May 29, 2012

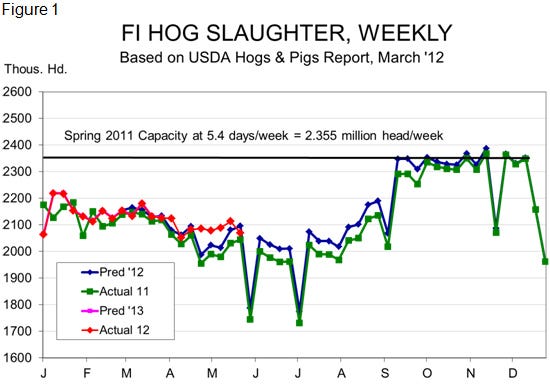

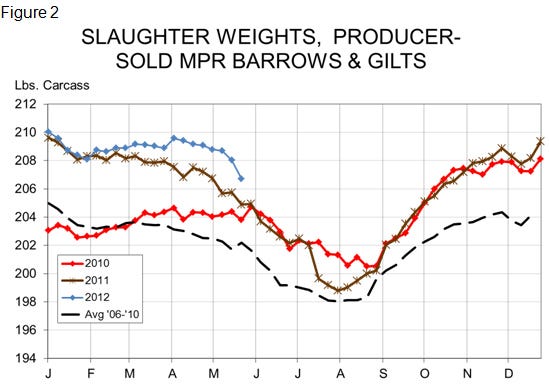

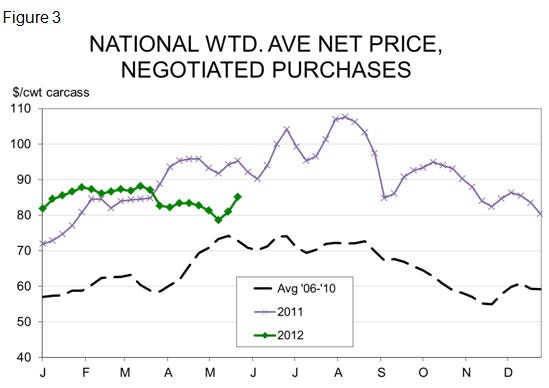

Last week’s combination of lower hog numbers (Figure 1), sharply lower hog weights (Figure 2) and higher hog prices (Figure 3) could mark a major turning point in the hog market, at least in the short run. And Weekly Preview readers are saying, “It’s about time!”

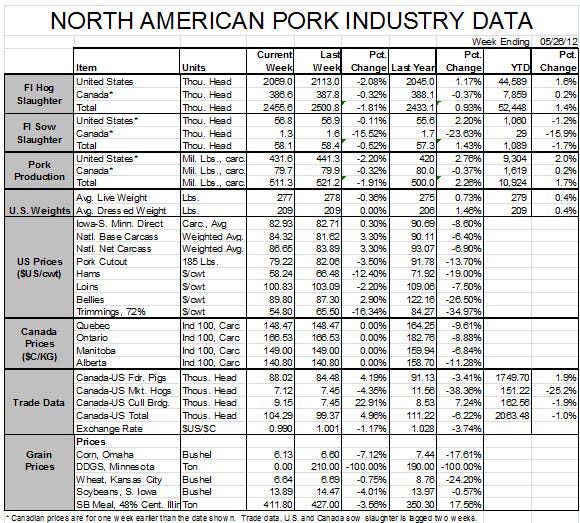

Last week’s slaughter total of 2.069 million head was still 1.2% higher than last year’s total, but was 2.1% lower than the week prior and broke a string of four straight weeks in which this year’s hog supplies have exceeded last year’s by an average of 5.2% or just over 100,000 head/week. They also exceeded my predicted slaughter figures (which are based on the March Hogs and Pigs report) by 3.2% or just over 65,000 head/week over the same period.

Whether these unexpected pigs are simply “extras��” that were not counted in USDA’s March 1 survey or pigs whose marketing dates have been moved remains to be seen. The irony of so many more pigs showing up during this time is, of course, that it corresponds well to when pigs from litters conceived in last summer’s heat should have shown up at plants, assuming that they had grown at relatively normal rates. The question that remains, was last week’s drop a slightly delayed “heat hole” for hog numbers? Slaughter over the next few weeks will, we hope, flesh out this story.

In my mind, the drop in average carcass weights for producer-sold barrows and gilts reported through the mandatory reporting system (Figure 2) is even more encouraging for hog numbers. Last week’s average was 206.7 lb. vs. 208 lb. the week before. The main explanation for higher weights this year has been superior growth performance but for that to be true, hog numbers and weights eventually have to fall. The fact that both declined in the same week could be indicative of lower supplies ahead. Readers should note that the last observation in Figure 2 represents only four days last week, since data for Friday was not available. I do not expect Friday’s data to change the weekly average significantly.

Lower numbers and lower weights have driven hog prices higher the past two weeks. Last week’s national weighted average net negotiated price averaged $85.13/cwt., carcass. Again, the price represents only Monday through Thursday, but Friday’s afternoon national purchase report indicates the average negotiated base price increased $0.14/cwt. from Thursday.

Last week’s price is the highest weekly average negotiated price since the last week of March. It is still over $10/cwt. lower than last year’s level, but a gain of nearly $6.50/cwt., carcass, in two weeks is a welcome development for producer revenues.

“But what about prices across all purchase methods?” you may ask. I usually use this price since it represents the average price received for all hogs sold in a given time period and, conversely, the average cost of all hogs for packers. In fact, it looks even better than the negotiated price for last week, rising to $86.76/cwt., carcass, which $5 higher than two weeks ago. This, too, marks the highest level since the last week of March and comes even closer (only $6.42 under) to last year’s level. I believe it to be a bit misleading, relative to the current spot market, since it includes a relatively large number of hogs that were price based on Chicago Mercantile Exchange (CME) Lean Hogs futures prices. Those pigs were fetching their owners, on average, $90.26/cwt., carcass, last week, driving the overall average price higher.

Some of these $90-plus pigs were contracted months ago. But some could have been contracted as recently as April 13. That’s the last day that June futures closed above $90.

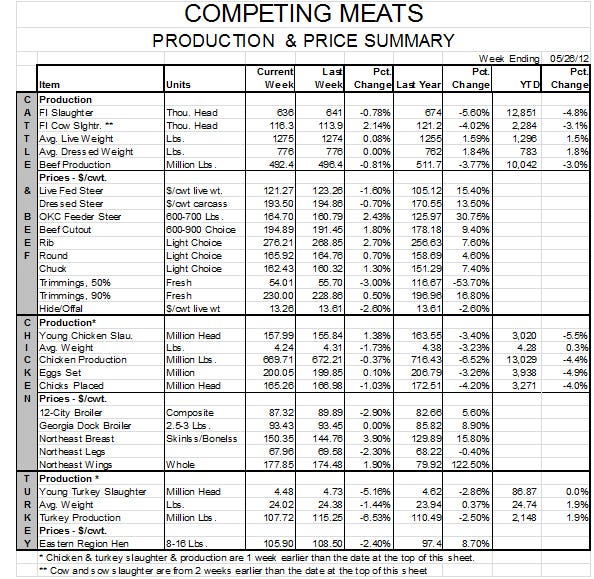

The fly in the ointment for all of this price recovery talk, however, is the cutout value. As you can see in this week’s North American Pork Industry Data table, the cutout averaged only $79.22 last week, down 3.5% from the week before and still nearly 14% lower than last year. Packers will not allow a minus-$7.48/cwt. meat margin to stand long, so either cut prices have to pick up quickly or these hog prices will not last long. Even near-record by-product values will not compensate for such a large negative meat margin.

About the Author(s)

You May Also Like