The pork production industry has received less allocation in USDA COVID-19 package than the hemp industry and its affiliates.

April 20, 2020

That sound that you heard coming out of Washington over the weekend was the bus backing up to run you over again. Pork producers have suffered another dismal defeat as they first sponsored the trade war with China on their back with little/no relief and now are doing the same with the COVID scenario with similar results.

The much-anticipated package from the USDA did not deliver on the promise for pork producers, the resulting legislation is both insufficient and misaligned — the verbiage seems to address the show pig industry, not the commercial side that feeds the world. To wit: if you are a 2,500-sow producer, the payment limit ($250,000) represents about $4 per pig of your annualized production … at a time when you are losing in excess of $40 per head with the prospects of the same indefinitely into the future.

Additionally, the evaluation for monetary proceeds are all coupled (meaning if you had a packer sale or hedges that afforded you price protection, this aggregate amount would be considered so you could possibly receive less money from the government). Essentially, you are being punished if you had the foresight and willingness to protect yourself against loss rather than relying on the government for a payout.

If you are a much-maligned "big guy" and have 40,000 sows, the government pat on the back represents roughly one half of a day of operational expenses, you will have chewed through the money by lunchtime. Literally. The clueless nature of this legislation has got to cause a producer to ponder whether the representation of his tax dollars show an equitable return.

The pork production industry has received less allocation than the hemp industry and its affiliates. That is not meant to be funny, it is the truth and it hurts. The inevitable consolidation, pain and bankruptcies that flow in the wake of this scenario will, oddly, add to the vertical integration and allow the big to get bigger — just the thing that your elected Senators and Representatives are thumping the podium claiming that they deplore.

As near as I can tell, whether a pork production system operating in our borders is owned by a Chinese entity, a Brazilian firm or an American-born native, they all employ tax-paying U.S. citizens who support our local economies and populate our communities. This is just ridiculous. Per Lee Schulz and his publication of 2018, "A baseline study of labor issues and trends in U.S. pork production," and my subsequent conversation with him regarding the same, the U.S. pork industry and its affiliated tentacles touch roughly 550,000 jobs in the United States, roughly five times more than the American Airlines employee base. American Airlines received $5.8 billion in direct payment from the government.

The airline industry received more than 12 times the money allocated to the pork industry with no mention that "big is bad" in the memo lines of those checks. Judging from this fact, I guess that making sure you travel to your Spring Break destination is more important than feeding society. I do not begrudge the airline industry for seeking and receiving relief for this situation, I am just yearning for some equity for pork producers to help stem the tide of pain and suffering.

Perhaps Sonny Perdue summarized the situation the best when, at the Friday briefing, he said, "There will be other extraneous people coming along that we identify as we go forward." Extraneous people? Washington speak at its best.

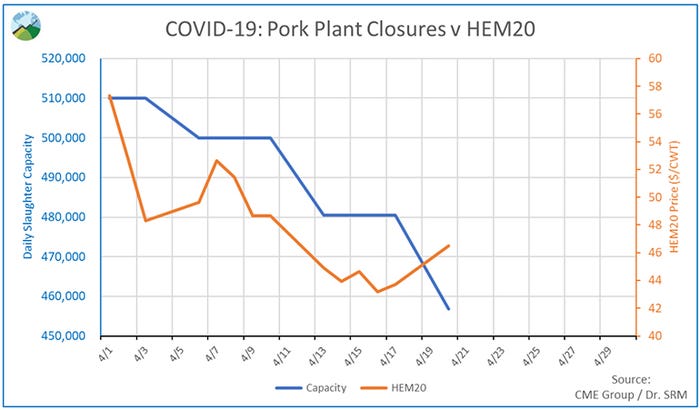

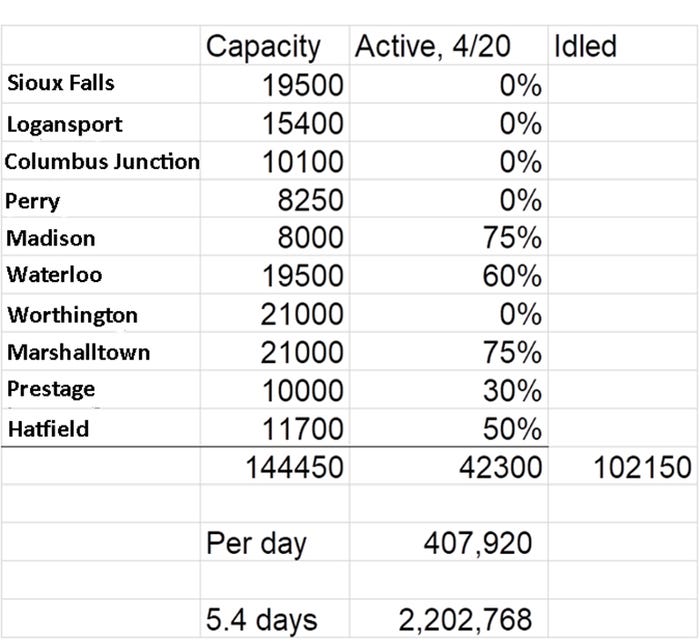

If you think the COVID situation has had an impact on futures prices, you are right. Look at the chart and table below depicting the performance of the June contract in relationship to plant closures and throughput compression.

This backup of market-ready hogs in the system has led to significant pressure on the wean pig market, our calculations indicate the fair market value for a wean pig does not make it to double digits for almost the balance of the year with late-summer representing negative numbers. This is not a healthy situation. The government checks are not going to be generated until June, if you can hold your breath that long.

The only industry worse than pork's take on the latest USDA announcement is ethanol. They got nothing. It is difficult to discern who, if any, should receive potential proceeds from the collapse — the corn producer or the ethanol plant? (as of this writing, crude oil is approaching zero. It can, technically, go to negative numbers.) The ethanol and biodiesel industries are going to have to have some massive structural reform in terms of output and governmental policy. Perhaps that hill was just too tall to climb this time around. I am reminded of how a friend of mine recently pointed out that, "the closer you are to the flame, the less long-term plans you tend to make." Pork producers are feeling the heat, the ethanol industry is in the midst of the fire.

What is a pork producer to do in this scenario? It is easier to find problems rather than solutions and I think this situation is still going to get worse before it gets better. We continue to back up hogs and the number of positive COVID cases in packing plants is increasing. The no-growth diets that you have implemented will have to be maintained for a bit, which will likely further backup wean pigs and create more consternation both in the cash butcher market. This may benefit the fall months.

Per the March Hogs and Pigs Report in addition to the economic backlash, we are already out of the woods in taxing the fourth quarter capacity if we are back to a normal pace of operation by then. Demand will, of course, be the variable that will drive prices, not a surplus of hogs. That is good news, if you can hold your breath that long.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like