The one number you need to continue to watch is the weekly slaughter numbers and see how they track from a year ago.

Last month, Mark Greenwood's column shared a sentiment we have all felt throughout the industry: "We just want to know."

For three months now, we have faced uncertainty and struggled for more information. Today, while we don't have all the answers, some things have become clearer. So for my column today, I'll discuss "What do we know?" as a follow-up with where we are today and what the future of the industry will look like according to my viewpoint.

Looking back, it was only five weeks ago when we hit the low number mark of 1.54 million head of hogs harvested for the week. Pigs were backing up with most processors and there was considerable talk about having to cull market hogs. Just 35 days later, we have gone from 56% utilization or packing plant capacity, to 89% last week and improving daily. For the first time in several weeks we had a slaughter number that was higher this past week than the previous year.

On the retail side, grocery store shelves are being restocked with product. Restaurants around the country are starting to reopen with limited capacity. Restrictions are easing everywhere, and exports have continued to be encouraging.

Talking to producers across the country, it is evident that there has been some culling of market animals. I have also heard of cutting breed targets, culling unthrifty pigs at weaning and some liquidation. The problem we are having with liquidation is the cull plant capacity. Based on the numbers I have seen, it could take a year to get to a meaningful liquidation number, as the system does not currently have the capacity to speed up liquidation. This is what we know today.

Now for the unknowns …

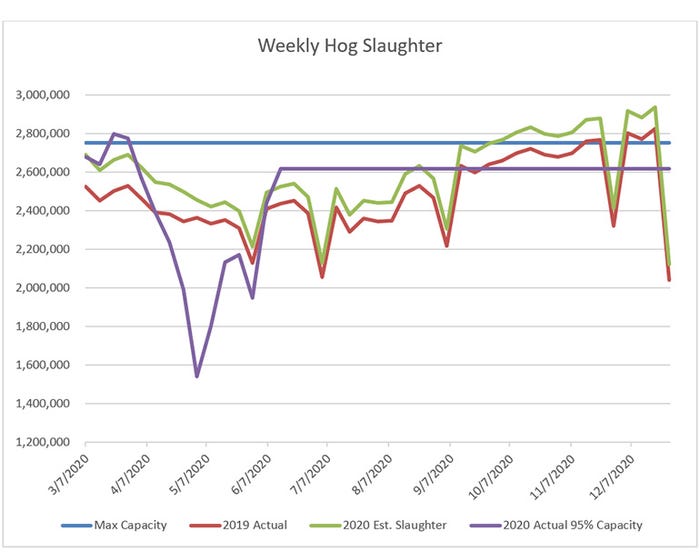

At Compeer Financial, we have been tracking weekly slaughter numbers relative to a year ago, using the latest USDA hogs and pig report increases. For 2020, we are projecting hog numbers to reflect 4.4% growth which we have used in our model. Using actual USDA plant harvest data and with these assumptions, our model suggests there may be approximately 3.2 million hogs backed up in the system today. With packing plants nearing capacity will that be the peak? Unfortunately, along with COVID-19 we anticipate continued challenges from a plant utilization standpoint and are predicting 95% of previous capacity. That scenario brings us to peak in mid-December with 3.8 million pigs still backed up.

Take a look at the chart below, based on the USDA projected Hogs and Pigs Report data. It shows that we will exceed capacity by the week of Oct. 3 if we get back to 100% capacity with all plants and remain there through 2020. Is it possible to slaughter that many hogs every week with the current backlog of 3.2 million head? I assume we can work through some of the inventory backlog if we push the packing capacity at 100% and slaughter on weekends and holidays for the rest of the year. But is that practical?

If we have any chance of catching up we need to see our weekly slaughter outpace last year's numbers through September. One assumption that I haven't accounted for is the level of hogs culled over the past few weeks. If I make the assumption this industry did cull market hogs or aborted sows to pull the inventory down by 5%, we will still exceed capacity as we did a year ago.

To help you manage your inventories, the one number you need to continue to watch is the weekly slaughter numbers and see how they track from a year ago.

Steve Malakowsky is a vice president Swine Lending specialist, with more than 22 years of experience at Compeer. For more insights from Malakowsky and the Compeer Swine Team, visit Compeer.com.

Source: Steve Malakowsky, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like