While the swine industry has had a nice run of profits, revenues in April of around $80/cwt., carcass, have us moving ever-closer to breakeven.

April 23, 2012

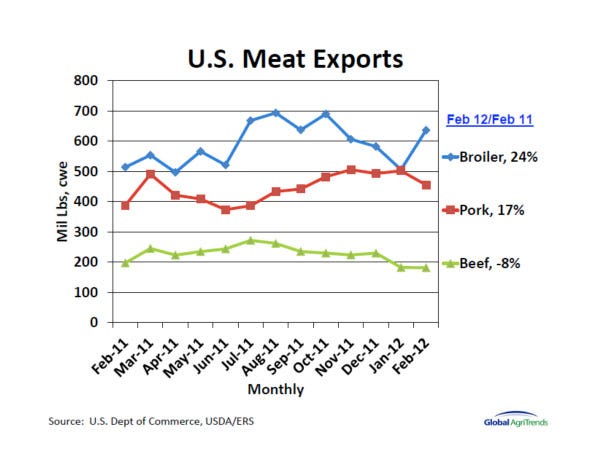

While the swine industry has had a nice run of profits, revenues in April of around $80/cwt., carcass, have us moving ever-closer to breakeven. We commonly see a run-up of prices in the summer, so profitability should hold through the coming months. There are, however, some points to be concerned about. While pork exports were up 17% compared to a year ago, a couple of key points must be considered. Figure 1, compiled by Global Agritrends’ Brett Stuart, shows a very strong Market in March 2011, but we must remember that spike was somewhat driven by the foot-and-mouth disease outbreak in South Korea.

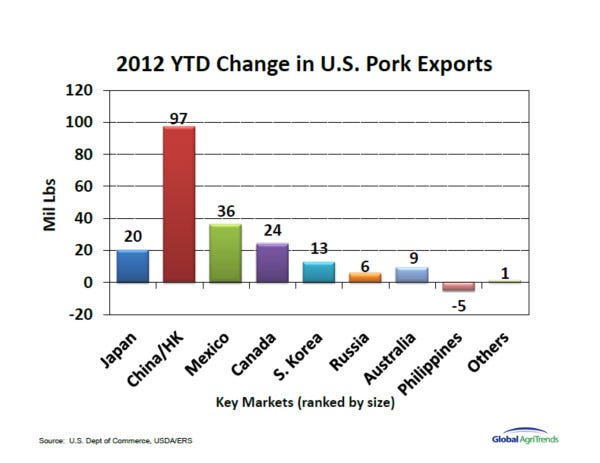

In addition, China’s pork purchases from September through the end of the year showed good growth (Figure 2). If the Chinese market continues to show good growth in 2012, it will help pork prices through the year.

Talk of Sow Herd Expansion – Maybe the only good thing about lower hog prices is it will slow down the inclinations to expand production. The cost to build a sow unit today is considerably more than just five years ago. In 2007, it cost around $1,100 per sow space to build a sow unit. Today, that same unit would cost close to $1,500 a space, or $400 more than five years ago. The per-sow-space cost is difficult to pin down because housing designs and the adoption of new technologies can vary widely. In addition, many producers plan to increase weaning age, thus increasing the need for farrowing crates, again driving up the cost. It is important to compare apples-to-apples. While older, heavier pigs add to the per-pig cost, wean-to-finish performance generally improves. What is the cost of new construction in your area compared to five years ago? I’d like to get a better idea of the construction cost differences around the country. Please send me estimates from your area, including the basic breeding-gestation housing design difference, weaning age, etc. My e-mail address is [email protected].

Are You Thinking about Expanding? If you are, as a major lender in the pork industry, I want to emphasize that you will need to make sure you have adequate liquidity. Many operations today have no operating debt and are looking at other investment options, such as owning more finishing spaces, instead of expanding the sow herd. If we have a downturn in the hog market, can you compete with producers who have very strong balance sheets and liquidity? I remember writing an article for this newsletter in 2009 entitled, “An Industry at a Crossroads.” Honestly, I do not want to go back to those days. As Steve Meyer (Paragon Economics, Inc.) often points out in his columns, any kind of expansion will put more pressure on slaughter capacity and that impact must also be considered.

You May Also Like