European Union is cleaning house in the global pork trade game. How are they doing it?

August 30, 2017

“Why is the U.S. losing market share globally when we are the most competitive producers on earth with the highest safety record?” Brett Stuart, Global AgriTrends chief executive officer, asks America’s pig farmers at the Carthage Veterinary Service Swine Conference in Macomb, Ill.

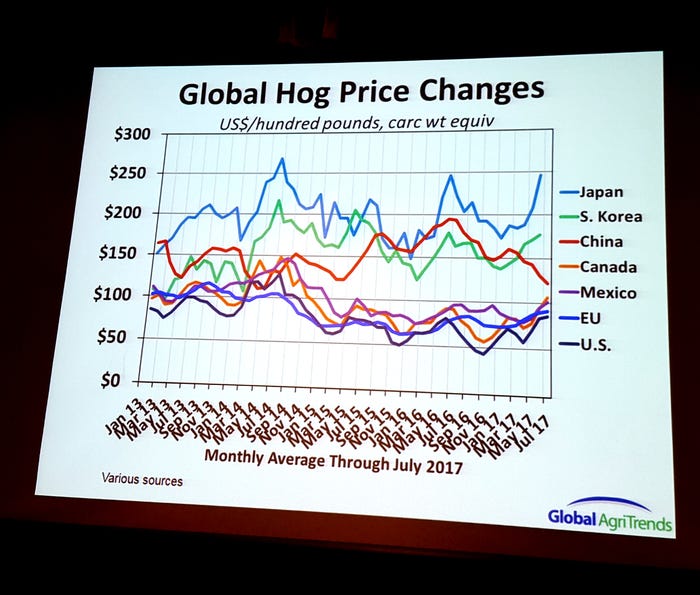

Looking at the major global players for pork, the most profitable hog farmers in the past three years raise pigs in China and the European Union, despite both countries having much higher costs than the United States.

Obviously, the massive reduction in its hogs inventory lead to record high prices in China. It is their turn at the good price cycle. Stuart says everyone wants to raise pigs in China because the money is there. However, “Expansion is under way, and it will weigh on hog prices in 2018,” states Stuart.

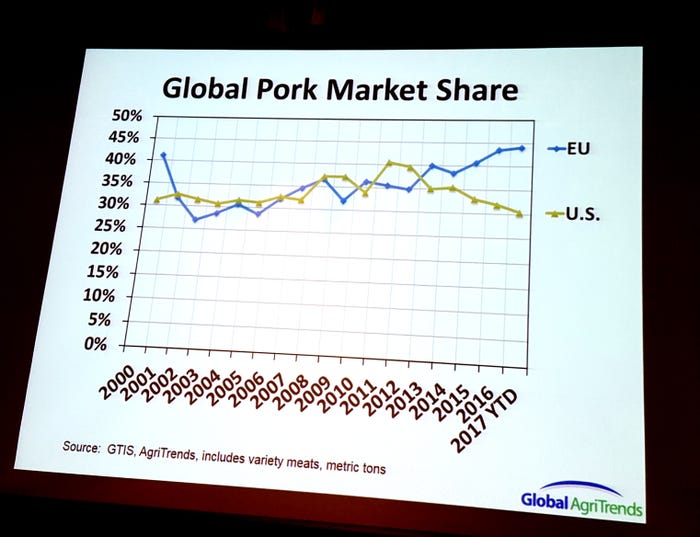

On the other, the European Union has a higher cost of production than the United States, but is capturing the majority of growth in global pork markets.

So, let’s stop, think about it and digest the current situation of the U.S. pork sector.

Over the years U.S. hog farmers have made great strides in producing safe, quality pork at low production cost. In fact, the U.S. pork industry is so efficient it is being modeled by China and other global competitors. Currently, U.S. hog farmers are shipping 27% of production overseas. Yet, the EU is cleaning house in the global pork trade game.

How are they doing it? It is not rocket science. It is simple — getting business done and gaining market access through trade agreements. Yes, lower pig prices in the EU are helping them sell more pork.

Historically, U.S. pork has gained ground in the global marketplace by identifying barriers and building a strategy to overcome it. The competition is heating up, and the United States needs to keep an eye on the ball.

Unfortunately, at a time that the world is craving U.S. pork, President Donald Trump is following up on his campaign promises of pulling out of the Trans-Pacific Partnership and revamping the North American Free Trade Agreement — two significant agreements for U.S. pork producers.

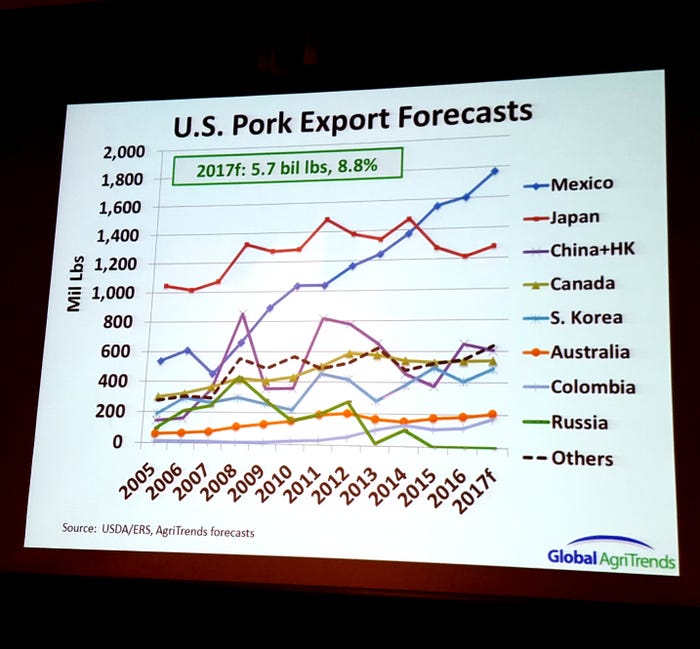

The tinkering with trade agreements or not moving the ball forward with major trade partners could be an unfortunate fumble, costing team pork the game. America’s pig farmers can’t afford to lose any trading partner, especially its top volume market Mexico and its top value market Japan.

The United States relies heavy on Mexico. Looking at the big picture, the United States can’t afford to lose market share in Mexico nor can it afford to continue to depend all its global trade on one country.

In the first round of talks, the United States, Canada and Mexico have determined to try to reach an agreement on the renegotiation of NAFTA as soon as possible. Yet, Trump, shortly after the first round of negotiations concluded, threatens to leave NAFTA all together, adding new wrinkles to the global trade woes. “We are in the NAFTA (worst trade deal ever made) renegotiation process with Mexico and Canada. Both being very difficult, may have to terminate?” Trump said.

Furthermore, in final days of August, the 11 remaining countries in TPP talks — Australia, Brunei Darussalam, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam — are devising a way to continue the deal without the United States.

Today, the United States holds 55% of the chilled pork market in Japan, and the competition is just waiting for the opportunity to steal the ball. Signing the TPP deal easily gives TPP member Canada an advantage over U.S. pork producers in Japan, Vietnam, Malaysia and other markets.

Given that the European Union and Japan have already reached an agreement in principle on a trade pact, the U.S. pork industry will lose valuable market share in the Asia-Pacific region if the United States doesn’t quickly conclude bilateral free trade agreements with countries in this region.

With two more rounds of NAFTA negotiations scheduled for September, it’s hard to predict what lies ahead in the global pork trade game. Clearly, as it stands now, Trump is holding the whistle. He is the official referee, controlling the U.S. path in future trade agreements.

Now, it is the time for team pork to huddle up. As Stuart explains, in the last 100 free trade agreements the United States has been a party to two. “Standing still is falling behind,” he stresses.

On the whole, America’s pig farmers are speaking out and stressing the importance of fair trade agreements.

Will the rest of the game be played with or without these trade agreements? Only time will tell.

You May Also Like