Progress in China trade talks one reason for optimism.

Hopefully, last Friday's announcement of a Phase 1 agreement in the 17-month-old U.S.-China trade dispute will boost farm commodity prices. The Associated Press reports that the United States has agreed to freeze or reduce tariffs on imports from China. China has agreed to annually buy $40 billion of U.S. farm products for the next two years. U.S. ag exports to China have never topped $26 billion in a single year. China has also agreed to stop pressuring U.S. firms to disclose trade secrets in order to do business in China. U.S. Trade Representative Robert Lighthizer indicates the agreement is likely to take effect in February.

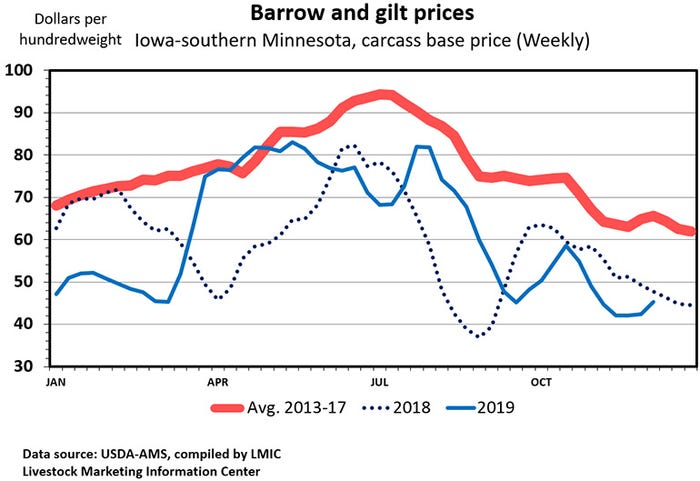

The hog price outlook for 2020 is bright. As of last Friday, the December hog futures contract, at $60.475 per hundredweight, is the lowest one on the board. All of the 2020 lean hog futures contracts are trading above $68 per hundredweight with the June, July and August contracts above $87 per hundredweight. The hog price optimism is mostly due to the expectation that production losses due to African swine fever will force China to buy large quantities of U.S. pork. With cost of production around $63 per hundredweight, next year should be a profitable one for hog producers.

Hog prices have been below cost of production in recent weeks, as they usually are at this time of year. The lowest hog prices of the year often come in the winter. Prices have had a bit of a rally in recent days. After New Year's Day, full slaughter schedules should reduce the supply of market-ready hogs and boost cash prices.

The USDA will release its quarterly hog inventory survey results Dec. 23. My prediction is that USDA will say the Dec. 1 breeding herd is 101.3% of a year ago, the market hog inventory is 103.3%, and the total swine herd is 103.1% of Dec. 1, 2018.

I am estimating September-November farrowings were 99.7% of a year ago. I expect December-February farrowings to be 100% of last winter. I'm predicting the number of litters that will be farrowed during March-May 2020 at 100.3% of last spring. These percentages are slightly higher than indicated by USDA's September report.

My forecast of pigs per litter during September through November is 102.9%. The combination of a 0.3% decrease in farrowings and a 2.9% increase in litter size should yield a fall pig crop that was 2.5% larger than last year. This means spring hog slaughter is also likely to be up 2.5%, more or less.

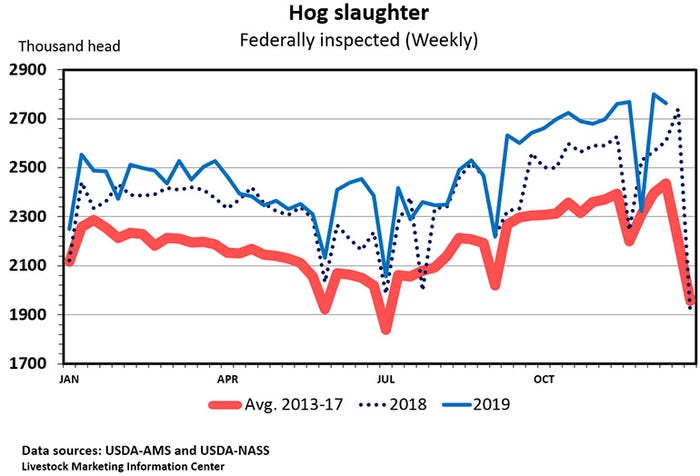

I'm predicting the market hog inventory weight groups in the quarterly survey to be: 180 pounds and up 105.0%; 120-179 pounds 103.5%; 50-119 pounds 102.8%; and under 50 pounds 102.5%. Hog slaughter during the first two weeks of December was up 7.4% which is more than my forecast of 105.0% for the heavy weight group. I expect a smaller increase in hog slaughter during the next few weeks.

Hog slaughter from Sept. 1 through Nov. 16 was right at the level implied by the heavy-weight market hog inventory in the September Hogs and Pigs report (up 5.8%). Since then, slaughter has been higher than indicated by the lighter-weight inventory in the September inventory report (up 7.0% versus up 2.4%). Thus, it is likely that USDA will make a modest upward revision to the September market hog inventory.

Sow slaughter is giving no obvious indication of herd growth. September-November sow slaughter was down 0.2% but, net of sows imported from Canada, sow slaughter was up 0.6%.

Hog slaughter has set many records in recent years. U.S. hog slaughter was record high in 2016 and each year since. Slaughter the two weeks before Thanksgiving and the two weeks after Thanksgiving were each larger than any week prior to November. Hog slaughter this coming week could well set a new record since it is followed by two holiday weeks when slaughter will be down.

Because it falls between the holidays of Christmas Day and New Year's Day, the last Saturday of December often has the largest Saturday slaughter of the year.

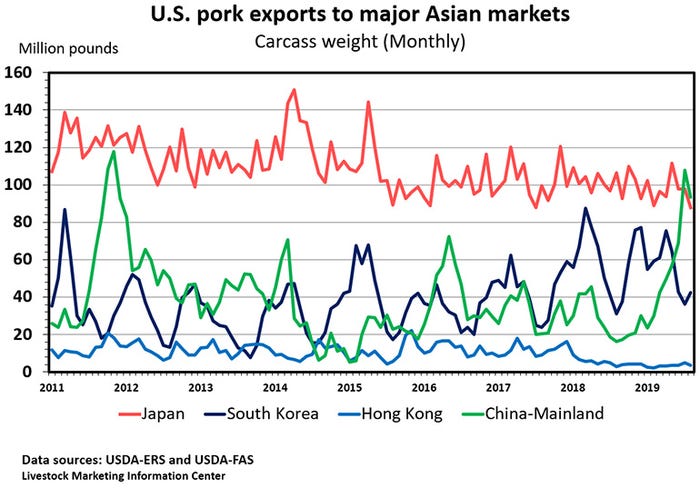

U.S. pork exports to China increased as we moved through 2019. In September and October, China imported more U.S. pork than Japan and was our second largest foreign customer after Mexico.

October pork imports equaled 3.15% of production. October pork exports equaled 19.99% of production. Pork exports are expected to set a record this year and again in 2020.

U.S. per capita pork consumption was below 50 pounds each year from 2010 through 2015. It was 50.1 pounds in both 2016 and 2017 and 50.9 pounds per person last year. It is forecast to be 52.7 pounds this year which will be the highest consumption since 54.2 pounds per capita in 1981. Pork production is forecast to grow 3.5% next year, but consumption is expected to decline by a slight 0.1 pound per American because of lower imports and higher exports.

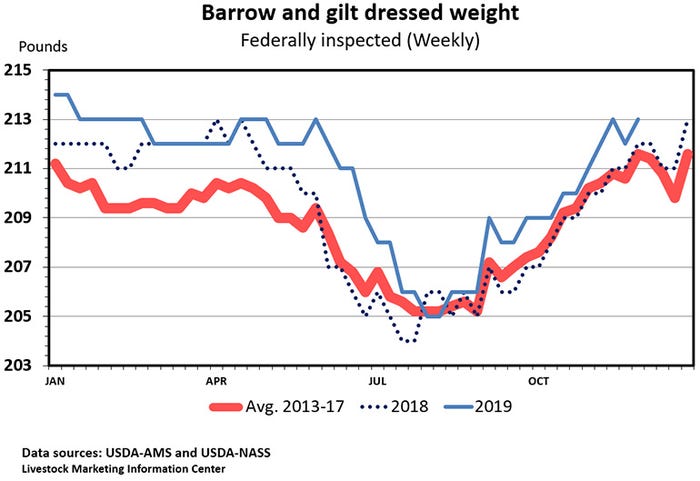

Slaughter weights in 2019 have been consistently higher than last year. Year-to-date hog slaughter is up 4.0%, but because of heavier weights pork production is up 4.6%. If, as expected, feed costs hold steady and hog prices increase, slaughter weights in 2020 are likely to average still higher.

USDA's Livestock Slaughter report for November will be released on Thursday afternoon. Preliminary data indicate November commercial hog slaughter totaled 11.34 million head, up 2.7% year-over-year on a monthly basis, or up 7.9% on a daily basis. The December Cattle on Feed report comes out Friday. The monthly Cold Storage report comes out next Monday.

Source: Ron Plain, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like