September 23, 2013

The hog market, along with the futures market on hogs, has been on fire. October 2013 futures are at almost the same price as July 2014 hog futures! I can’t remember ever seeing this happen before.

We work with many clients across the United States, who have developed a disciplined margin management approach. Many producers started to lock in margins some time ago when there were acceptable margins, and they continue to increase their overall coverage as margins improve.

In looking at the forecast for the next 12 months, there are profits of close to $25 per head on average. Many producers started locking up profits when margins were at $15 a head. This has resulted in a lot of margin calls for many producers.

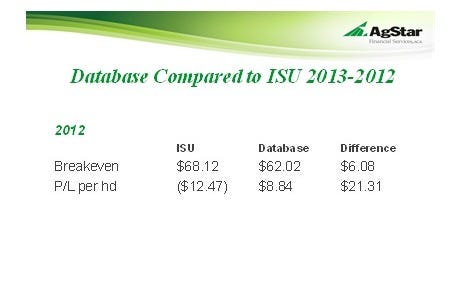

I have received many calls from producers wondering if they should change or lift their positions. I tell them to stay the course, keep the positions and stay disciplined in this approach. I also use the chart below to illustrate my point. It shows data from a benchmarking study we conducted on our clients in 2012.

Like what you’re reading? Subscribe to the National Hog Farmer Weekly Preview newsletter and get the latest news delivered right to your inbox every week!

In that study last year, the average client made $8.84/ head compared to the Iowa State University (ISU) average of more than a $12/head loss. This calculates to a difference of more than $20/head! The biggest reason for this difference is the risk management practices used by our clients in 2012. From an operational perspective there were very little profits made in 2012.

We have also been very busy with increasing hedge lines needed to fund all of these margins calls. Again, the prudent thing to do—the bottom line—is to stay the course. You never go broke locking up a profit!

Review of 2013 and Forecast for 2014

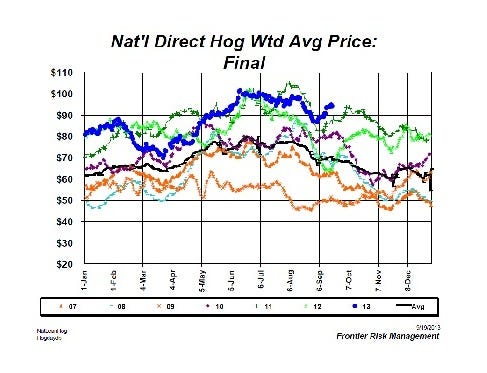

We’ve had a good run of strong cash prices for quite some time. September’s $95 cash hogs are the highest prices that we’ve seen for this time period (See chart below). Domestic demand has been very strong and export demand has picked up recently.

In reviewing 2013, most producers will be at breakeven, at best, or a slight profit. In the first six months of this year, the average client in our portfolio lost between $5-6/head. The ISU model was at -$21.76/head. The last six months of the year will help, but when market-to-market losses due to hedge losses and a stronger cash market are factored in, most producers will still record a loss for 2013.

It appears that 2014 will be a different story. In our opinion, profits will be more than $15/head. Strong cash prices—but substantially lower feed costs—will help pork industry economics in 2014. Overall feed costs appear to be more than $25/head less than a year ago. Nothing is ever guaranteed in our business. But it looks like lower feed costs are on the horizon.

You might also like:

Pork Repeats Strong Demand Showing

Analyzing How Farm Size Impacts Piglet Survival

You May Also Like