Last week’s decision by the Environmental Protection Agency (EPA) to deny requests to waive the Renewable Fuels Standard (RFS) came as no surprise to me and was not at all unexpected by the livestock and poultry sectors.

November 19, 2012

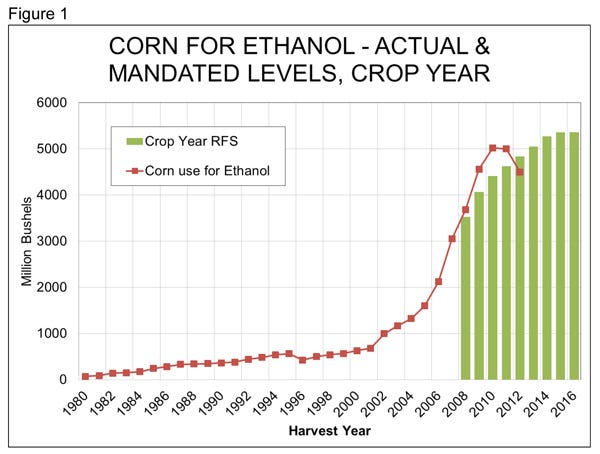

Last week’s decision by the Environmental Protection Agency (EPA) to deny requests to waive the Renewable Fuels Standard (RFS) came as no surprise to me and was not at all unexpected by the livestock and poultry sectors (Figure 1). There was doubt in many quarters as to whether the waiver would have any significant impact on corn prices. And, as expected, there were arguments from the ethanol sector fearful that the final major piece of the federal ethanol program might be damaged. Then there was the factor that an affirmative decision from EPA would help the livestock/poultry and petroleum industries – two groups that I doubt are very high on EPA’s “help list.” While the decision was not unexpected, it did push December corn 5-3/4 cents higher on Friday and 11-12 cents by midday Monday.

That’s the bad news on feed costs. The good news is the significant selloff that we have seen in the soy complex. On Friday, December meal futures saw its lowest close since July 2 at $424.60. Every contract from May forward closed below $400/ton. I still can hardly believe that I think those are bargain prices, but they certainly are compared to futures prices we saw earlier this summer close to $500/ton.

Part of the pressure on soybeans and soybean meal, of course, is the positive crop news out of South America. Analysts still expect a Brazilian crop that will likely be larger, for the first time ever, than this year’s U.S. crop. Parts of Argentina are very wet, but we all know that wet is better than dry almost every time. In spite of the logistical challenges that Brazilian soybean merchants may encounter, the existence of more beans in the southern hemisphere will put some downward pressure on world prices both now and after their harvest begins in February.

The bottom line is that steady corn futures and lower soybean meal futures will put production costs for 2013 at levels significantly lower than had previously been expected. In fact, my estimate of breakeven costs as of Monday morning was just under $94/cwt., carcass, up about $1.00 from last week, but nearly $8.00/cwt. lower than its peak last summer. Compare that to a $91.68 average or the eight 2013 Lean Hog futures contracts and one can see that losses next year may be much lower than earlier expected. I know “smaller-than-expected losses” rings pretty hollow in the good news category, but it is good news nonetheless.

Fewer Cattle in Feedlots

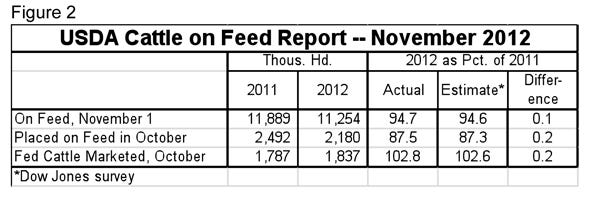

The other piece of good news from Friday is a further reduction in the number of cattle on feed relative to one year ago. As Figure 2 shows, the numbers from Friday’s Cattle on Feed report were almost precisely as was expected by analysts. Live Cattle futures were virtually unchanged in early Monday trading.

But the expectations and actual numbers were far below the levels of 2011. Actual placements were 13% lower than last year and that reduction comes on year-on-year declines of 10, 10.6 and 19% the past three months, resulting in the lowest number of cattle in feedlots on Nov.1 since 2009.

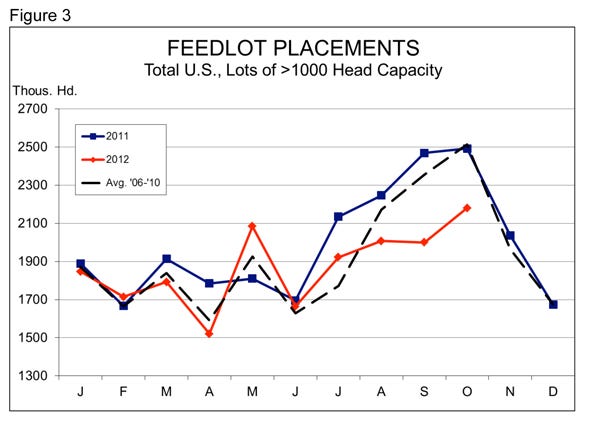

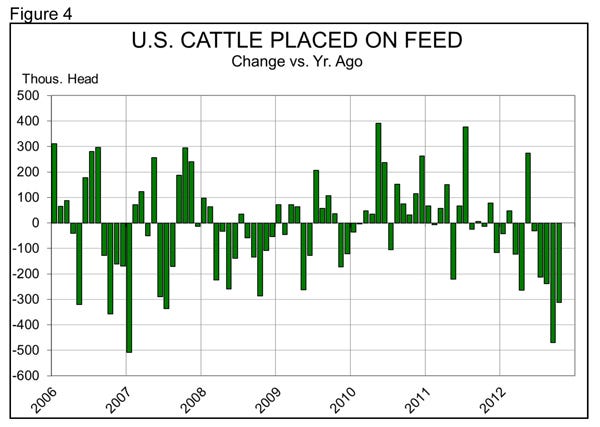

Figure 4 presents these reductions in another manner. Since Jan. 1, U.S. feedlots with capacities of 1,000 head and more have placed 1.371 million fewer cattle on feed than they did last year (Figure 3). Part of that decline, of course, was due to the drought-induced placements of cattle last year, but we must remember that pastures, especially in the western plains, are not exactly lush this year, and most cow-calf operators have shipped the calves in an effort to maintain their cow herds on scarce forage supplies. Those calves have had to go somewhere and wheat pasture conditions in the southwest have not been good. And if they have moved to lots, their numbers are still this much lower.

Note in Figure 4, the only month this year that has seen significantly higher placements was May. Those cattle are coming to slaughter right now and are the main reason for slightly higher steer and heifer numbers in recent weeks. When they are gone, though, there are not many behind them. I look for much higher beef prices next year.

Higher beef prices mean stronger pork demand. Now add in some cuts in the broiler breeder flock and likely reductions in per capita chicken offerings next year and you get even more help for pork. If exports can hold together in 2013, it could be a good year – if rainfall is normal and the 2013 crop is a good one. Pray for rain!

Be Thankful

And take time this week to think about the things you are thankful for. We don’t do that often enough. Spouses, family, friends, jobs, churches – all provide us with so much and often go so unnoticed. Make sure to rectify that this week. Tell people you appreciate them.

About the Author(s)

You May Also Like