What could prevent U.S. pork producers from this year being their second best? Steve Meyer outlines risks in his 2018 hog outlook.

January 30, 2018

America’s pig farmers are walking around pinching themselves seeing if this is real, Steve Meyer, economist at Kerns and Associates, tells the Iowa Pork Congress.

Cash is flowing in the swine business despite the record-smashing production. The last 12 months defied the old supply and demand rule of thumb as hog prices settle higher than the previous year despite the record pork supply. In fact, as Meyer says, 2017 was the year of plenty — pork, beef, chicken, corn, soybeans and meat consumption.

So let’s look at why it is good to be in the swine business.

6 more cents

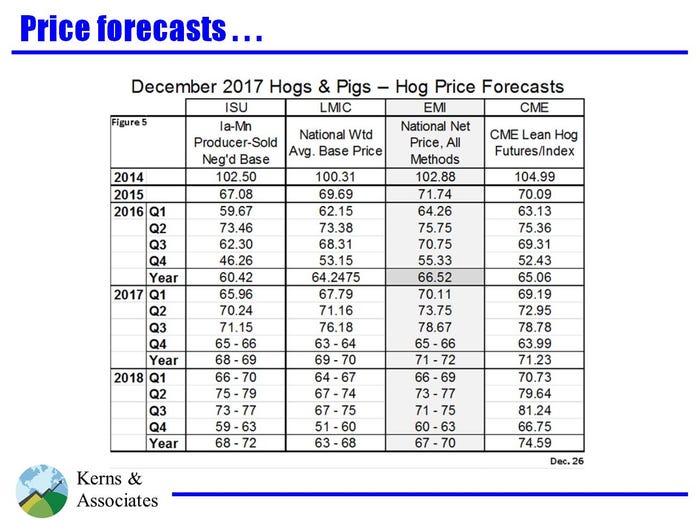

Comparing 2017 to the previous year, the average hog prices were 6.174 cents per hundredweight higher. Based on CME Lean Hog Future/Index 2017 average price was $71.23 per hundredweight while 2016 average was $65.06.

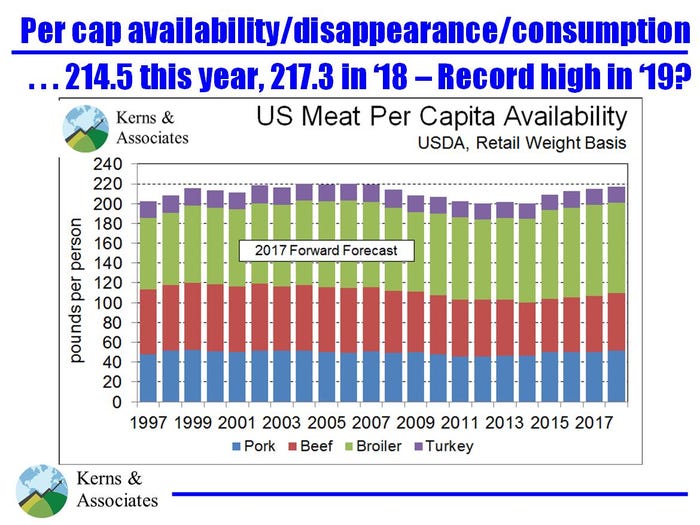

200 pounds plus

Americans are eating more meat and poultry. There was a time that Meyer and other market watchers did not think that consumers will surpass the meat consumption record in 2004. However, USDA estimates Americans will eat 222.2 pounds of meat and poultry in 2018, continuing a steady uptrend. At the same time, U.S. livestock producers produced 100 billion pounds of meat and poultry for the first time in 2017. Despite the loud noise from the anti-meat campaign, consumers ultimately want quality meat at an affordable price and the numbers show it in 2017, Meyer explains.

60 cents boost

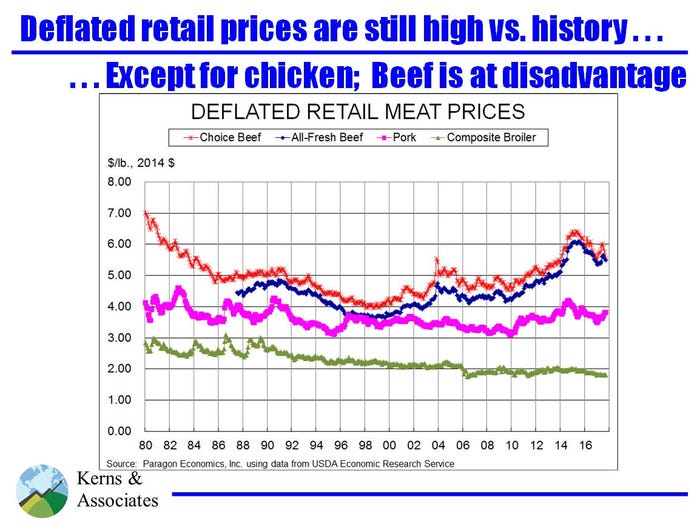

Deflated USDA meat prices show pork is hanging in the $3.60-$4 per pound range compared to the $3-$3.60 range of 2016. Consumers are voting with their dollars by purchasing the current pork supply at the present retail prices.

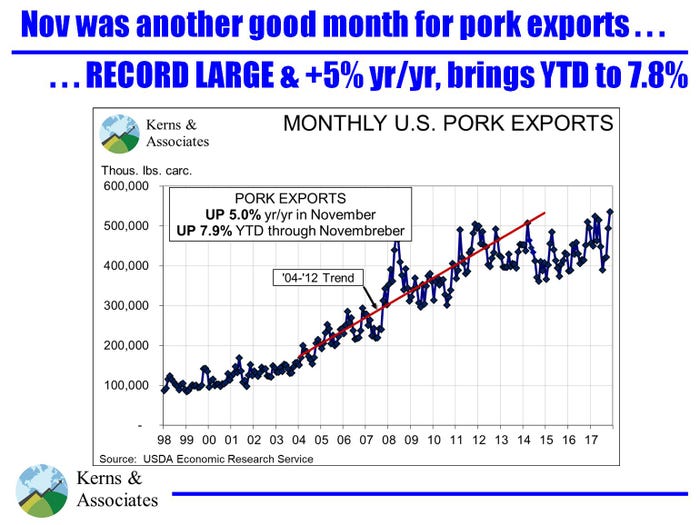

7% year-over-year increase

At the end of November, the USDA export data show U.S. pork exports volume remained on pace for a new record at 2.23 million metric tons — up 7% year-over-year. November export value was a record-high $615.8 million, up 5% year-over-year and just the fourth time the monthly export value has topped $600 million. Through November, pork export value increased 10% to $5.9 billion.

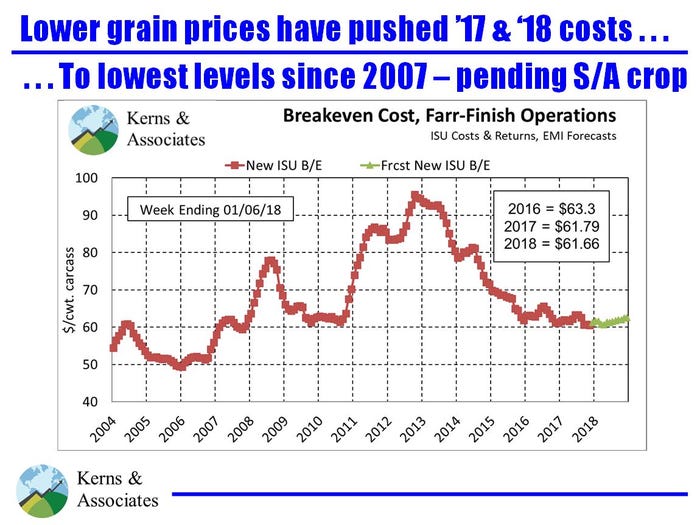

$61 and change costs

For 2018, the Iowa State University breakeven cost for farrow-to-finish operations forecast is slightly lower than last year. The lower grain prices are pushing the cost of production lower. Basically, the United States is two disaster crop years away from higher feed costs, Meyer notes.

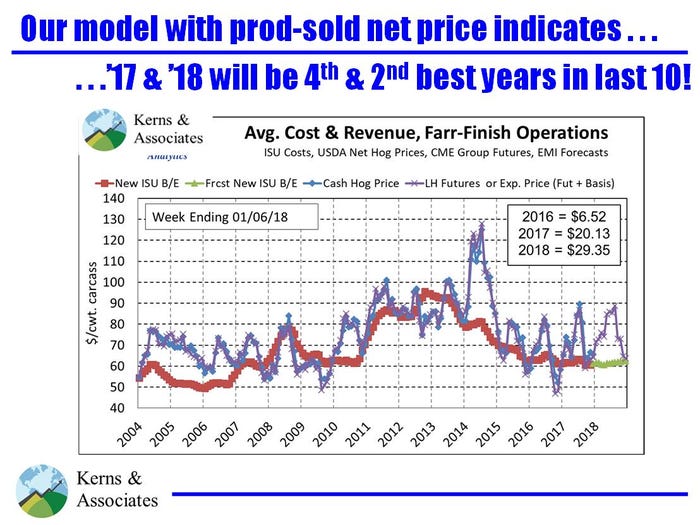

2nd best year

Based on the recent rally in lean hog futures and current soybean meal prices, models pencil the returns for hog farms at nearly $30 per head for 2018.

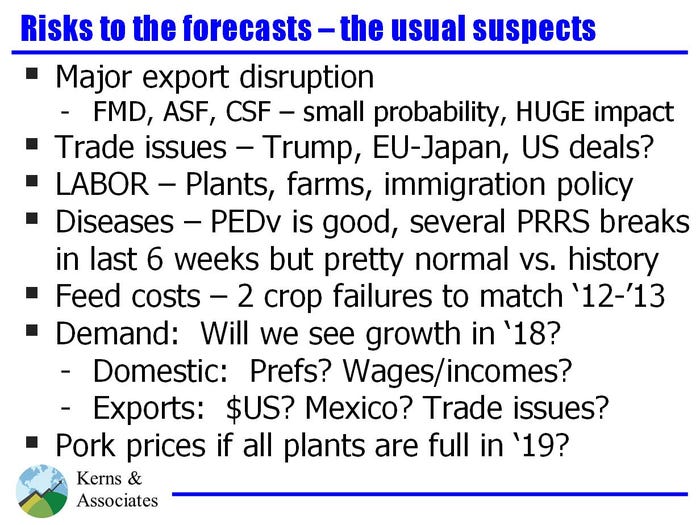

Whereas all pork producers are silently cheering about a good profit year in 2017, they remain cautiously optimistic for solid profits in 2018. Still, the usual suspects can loudly disrupt any market. Meyer reminds producers of the major risk to forecasts.

You May Also Like