November 24, 2014

First, please accept our wishes for a very happy Thanksgiving holiday. This time of year is good for me – and probably many of you, too – as it provides a reminder and an opportunity to stop taking things for granted.

Most of us are so blessed and we just don’t stop to think about either God’s gracious provision or the fact that many are not nearly as fortunate.

Take time to contemplate both this week, enjoy your family and friends and travel safely. Best wishes for the holiday!

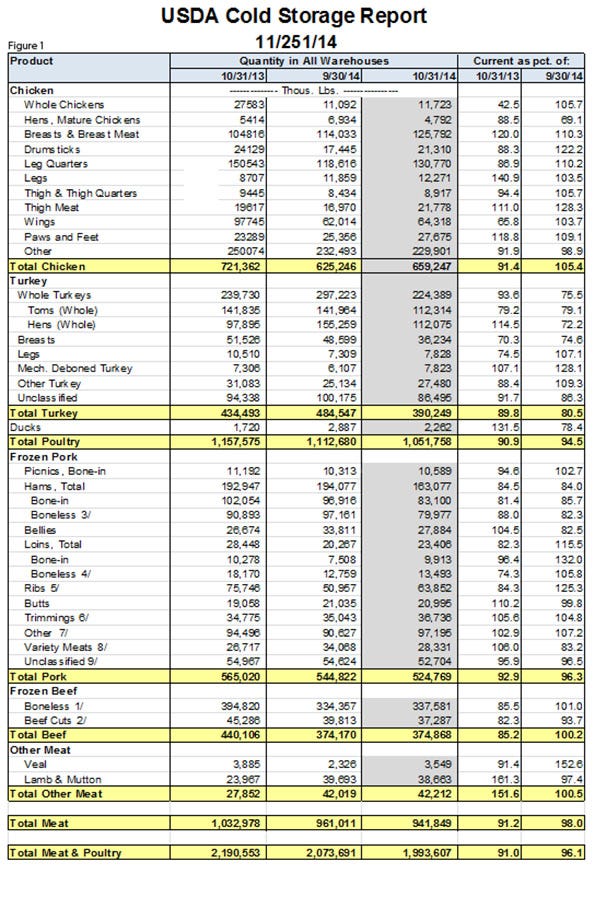

The U.S. Department of Agriculture’s November Cold Storage report indicated continued tight freezer supplies for all meat and poultry (see Figure 1).

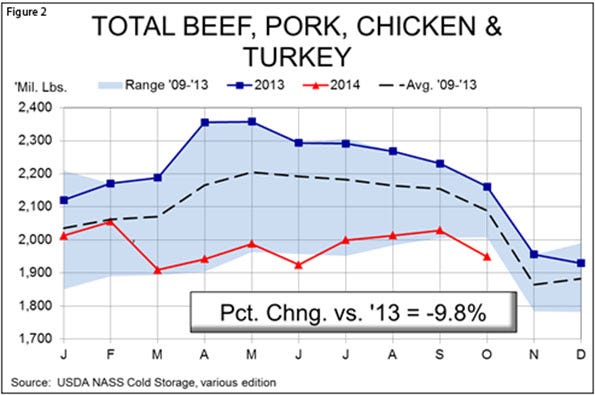

The Oct. 31 inventory of 1.949 billion pounds of beef, pork, chicken and turkey in U.S. freezers was the lowest October total since 1996, and the first such figure under 2 billion pounds since 2001. The figure is 9.8% lower than one year ago (see Figure 2).

The October drawdown of 79.652 million pounds was larger than the five-year average (65.502 million pounds) but was smaller than two of the past three years. The biggest contributor to October freezer drawdowns, of course, is the movement of turkeys to retailers in preparation for the Thanksgiving holiday. Turkey stocks on Oct. 31 were nearly 20% lower than at the end of September.

The October drawdown of 79.652 million pounds was larger than the five-year average (65.502 million pounds) but was smaller than two of the past three years. The biggest contributor to October freezer drawdowns, of course, is the movement of turkeys to retailers in preparation for the Thanksgiving holiday. Turkey stocks on Oct. 31 were nearly 20% lower than at the end of September.

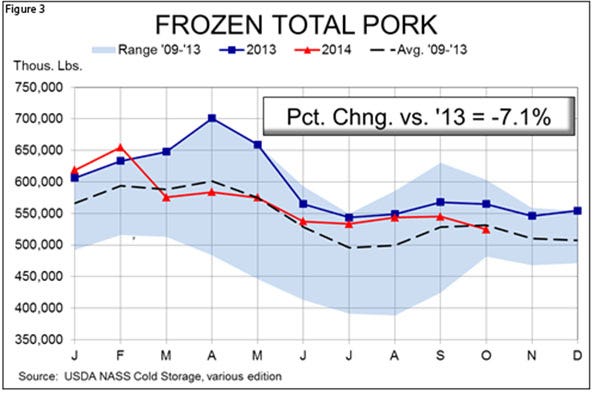

All of the major species contributed to the reduction versus one year ago. Beef saw the largest reduction in both quantity (down 65.2 million pounds) and percentage (down 14.2%) versus last year. Tight fed cattle and cow supplies both contributed to the reduction. Total frozen pork stocks declined by 7.1%, or 40.3 million pounds, from last year while chicken inventories fell by 8.6% and 62.12 million pounds. The 524.8 million pounds of pork in freezers at the end of October is the lowest such figure since December 2011.

As can be seen in Figure 3, the reduction in pork stocks is rather unusual as they normally are steady to up-trending given October’s larger slaughter runs. Those runs, which were significantly lower than one year ago but growing during October, were apparently not large enough to support consumers’ needs at prevailing prices since product had to be pulled from freezers. It would be possible for exports to have driven this reduction but I think that is unlikely given anecdotal evidence of slow export trade and the rise of the U.S. dollar. October export data will be released on Dec. 5. Ham stocks at the end of October were 15.5% lower than one year ago and 16% lower than at the end of September. Bellies stocks were still higher than one year ago but by only 4.5% (1.2 million pounds) this month. That is the closest bellies inventories have been to year-ago levels since July 2013. Recall that stocks were very tight that year leading to a spike in bellies prices that, in turn, drove bellies users to build substantial stocks last winter. Those stocks have kept bellies prices closer to year-ago levels than have been the prices of any other pork cut. The reduction in stocks is good news for bellies prices moving forward.

Ham stocks at the end of October were 15.5% lower than one year ago and 16% lower than at the end of September. Bellies stocks were still higher than one year ago but by only 4.5% (1.2 million pounds) this month. That is the closest bellies inventories have been to year-ago levels since July 2013. Recall that stocks were very tight that year leading to a spike in bellies prices that, in turn, drove bellies users to build substantial stocks last winter. Those stocks have kept bellies prices closer to year-ago levels than have been the prices of any other pork cut. The reduction in stocks is good news for bellies prices moving forward.

The number of cattle on feed moved above its year-ago level for the first time in 27 months as of Nov. 1. The 10.633 million head in feedlots as of the first of the month is 0.5% larger than last year but still 5.7% smaller than the average Nov. 1 inventory over the period 2009 through 2013. The increase was driven by higher-than-expected placements. The 2.357 million cattle that entered lots in October were 0.9% lower than last year but analysts had expected placements to fall by just over 4%, year-on-year.

Placement weights skewed toward the heavy end of the distribution continue to suggest some “bunching” of cattle this winter and into spring but we still expect cattle supplies to be tight relative to history through 2015 and 2016. Pasture conditions and potential profits are still driving heifer retention and that will keep supplies tight for the foreseeable future. High beef prices will still provide some opportunities for pork.

Happy Thanksgiving!

About the Author(s)

You May Also Like