April 23, 2012

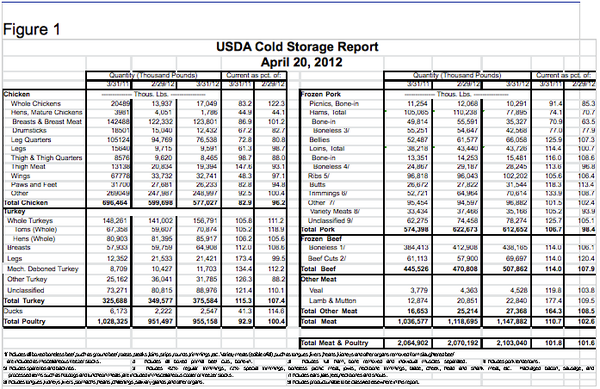

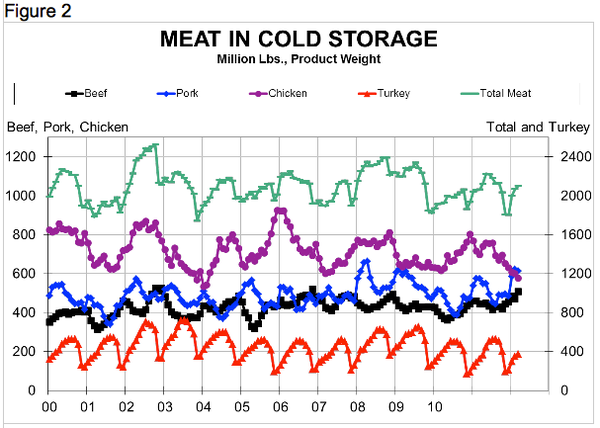

The USDA’s Cold Storage report, released on Friday, clearly underscores the difficulties the beef and pork sectors faced in March as freezer inventories mounted for both species (Figure 1). Monthly stocks for each species and all meat and poultry can be found in Figure 2.

Total beef inventories increased 7.9% from the end of February to the end of March. The 507.9 million pounds of beef in freezers on March 31 was 14% higher than a year ago and the largest month-end frozen beef stockpile since November 2006. That was the highest March total in our data set, which runs back to 1993.

The big driver in tonnage terms, of course, was boneless beef which grew by 26 million pounds in the month and ended the month 54 million pounds higher than last year. Those reflect increases of 6.1% and 14%, respectively. The totals came as no surprise because they were measured one month into the lean finely textured beef (LFTB) crisis. Interestingly, the stock of beef cuts rose 14%, year-on-year, also, but that represents only 8.5 million more pounds since beef cut stocks account for only about 14% of the total.

Pork inventories of 612.7 million pounds on March 31 were actually 1.6% smaller than one month earlier, but were 6.7% higher than last year. Every cut except hams and picnics was in greater supply this year with bellies and trimmings leading the way in both percentages (25.9% and 33.9%, respectively) and tonnage (13.6 million pounds and 17.9 million pounds, respectively). The increase in bellies stocks is reflective of last year’s excellent movement of bellies to South Korea during their foot-and-mouth disease outbreak. The increase in trimmings is most likely due to a slowdown in processed meat sales and some substitution of now-cheap 50% lean beef into processed meat formulations – both the result of the LFTB fallout.

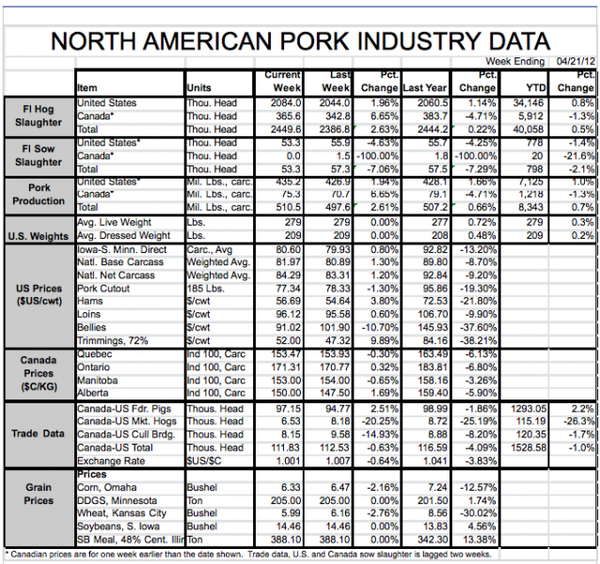

Anecdotal evidence points to slower pork exports even though February’s shipments were still much larger than one year ago. We expect March export data to be lower than last year (released in May). That should not be a surprise since exports surged by over 100 million pounds (26%) from February to March 2011. It would have been almost impossible to match that kind of increase even with perfect conditions and conditions in export markets are far from perfect.

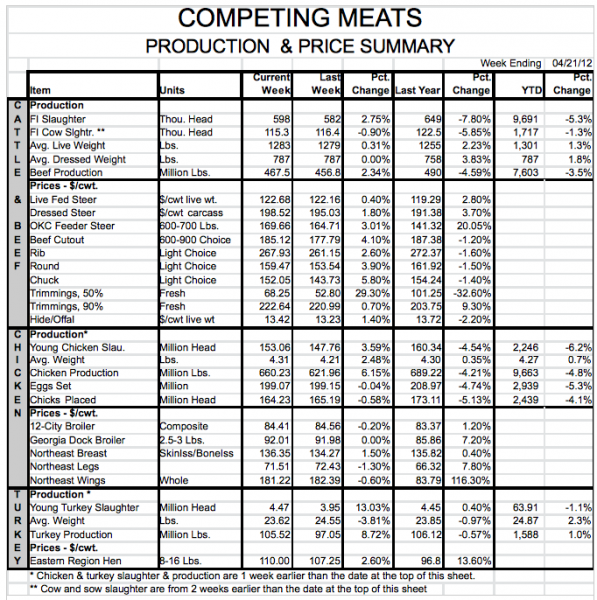

The report’s bright spot was a continuing decline in chicken inventories, which fell to 577 million pounds, 7.1% lower than last year and 3.8% lower than last month. March 31 stocks are the lowest they have been since February 2004. Breast meat stocks, though still at 123.8 million pounds (just over 21% of total frozen stocks), were 13.1% lower than last year.

The April Cattle on Feed report came in about as expected, with the number of cattle in yards with capacities of more than 1,000 head rising 2% from last year. Placements were 6.4% lower than last year, but still over 1% larger than expected. That increase was offset by slightly higher-than-expected marketings.

Steer and heifer slaughter continues to run well below last year’s level but, again, the LFTB situation has taken $15-$10/cwt. off of beef cutout values since late February. That hurts pork demand by placing lower-cost beef in front of consumers – if they will still buy the beef. One encouraging sign is that 50% beef trim gained nearly $17.50/cwt. last week to get back to $68.25. That’s a far cry from the $101 of late February, but 26% higher than the week before.

Pork’s Seasonal Rally

I still think hogs will rally as seasonal supplies tighten. Iowa-Minnesota carcass prices rose 0.8% last week while national base and net prices gained over 1%; net prices averaged $84.29 for the week. The five-year average seasonal rally is about $12 from mid-April to June and July peaks. The five-year average includes a $3 rally in 2009, when we had our own undeserved debacle with the H1N1 influenza virus disruption. The additional $12 on last week’s average would put us in the mid-$90s for summer highs and push Q2 and Q3 averages into the low- to mid-$90s.

About the Author(s)

You May Also Like