog inventory was decreased by 1.1% and total herd decreased by 1.0%.

There were numerous revisions to the weight group inventories — 23 of the 28 market hog weight group inventories included in the September Hogs and Pigs report were revised in the December report.

There were no revisions to past pigs per litter estimates.

The likely reason for the large number of revisions is the impact COVID-19 has had on slaughter operations. USDA matches market hog inventories to hog slaughter, but COVID so disrupted 2020 slaughter that straight forward comparisons can be misleading.

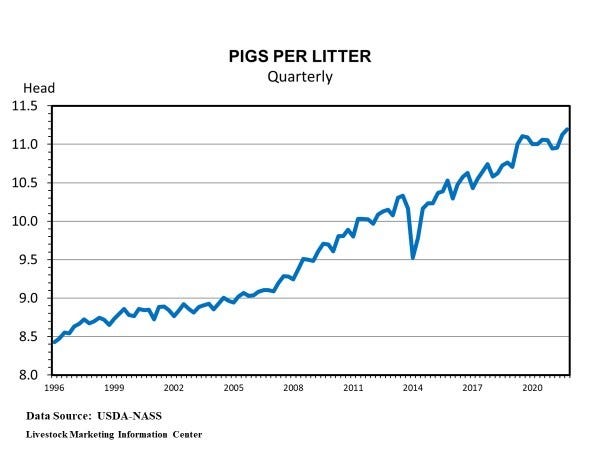

Pigs per litter during September-November averaged a record 11.19 head, breaking the old record of 11.13 head set in June-August 2021. Pigs per litter was up 1.3% year-over-year. This was the largest percentage increase in PPL since December-February 2020. Needless to say, an increase in PPL adds to the hog supply.

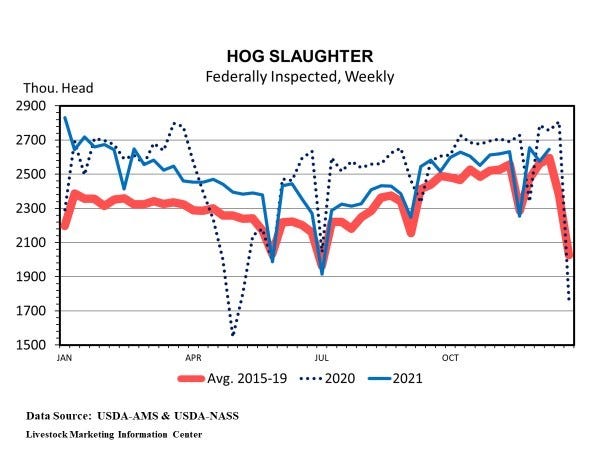

The first check on the accuracy of a quarterly Hogs and Pigs report is the relationship between recent hog slaughter and the heavy-weight market hog inventory. The 180-pounds-and-up market hog group on Dec. 1 was 6% smaller than last year implying that December and early January hog slaughter will be down 6% year-over-year. Daily hog slaughter since Dec. 1 has been roughly 4.7% below year-ago. What slaughter will be at the end of the month and early January is difficult to estimate because of Christmas and New Year's holidays both falling on Saturday this year and Friday last year.

I doubt January hog slaughter will be down the full 6.2% reduction that the market hog inventory implies. If I'm right, USDA's heavy-weight market hog inventories may be a bit low.

Farrowing intentions for winter are up 0.5% and for spring (March-May) are down 0.8%. If pigs per litter increases 1% year-over-year, then the winter and spring pig crops should be roughly 100.7% of year ago. Thus, summer and fall hog slaughter might be up about 0.7%. This won't be enough to offset the reduced slaughter in the first half of the year. Thus 2022 hog slaughter is likely to be lower than this year.

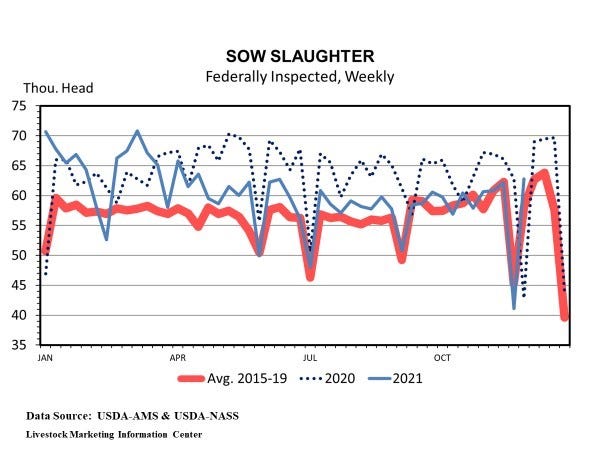

There is good reason to believe hog slaughter will increase as we move through 2022. Sow slaughter has been consistently below the year-earlier level since March. Hog profits in 2021 have been the highest since 2014. High feed costs may be the biggest hinderance to growth.

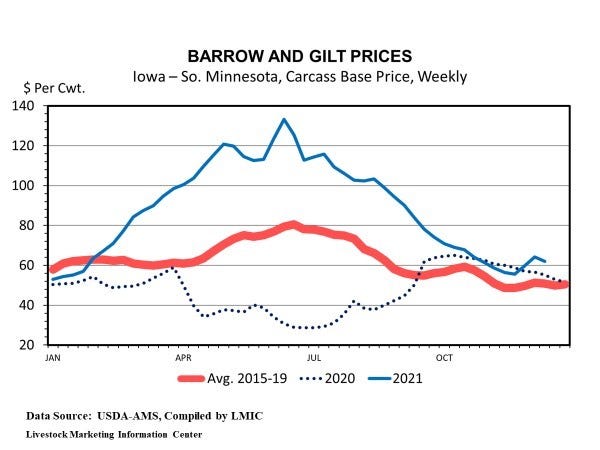

Table 2 shows actual quarterly commercial hog slaughter and Iowa-Minnesota negotiated base carcass hog price for 2020 and the first three-quarters of 2021. It also shows my forecast for hog slaughter and hog price for the rest of 2021 and for 2022. Commercial hog slaughter in 2020 was a record 131.6 million head. If USDA's numbers are correct, production trends continue, and hogs are marketed on a timely basis, then 2021 hog slaughter is likely to be roughly 129.14 million hogs, down 1.8% compared to 2020. Hog slaughter in 2022 should be slightly lower, perhaps 127.3 million head, down 1.4%.

The Iowa-Minnesota negotiated carcass base price series started the year at $54.00/cwt, peaked at $134.41/cwt on June 18 (just 58 cents below the record of $134.99/cwt set on July 14, 2014) and was $61.48/cwt last Thursday. Although I'm predicting lower pork production in 2022, I'm also predicting lower hog prices. I'm skeptical that meat demand will remain strong.

The 2021 pig crop is smaller than the year before, for the first year since 2014. This should assure good hog profits in 2022.

Sources: Ron Plain, who is solely responsible for the information provided, and wholly own the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like