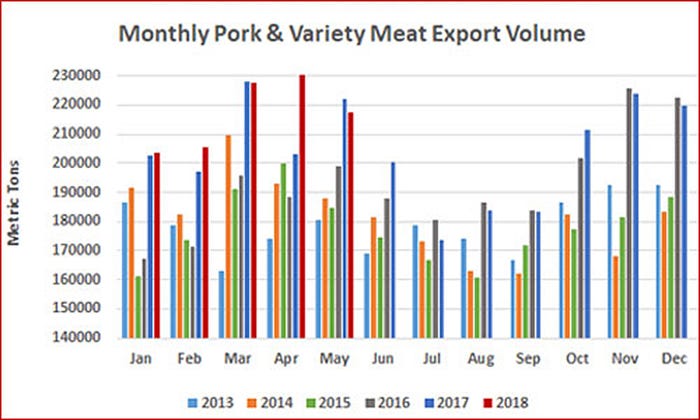

Following a record performance in April, May pork export volume was 217,209 metric tons, down 2% from a year ago and reflecting smaller exports of variety meats.

July 10, 2018

Source: U.S. Meat Export Federation

May pork exports were lower than a year ago, though January-May totals for U.S. pork remained ahead of last year’s pace, according to data released by the USDA and compiled by the U.S. Meat Export Federation. U.S. beef exports set a new value record in May while also increasing significantly year-over-year in volume.

Following a record performance in April, May pork export volume was 217,209 metric tons, down 2% from a year ago and reflecting smaller exports of variety meats. Export value was $562.5 million, down 3.5%. For January through May, pork export volume was still 3% ahead of last year’s record pace at 1.08 million mt, while value increased 6% to $2.85 billion.

Exports accounted for 27.8% of total pork production in May, down from 29.5% a year ago, while the percentage of muscle cuts exported fell about one percentage point to 24%. For January through May, the percentage of total production exported was slightly below last year at 27.5%, while the percentage of muscle cuts exported increased slightly to 23.7%.

May pork export value averaged $55.05 per head slaughtered, down 6% from a year ago. The January-May per-head average was $55.57, up 2% from last year.

Beef export volume was 117,871 mt in May, the sixth-largest on record, valued at a remarkable $722.1 million, which surpassed the previous monthly high (March 2018) by a healthy 4% and was 24% higher than a year ago. Through the first five months of 2018, beef exports were up 10% in volume to 547,157 mt while export value was $3.32 billion, 21% above last year’s record pace.

Exports accounted for 13.6% of total beef production in May, up from 13% a year ago. For muscle cuts only, the percentage exported was 11.1%, up from 10% last year. For January through May, exports accounted for 13.5% of total beef production and 10.9% for muscle cuts — up from 12.8% and 10%, respectively, last year.

Beef export value averaged $313.39 per head of fed slaughter in May, up 18% from a year ago. The January-May average was $317.69 per head, also up 18%.

Pork exports still ahead of last year�’s record pace, but will be tested by higher tariffs

Mexico’s retaliatory duties on U.S. pork took effect in June, so January-May results were not directly impacted. May exports to Mexico increased 3% from a year ago in volume (70,589 mt) but slipped 11% in value to $115.6 million. Through the first five months of 2018, exports to Mexico were 6% above last year’s record volume pace at 353,264 mt, with value up 2% to $621 million. On June 5, Mexico imposed a 10% duty on fresh/frozen pork muscle cuts from the United States, and the rate increased to 20% on July 5. Also in June, Mexico imposed a 15% duty on U.S. pork sausages and a 20% duty on some prepared hams (these rates did not increase July 5) and opened a duty-free quota aimed at attracting imports from non-U.S. suppliers.

Pork exports to the China/Hong Kong region were well below year-ago levels in May, due in part to the additional 25% tariff imposed by China on April 2 (the increase does not apply to product entering Hong Kong). May exports to China/Hong Kong were 34,191 mt, down 31% from a year ago, while export value dropped 25% to $79.9 million. For January through May, exports to China/Hong Kong were 18% below last year’s pace in volume (187,439 mt) and down 6% in value to $436.4 million.

Exports to China will face an even steeper challenge in the second half of 2018, as China recently hiked the duty rate on U.S. pork by another 25%. This means U.S. pork cuts and pork variety meat entering China now face a duty rate of 62%, compared to 12% for China’s other suppliers, including the European Union, Brazil and Canada.

“It is unfortunate that U.S. pork is caught in the crosshairs of a dispute that has nothing to do with pork trade,” says USMEF President and CEO Dan Halstrom. “USMEF is focusing on the factors we can control by partnering with U.S. packers and exporters to make every effort to defend our market share and protect our business in Mexico and China. USMEF also consistently stresses the importance of diversifying our export markets and expanding U.S. pork’s footprint into emerging markets, and those efforts are more critical than ever.”

January-May highlights for U.S. pork include:

• As an outstanding destination for U.S. pork for further processing and value-added items destined for the home meal replacement sector, exports to South Korea continue to achieve impressive growth. May exports climbed 44% from a year ago in volume (22,447 mt) and 47% in value ($64.4 million). For January through May, exports to Korea totaled 117,335 mt (up 44%), valued at $340.6 million (up 54%).

• Exports to leading value market Japan were 1% below last year in volume (167,294 mt) and steady in value ($689.6 million). This included a 4% decrease in chilled pork, with value down slightly at $424 million.

• Surging demand in Colombia and solid growth in Peru pushed pork exports to South America up 26% from a year ago in both volume (50,993 mt) and value ($125.4 million). Argentina officially opened to U.S. pork in April, but it has taken some time for exporters to complete various regulatory processes. USMEF is optimistic that shipments to Argentina can begin soon.

• Exports to Australia and New Zealand were up 8% in volume (36,184 mt) and were 11% higher in value ($107 million) as the United States has gained market share in Oceania, an increasingly important market for U.S. hams.

• Led by strong year-over-year growth in Honduras, Panama, El Salvador and Guatemala, pork exports to Central America climbed 18% from a year ago in volume (33,590 mt) and 20% in value ($79.7 million). Coming off a record year in 2017, exports to all seven Central American nations achieved double-digit growth in the first five months of 2018.

• Exports to the Dominican Republic, which were also record-large in 2017, increased 19% in both volume (19,102 mt) and value ($42.4 million) through May. For the Caribbean region, exports were up 13% in volume to 25,667 mt and 14% in value to $60.8 million.

• With solid growth in the Philippines and Vietnam offsetting lower shipments to Singapore, pork exports to the ASEAN region increased 12% in volume (20,630 mt) and 24% in value ($57.4 million). Pork variety meat exports to the ASEAN, which are especially important when shipments to China are declining, increased 50% in volume (6,827 mt) and 58% in value ($12.5 million).

Japan, Korea lead the way as global demand for U.S. beef continues to climb

Japan and South Korea continue to be the pacesetters for U.S. beef export growth. In May, export volume to Japan totaled 30,117 mt (up 19% from a year ago) valued at $196.8 million (up 22% and the highest since August 2017). Through May, exports to Japan were up 4% from a year ago in volume at 128,207 mt while value increased 13% to $822.9 million. This included a 6% increase in chilled beef volume to 61,178 mt, valued at $488 million (up 18%).

May exports to Korea were up 46% from a year ago in volume (20,781 mt) and jumped 64% in value to a record $146.2 million. For January through May, exports to Korea climbed 34% to 91,875 mt, valued at $647.3 million — 49% above last year’s record pace. Chilled beef exports to Korea totaled 20,365 mt (up 30%) valued at $196 million (up 41%).

“Despite the intense competition U.S. beef faces in Japan and Korea, these markets continue to display a terrific appetite for a growing range of cuts,” Halstrom says. “Beef items that are traditionally popular in Asia continue to perform and other items more suitable for thick-cut steaks and barbecue concepts are gaining more traction, resulting in exceptional growth opportunities. But the enthusiasm for U.S. beef extends well beyond these two leading markets, and that’s how exports have reached this record-breaking pace.”

For January through May, other highlights for U.S. beef include:

• In Mexico, exports were up 4% in volume (98,900 mt) and 13% higher in value ($427.9 million). Mexico is a critical market for U.S. rounds, shoulder clods and other muscle cuts which are typically undervalued in the U.S. market. It is also the leading destination for U.S. beef variety meat exports, which increased 15% from a year ago in value ($98.9 million) despite a 2% decline in volume (43,479 mt).

• Exports to China/Hong Kong increased 20% in volume (57,186 mt) and 47% in value to $442.2 million. May exports to China were the largest (834 mt) since the market opened in June of last year, pushing the January-May total to 3,133 mt valued at $28.7 million. However, effective July 6, China’s import duty rate on U.S. beef increased from 12% to 37%. The higher tariff will make it difficult for end-users to profitably utilize U.S. beef, especially with U.S. beef already priced at a premium compared to imports from other suppliers and with Australian beef subject to a duty of just 7.2% through the China-Australia Free Trade Agreement.

• Coming off a record performance in 2017, beef exports to Taiwan continue to gain momentum. Exports were up 31% from a year ago in volume (22,127 mt) and 43% higher in value ($209.9 million). Chilled exports increased 39% in volume (9,272 mt) and 52% in value ($116 million), as U.S. beef captured 74% of Taiwan’s chilled beef market.

• More reliable access to Indonesia has helped bolster beef exports to this promising market, with volume increasing 52% from a year ago to 6,247 mt and value nearly doubling to $28.7 million. Due in part to the United States successfully challenging Indonesia’s import restrictions at the World Trade Organization, U.S. beef now faces fewer obstacles and a more consistent regulatory environment. Indonesia’s strong performance and solid growth in the Philippines helped push exports to the ASEAN region 17% higher in volume (18,472 mt) and 28% higher in value ($102.4 million).

• Led by strong growth in Guatemala, Costa Rica and Panama, exports to Central America jumped 21% in volume (5,436 mt) from a year ago and 22% in value ($30.6 million).

You May Also Like