October 26, 2015

Editor's note: Steve Meyer is on vacation this week, so Amanda Martin and Sue Trudell, also with Express Markets, Inc. Analytics, are writing in his absence. Martin is EMI's senior analyst for turkey and eggs, while Trudell is EMI's vice president of analytics concentrating on broilers. They are offering insight into the current poultry market, as well as the outlook in the new world of avian influenza cases. It's always good to see what competing meats are up against.

Even though no new H5N2 Avian Influenza cases have been confirmed since early June, the disease is still top of mind for many in the turkey industry as we look toward possible impacts moving toward 2016, along with the uncertainty of new cases occurring with colder months quickly approaching.

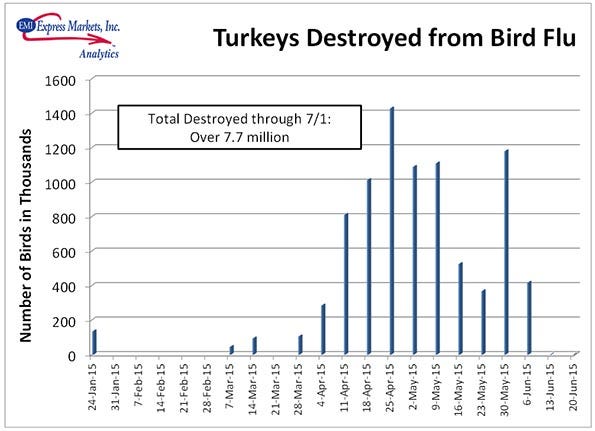

Over 7.7 million turkeys were killed by the disease or had to be destroyed due to being in an infected flock since March, which was a loss of around 3 to 4% of an average year’s turkey slaughter total.

Total turkey slaughter for August was reported by the USDA at 19.3 million head, which was a 4.4% decrease from August 2014. The impact of avian influenza on slaughter is expected to continue through the remainder of the year, and into early 2016, as many of the barns that were impacted have begun repopulating with birds in the past few months. Getting an adequate supply of poults to fill those barns has also proven to be difficult. Current forecasts estimate total turkey slaughter for 2015 at 232 million head, which would be a 2% decrease from the 2014 level.

While the majority of producers that were impacted by AI were in the central and the Upper Midwest states, all producers felt the impacts of lost export markets, but you would never notice an issue with continued near-record spot market prices across the board.

On the other side, many of the import bans could be lifted 90 days (not all did) following the last AI occurrence, according to our trade agreements. Therefore, product had the ability to begin moving again to many destinations in September.

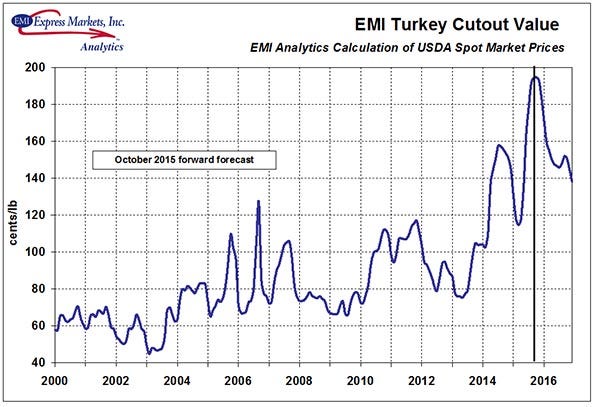

With the decreases in production have come increases in spot market prices. The Express Markets Inc. Turkey Cutout Value is composed of a formula breakout of USDA prices for breast meat, thigh meat, whole wing, whole drum and mechanically separated turkey spot market values. Basically, we are building the spot market values back up to a whole turkey. Breast meat is the largest component of this cutout value.

Last year broke all previous records when the cutout value reached $1.57 per pound during July, when turkey breast meat hit $4.05 for a monthly average on USDA’s report. After decreasing ahead of the AI outbreak in anticipation of increased production, 2015 quickly surpassed 2014’s records by early summer. For September, the cutout value reached $1.94 per pound, with breast meat hitting a new record $5.75 per pound. Currently, production increases are expected moving into 2016, which would likely drop prices from their record levels. Of course, this is pending any additional highly pathogenic avian influenza outbreaks moving into 2016.

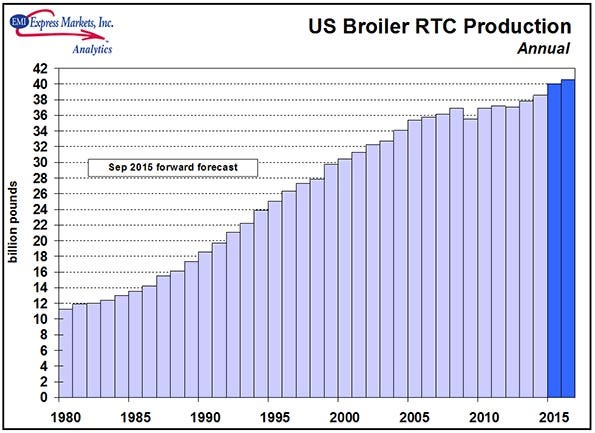

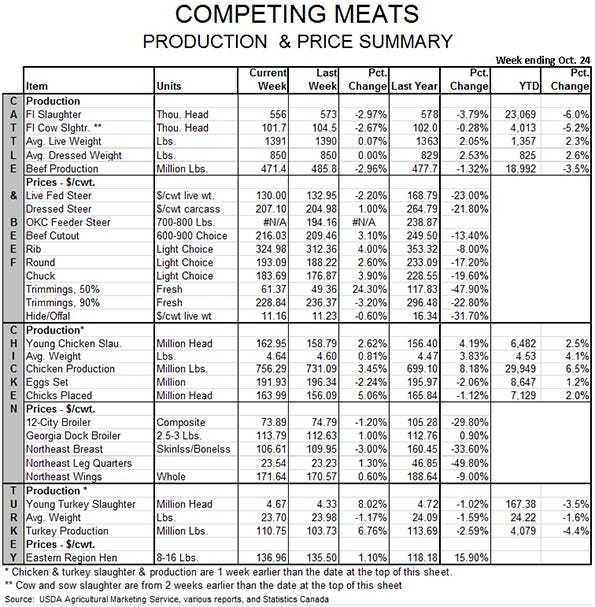

On the broiler side, no HPAI has been reported. Thus far, the U.S. broiler industry continues to increase production, although some export markets are still blocked to U.S. poultry products due to HPAI. Because of those blockages, prices for export items have significantly declined. As the majority of the broiler meat exported by the United States is dark meat, wholesale EMI leg quarter prices declined from 45 cents per pound during mid-2014 to wholesale values currently in the 20- to 22-cent per pound area.

Current forecasts expect U.S. broiler production to continue to increase, and 2015’s annual production total is forecast at a record 400.4 billion ready-to-cook pounds, which would be a 3.9% increase from 2014. Additional small increases are expected for 2016. With reduced exports, domestic broiler supplies are expected to top 89 pounds per person for 2015.

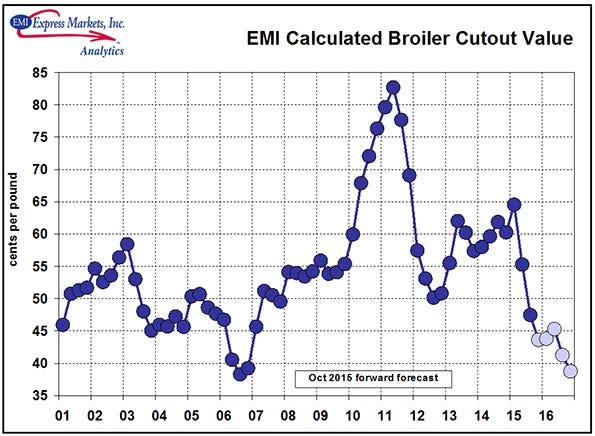

As the broiler industry has been in the process of increasing broiler production, reduced exports will provide additional price pressure. EMI wholesale cutout values have been declining as more dark meat has been absorbed into U.S. distribution. Wholesale cutout values have dropped below 47 cents per pound, and are forecast to run in the 39- to 47-cent per pound area through 2016.

About the Author(s)

You May Also Like