April 8, 2013

As expected, February proved to be a tough month for U.S. pork exports – and that was before Russia and China imploded over alleged concerns about ractopamine residues. To say the least, the February data do not provide a good place to go in to a crisis.

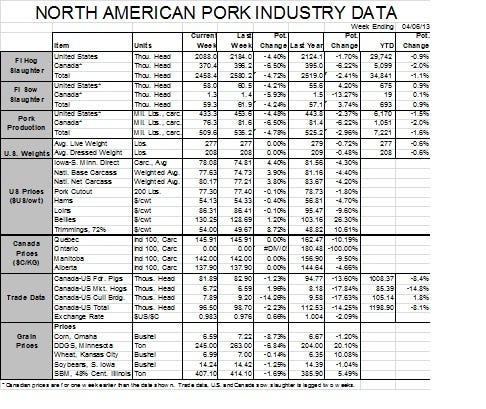

Total U.S. pork exports in February amounted to 132,897 metric tonnes, product weight, valued at $404.2 million. Those figures are 12.6% and 12.1% lower, respectively, than during February 2012. They bring the year-to-date totals for product-weight shipments and value to 275,558 metric tonnes and $841.27 million dollars. Those numbers are 14% and 12% lower than one year ago.

It was hard to find a specific culprit in the decline because there were several. Of our top 10 pork export markets, shipments were higher than one year ago to only Canada and Philippines. In the Canadian market, the 10.8% increase in quantity means something since it represents over 17,000 metric tonnes. In the case of Philippines, the 37% year-on-year increase doesn’t mean much since it still represents only 2,683 metric tonnes. But this year, we’ll gladly take what we can get.

Japan returned to the top spot for both volume and value of pork exports after ranking second in total volume to Mexico in January. But the totals for Japan (32,519 MT and $144 million) were 11% and 13% lower than one year ago. Still, Mexico and Canada held their traditional second and third spots for both volume and value. Korea moved ahead of China in the individual country rankings, but they still rank below the combined China/Hong Kong market whose February purchases were down 27% for volume and 23% for value.

February shipments to Russia were down by more than half from one year ago and year-to-date through the end of February exports to Russia were down by about one-third.

China/Hong Kong and Mexico continue to dominate U.S. pork variety meat exports, accounting for over 85% of both volume and value during February. Shipments to Mexico were down by 19% in volume and 18% in value from last year during February, while shipments to China/Hong Kong were more than double the level of 2012. Japan is our third largest variety meat market but so far in 2012, their purchases have amounted to only 8% of the volume and 15% of the value of the variety meats sent to No. 2 Mexico.

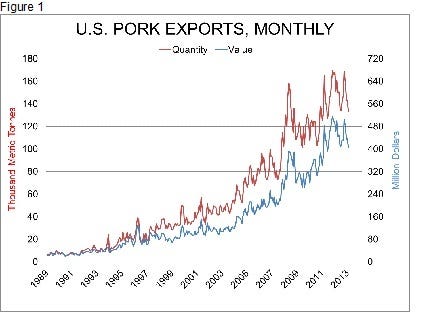

Figure 1 provides a look at historical monthly product weight exports and their values. The rapid growth of both can be clearly seen as can the spike in 2008. That, of course, was driven by China’s first large foray into the U.S. market. The February figures for both volume and value were the lowest since July 2011 and June 2011, respectively. Perhaps more importantly, it is increasingly looking as if the trend for U.S pork export growth has slowed. Isolating just those observations since January 2011 doesn’t allow for much slope in a trend line and with February’s results and the ongoing ractopamine issues, I find it very difficult to argue that the situation will get better. That conclusion applies just as well to the value of exports.

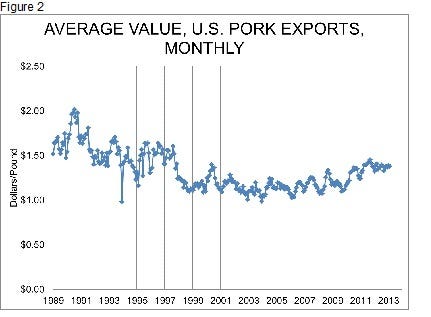

In preparing today’s column, I ran across an interesting relationship. Figure 2 shows the average per-pound value of U.S. pork muscle cut exports since 1989. It didn’t surprise me that the average unit value of exports declined in the 1990s as U.S. export grew. Many businesses that gain market share do so, at least initially, due to technology-driven cost advantages and this period corresponds to a time of low U.S. grain prices and rapid efficiency gains by U.S. pork producers and packers.

Like what you're reading? Subscribe to the National Hog Farmer Weekly Preview newsletter and get the latest news delivered right to your inbox every Monday!

I was, however, surprised by the magnitude of the decline $1.61/lb. in 1989 to $1.11/lb. in 2003. That certainly looks like a business that was buying market share with lower-cost products – a good thing indeed for consumers.

But beginning in 2003, not coincidentally, I believe, after the North American Free Trade Agreement (NAFTA) was fully implemented in 2004, the average value of U.S. pork exports steadily climbed to $1.38/lb. in 2011 before dropping by $0.01/lb. last year. A U.S. dollar that was 17% less valuable (according to the average weekly dollar index futures value) in 2012 than it was in 2003 is a big part of the increase but, even allowing for exchange rates, U.S. pork exports have gained in unit value over that time period.

More volume at higher per-unit prices and higher total value – those factors have been very good to hog producers over the years. Whether we can keep that going is in some doubt this year, I feel.

You might also like:

How Gilt management Drives Production

Look for New Chapter in Pork Checkoff Advertising in 2013

Countries Continue to Use SPS Trade Barriers

You May Also Like