Swine industry's switch is stuck on expansion mode.

Modern expansion is the pathway America’s pig farmers continue to tread and the sow intention numbers in the USDA March Quarterly Hogs and Pigs report carve that pathway for pork production this year. “The switch is turned toward expansion mode by default,” notes Kevin Bost, president of Procurement Strategies Inc.

He continues, “Hogs numbers are still growing. As a trader, it is hard for hog prices to increase until you see a cut in numbers.”

From a price standpoint, 2014 was an extremely good year for the hog farmer. “The hog producers in 2014 made so much money that they still have it their pockets. The bankers are not controlling the expansion as much as the hog farmers are,” explains Len Steiner, president of Steiner Consulting Group.

Furthermore, Daniel Bluntzer, partner at New Frontier Capital, says the new packing plants are still the driving force behind the expansion. “If you spend that much money building a few plants you are going to make sure those hogs are there. The incentive was there and pushed by the packers.”

Currently, U.S. packing capacity stands at 2.453 million head for weekly slaughter under the assumption of 5.4 work days. Three new processing plants are anticipated to be in operation in the fall of 2017, boosting weekly slaughter capacity by 137,000 head. That is 2% larger than the largest weekly slaughter in the fall of 2016.

Market watch list

Moving forward there are three main pivotal points to watch, Steiner stresses.

Exports: For 2017, U.S. pork exports are forecast at 21.7% of total production. That is up slightly from a year ago. “We have to expand this not only per pound but as a percentage of total production because more is coming at us,” Steiner states.

Per capita consumption: Despite an increase in exports, pork per capita consumption is anticipated to be up 1.27% this year. “If exports or per capita consumption does not increase then you will have some problems on prices,” he warns.

New packing plants: According to Steiner, the U.S. slaughtered 91,000 more head than estimated capacity for the week last year. Steiner says, “If these three plants are operational in October or November, we are only going to be 49,000 over the theoretical capacity. However, if you run into construction delays then the number gets a lot bigger than 91,000 over capacity.”

He further explains, “Slaughter capacity in this country only lasts about eight weeks but it is the same eight weeks we saw in 1998 that came a debacle at that point in time. We just ran out of capacity.”

By the numbers

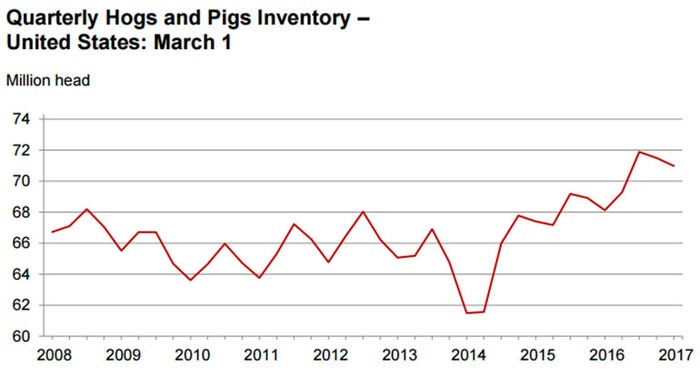

The estimated numbers in the quarterly report fell in line with pre-report expectations of market analysts. U.S. pig inventory stands at 71 million head on March 1, up 4% from the previous year but fell 1% from last quarter.

• Breeding inventory, at 6.07 million head, was up 1% from last year, but down slightly from the previous quarter.

• Market hog inventory, at 64.9 million head, was up 4% from last year, but down 1% from last quarter.

• U.S. hog producers intend to have 3.01 million sows farrow between March and May of this year, and 3.05 million sows farrow between June and August.

• The December 2016-to-February 2017 pig crop, at 31.4 million head, was up 4% from 2016. Sows farrowing during this period totaled 3.01 million head, up 3% from 2016. The sows farrowed during this quarter represented 49% of the breeding herd.

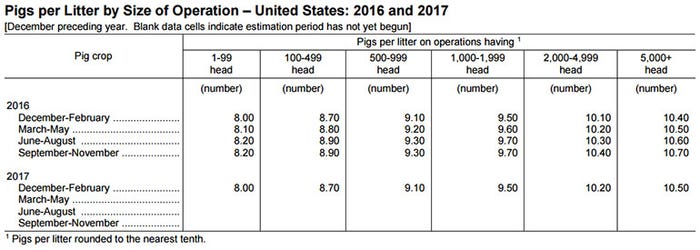

• The average pigs saved per litter was a record high of 10.43 for the December-to-February period, compared to 10.30 last year. Pigs saved per litter by size of operation ranged from 8.00 for operations with 1-99 hogs and pigs to 10.50 for operations with more than 5,000 hogs and pigs.

The entire report can be found here.

About the Author(s)

You May Also Like