Sow numbers in the European Union (EU) are down slightly from 13 million sows, 2010 vs. 2011. “A number of big countries have seen limited change, while in a number of eastern and central European countries the change is massive,” points out Peter Kristensen, DVM, former general manager of animal health for Boehringer Ingelheim in the Ukraine, Belorussia and Kazakhstan.

July 15, 2012

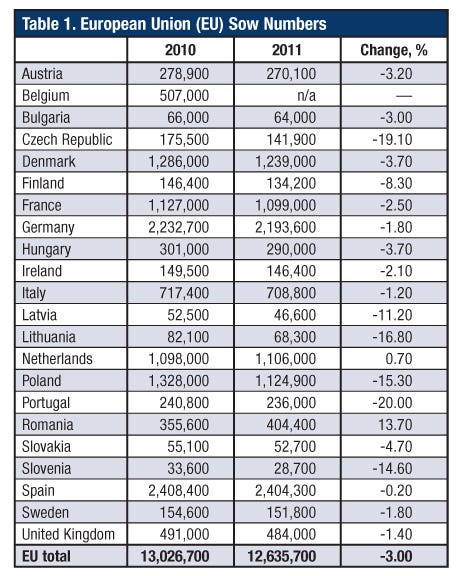

Sow numbers in the European Union (EU) are down slightly from 13 million sows, 2010 vs. 2011 (Table 1). “A number of big countries have seen limited change, while in a number of eastern and central European countries the change is massive,” points out Peter Kristensen, DVM, former general manager of animal health for Boehringer Ingelheim in the Ukraine, Belorussia and Kazakhstan.

“Think of the EU with a tier that has two million sows — that’s Spain and Germany. Then there is a tier of one-million-sow countries — Denmark, France, The Netherlands and Poland. Except for Poland, we don’t see much wiggling in those numbers,” he says. “The reason is Denmark and The Netherlands are increasing their sow base to be able to sell 30-kg. (66 lb.) pigs. They have created a model now where there is a premium for 66-lb. pigs from The Netherlands and Denmark, with the excess sent to the Czech Republic, Poland and Hungary.

“We are starting to see a trend (in some countries) where producers are sourcing pigs from western Europe instead of hassling with the sows,” he notes.

EU Countdown

The United Kingdom and Sweden are expected to be fully compliant with the sow stall ban by the end of the year (Table 2). “The UK is leading the crusade because they see it as an opportunity for their domestic production to shield them from pork imports. They will be very aggressive on the retail side and will not accept meat from sows that are not housed in loose housing,” he says.

Denmark will be compliant because of their reliance on exports and their early relations with the UK. The Netherlands will not be compliant. Poland never went to stalls in their small farms. The big question marks are Spain and Italy.

“Small countries (UK, Spain, Italy) do not export, so their production is for domestic consumption,” Kristensen explains.

What will the EU do? Will they force non-compliant farms to close? Will they allow them to sell their product within the EU? Will they allow them to export pork?

In an attempt to find answers, the InterPIG group collaborated with British Pig Executives (BPEX) and came up with three scenarios:

Scenario #1: Production in the EU will decline 5%. “Remember, when you take out 5% of production from small farms, that doesn’t mean you take out 5% of the finishing pigs. While we like to look at sow numbers, we may be taking out 5-6% of the least-productive sows in the base,” Kristensen explains.

Prices for non-compliant producers will decline or they will be penalized, while the price of finisher pigs from compliant producers could increase 10%.

The processing sector may consolidate.

“When we look at the EU27 with 250-260 million pigs and there is no packer that controls more than 20-25 million pigs, many feel that to wrestle with the retailers, we need a larger integrator with 60-75 million pigs that are welfare compliant. Personally, I think the retailers will say they have had 10 years to comply with the rules, so they will get nothing (extra) for complying. I think that’s the likely outcome,” he says.

Scenario #2: Rigorous enforcement of the rules, which will lead to up to a 10% decline in production.

Substantial increases in prices with more competition for supply.

Potential consumer reaction with political intervention, which could lead to incentives to be welfare compliant.

“If we see a substantial increase in prices, you will see some consumer pushback,” he predicts. “The industry has to be ready to deal with that. Again, they may ask why they should pay more for something they have had over 10 years to comply with.”

Scenario #3: Fundamental realignment of pork production across the EU. Sows may be

located in northwestern Europe and finishers will be located in eastern and southern Europe.

“In Denmark, about 10 million of the 24 million pigs produced annually leave the country on four hooves, going to Germany and eastern Europe as feeder pigs,” Kristensen explains. “Those markets have exploded the last 4-5 years. In Germany, if retailers want loose sow housing compliance, the potential to increase that even more is there. A major barrier to this evolution is animal welfare legislation for the transport of animals and concerns about long-distance transport of pigs across Europe. Long-distance transport is 8 hours maximum or 24 hours with a permanent water supply.

You May Also Like