Market analysts are conservatively predicting a slight bump in total hog inventory.

The volatility in the hog market this week illustrates the trade is nervous about the upcoming USDA Hogs and Pigs Report, set to be released Sept. 30. The tension over anticipating the numbers to be revealed is justified as recent hog slaughter numbers show production is outpacing packing capacity. Therefore, the highly anticipated report will indicate the U.S. hog inventory numbers moving forward.

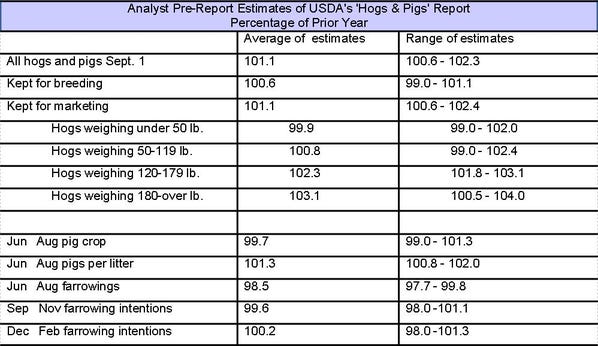

In pre-report estimates, market analysts are conservatively predicting a slight bump in total hog inventory, breeding herd and market animals.

Market experts urge hog producers to watch the following key numbers in September’s USDA Hogs and Pigs Reports:

1. Breeding inventory

The estimated size of the breeding herd and farrowing intentions are always numbers worth noting, however these figures will be especially important this time around. Looking at the pre-report estimate, market experts forecast the breeding herd to grow by 6%. If this is accurate, the U.S. breeding herd will reach over 6 million head or 167,000 more head than the inventory at the end of 2014, reports Steiner Consulting Group in the Daily Livestock Report.

Anecdotal evidence across leading pork-producing states signifies there are more sows on the ground. Some would say we are amidst of a “pork boom.” More sows coupled with low disease pressure and even lower sow slaughter rates this year only adds to the pork industry’s growing pains. As the Daily Livestock Report authors note, “So while the forward profit outlook has changed dramatically in the last few weeks, the question is what kind of supply we have inherited to this point.”

2. Farrowings

Dennis Smith, Archer Financial Services Inc., warns that even a fairly stable breeding herd will still grow the U.S. hog inventory as hog producers make great strides in efficiencies. He says, “If the report should happen to show expanding breeding numbers, in tandem with improved efficiencies, the report could prove to be extremely negative.”

Analysts are taking the middle-of-the-road approach to farrowings and pig per liter forecasts. The June-August farrowing is estimated to decline by 1.5%, whereas pigs per litter are forecast to jump 1.3%. Moreover, the September-November farrowing intentions predictions are pegged to increase 0.4%, which is not aligned with the expanding breeding herd.

3. November-December slaughter

A year-over-year increase in hog slaughter obviously translates into a drop in hog prices. As Ron Plain, University of Missouri, explains the USDA June Hogs and Pigs Report indicated a 2.4% boost in September-November slaughter. Normally, a 2.4% increase calculates to an 8% drop in hog prices. However, this year the hog market is not following the usual rule of thumbs. Plain notes, “This year’s price decline could be much more. In September-November 2015 the Iowa-Minnesota negotiated base hog price averaged $63.97 per hundredweight. December 2015 averaged $50.83 per hundredweight. A drop of 8% would give a September-November 2016 average of $58.85 per hundredweight. Current cash prices are well below that.”

Noteworthy, the average of analyst estimates does not depart much from the June report. Market participants should tune in to two categories numbers — pigs weighing 120-179 pounds and 50-119 pounds. These inventory categories will challenge future packer capacity. Based on the pre-report forecast, hog slaughter in November and early December may only climb slightly.

About the Author(s)

You May Also Like