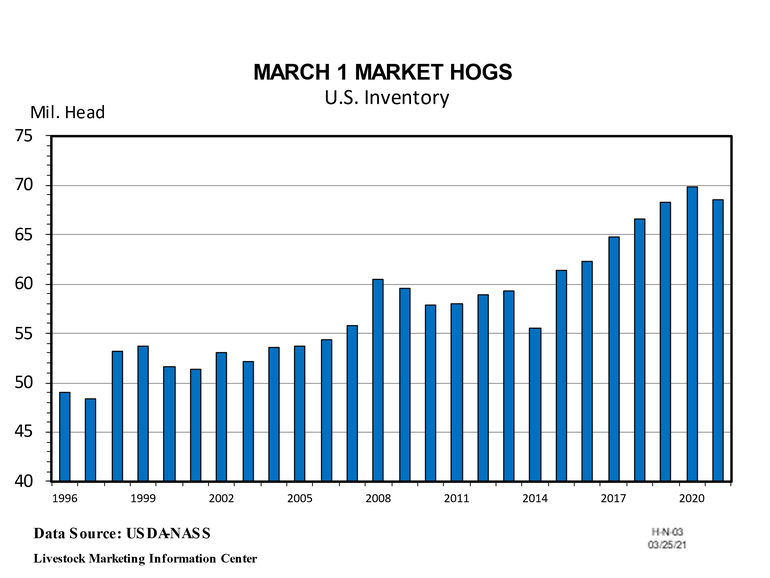

March 1 market hog inventory was smaller than a year ago for first March since 2014 when PED virus drove up death loss.

The lean hog futures contracts have been rising since mid-December. The latest USDA hog farm survey supports that optimism. The March pig report had bullish market hog numbers and even more bullish farrowing intentions. The March 1 market hog inventory was smaller than a year ago for the first March since 2014 when the PED virus drove up death loss.

There were only a few minor revisions in this latest report. USDA lowered the December market hog inventory by 190,000 head (0.3%). They lowered the September-November pig crop by 9,000 head (0.03%) and they lowered the March-May farrowing intentions by 53,000 litters (1.7%).

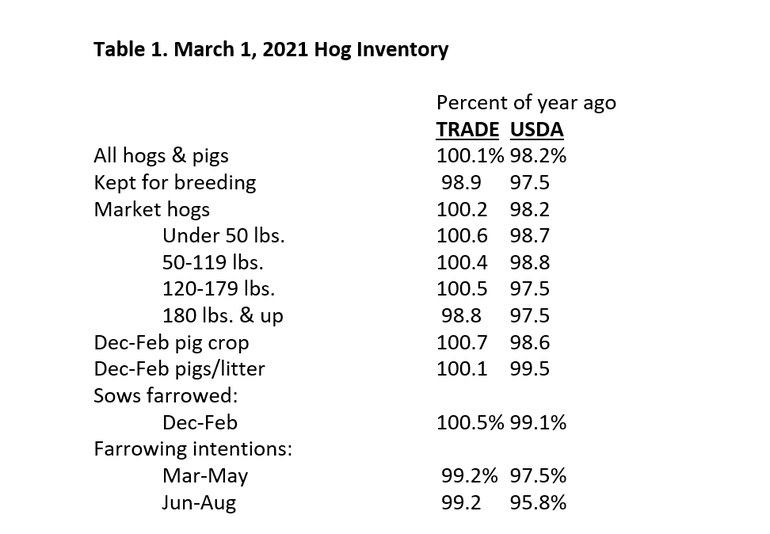

Table 1 shows this year’s March 1 hog inventory as a percent of a year earlier for both the average of pre-release trade forecasts and for the USDA “Hogs and Pigs” survey. In a very rare occurrence, USDA’s inventory numbers are lower than the average of trade estimates for every survey category.

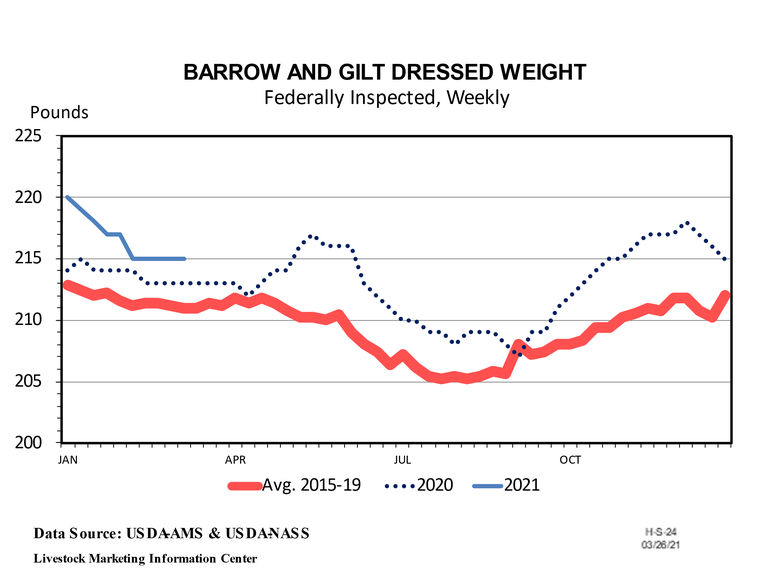

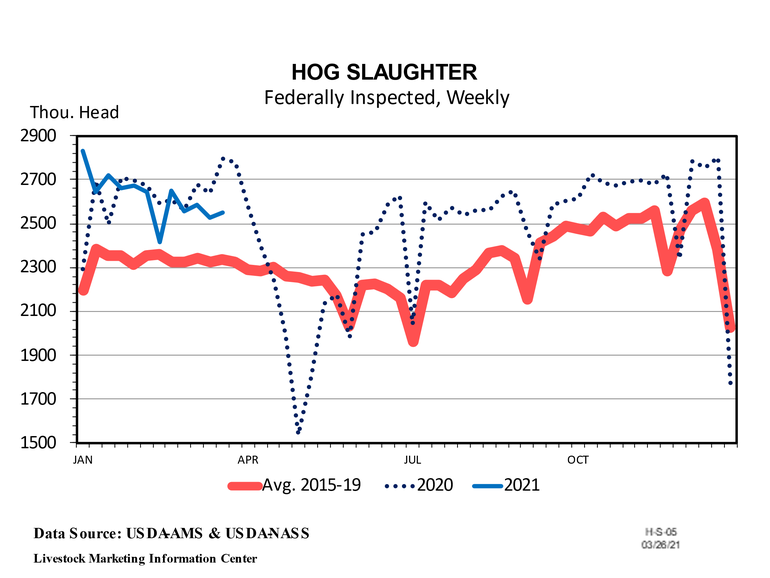

COVID-19 in packing plant workers restricted spring 2020 slaughter capacity causing hogs to back up on the farms. This increased slaughter weights. Barrow and gilt dressed weights were below the year-earlier level only once in 2020 and have not yet been below this year.

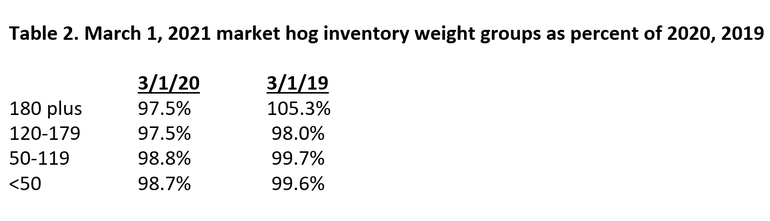

The March report said each market hog weight category was below the year-ago level. That implies March-August hog slaughter will be below the year-ago level. But, hog slaughter in April and May of 2020 was down 14% year-over-year due to a drop in slaughter capacity caused by COVID among packing plant workers. Thus, barring any unexpected disruption, hog slaughter in April and May 2021 will be well above the year-ago level, something not indicated by the market hog inventory. Since last year’s hog slaughter was so disrupted by COVID, it is better to compare the inventory to two years ago.

USDA’s estimate of the March 1 inventory of market hogs weighing 180 pounds or more was down 2.5% compared to March 1, 2020 but was up 5.3% compared to March 1, 2019. Since the beginning of March, hog slaughter has totaled 10.2147 million head which equals 76% of the 180 pound plus inventory group. In the four weeks starting on March 1, hog slaughter has been down 6.25% compared to last year and up only 2.1% compared to two years ago. Thus, it appears USDA may have overestimated the size of the 180 pound-plus inventory.

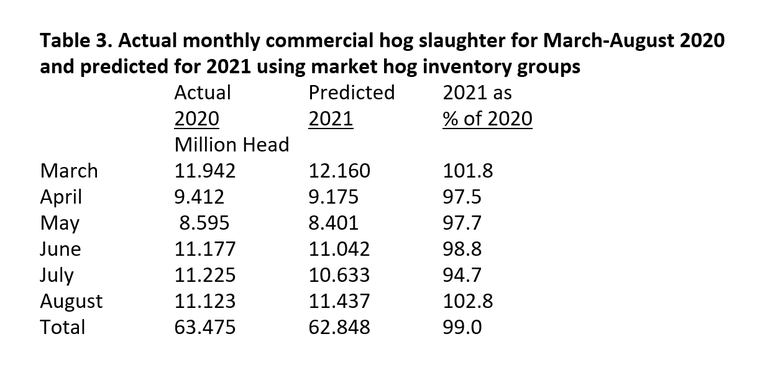

One normally uses the year-to-year change in the market hog inventory to predict the year-to-year change in future hog slaughter. Table 3 shows 2020 hog slaughter and estimated 2021 monthly slaughter using that approach.

As Table 3 shows, U.S. commercial hog slaughter during March-August 2020 totaled 63.475 million head. If one compares the March 1, 2021 market hog weight groups to the same March 1, 2020 weight groups, it looks like March-August 2021 hog slaughter will total 62.848 million head, down 1% from a year earlier. This approach also shows April and May slaughter down. It is unreasonable to expect hog slaughter during April and May of 2021 to drop below the year-ago level, given how low slaughter was last spring.

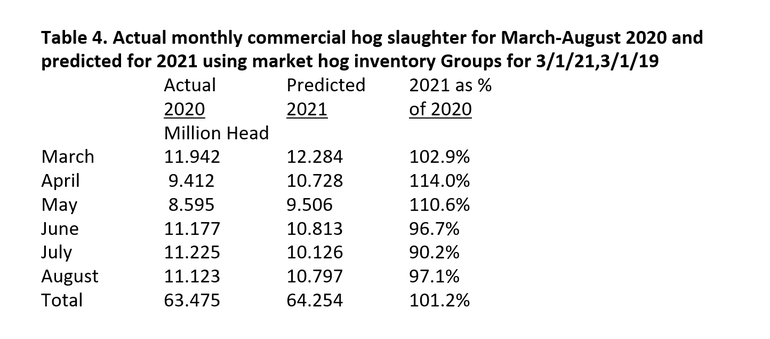

As Table 4 below shows, if one compares the March 1, 2021 market hog inventory groups to the March 1, 2019 inventory, it looks like March-August 2021 hog slaughter will total 64.254 million head, up 1.2% from a year earlier. It also shows April and May slaughter up sharply, which is a near certainty. It also shows lower slaughter in June, July, and August, which is likely given what happened last year, i.e. slaughter rebounded sharply from the April-May low due to backed up hogs.

I believe Table 4 is more likely to accurately describe summer slaughter than Table 3.

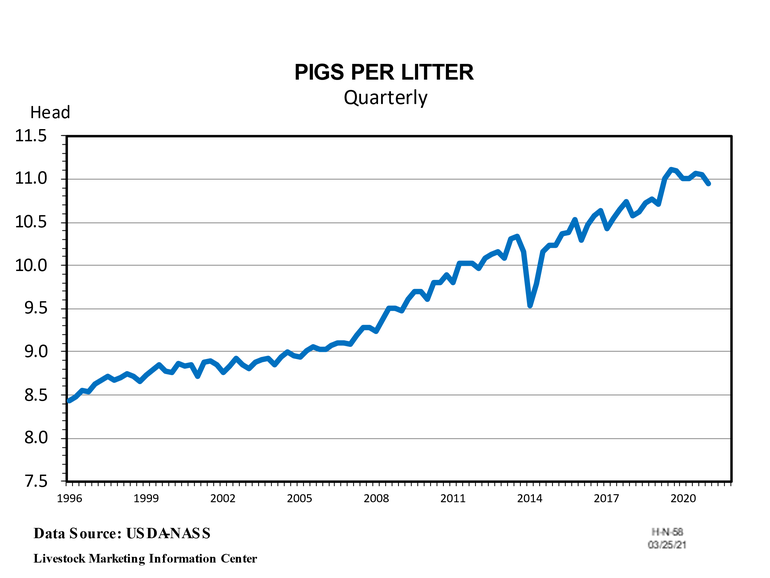

Pigs per litter during December-February dipped to 10.94 head, the lowest quarter since December-February 2019. Pigs per litter has held fairly steady at 11 head, more or less, for the last 8 quarters.

USDA said the March breeding herd was down 2.5% year-over-year, which is a reasonable number given that December-February farrowings were down 0.9%, and March-May farrowing intentions are down 2.5% and June-August farrowing intensions are down 4.2%. The low farrowing intentions imply declining slaughter and rising prices as we move towards the first quarter of 2022. The farrowing intentions call for the lowest spring farrowings since 2018 and the lowest summer farrowings since 2017.

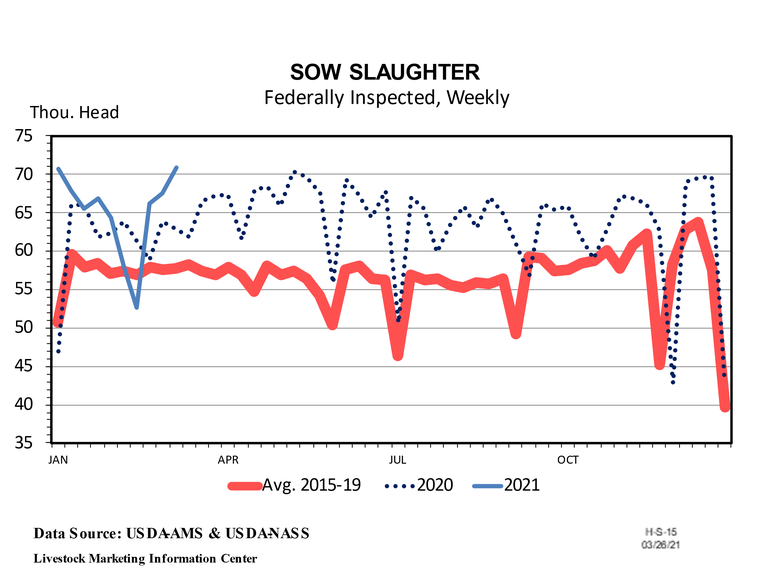

Sow slaughter is consistent with the low farrowing intentions. Sow slaughter was up every week in 2020 except for four. It has been up eight of 11 weeks thus far in 2021. Higher sow slaughter implies lower farrowings.

As is typical for this time of year, hog slaughter is trending lower. As I’ve said, April and May slaughter should be higher than last year. The inventory report implies June-December hog slaughter will be below the year-ago level.

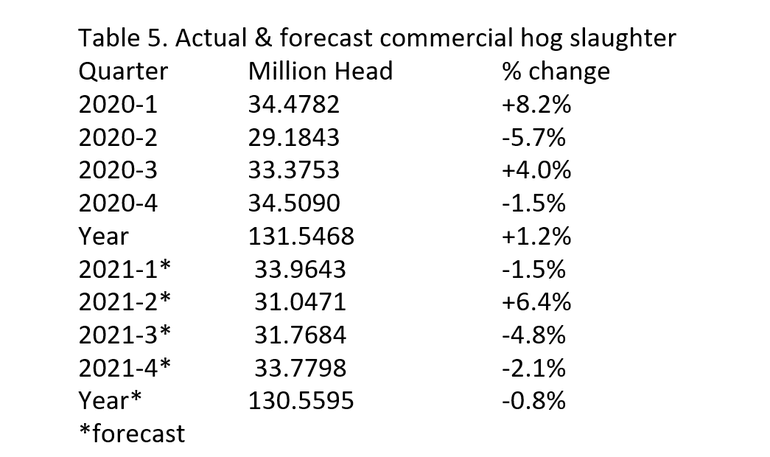

Table 5 shows actual hog slaughter for 2020 and my forecast for 2021 hog slaughter. Commercial hog slaughter in 2020 was a record 131.5 million head. If USDA’s numbers are correct, production trends continue, and hogs are marketed on a timely basis, then 2021 hog slaughter is likely to be roughly 130.6 million hogs, down 0.8% from 2020.

Cold storage numbers came out last week and indicate strong pork demand. The amount of pork in cold storage dropped sharply last spring when hog slaughter was curtailed due to COVID among packing plant workers. It has stayed low. In the last nine years frozen pork stocks at the end of the month were below 500 million pounds 14 times – in December of 2011, 2016, and 2017; November 2014; and each of the last 10 months.

After six years of growth, the March “Hogs and Pigs” report indicates significant herd reduction. If pork demand remains strong the falling hog inventory should yield good profits ahead for producers.

Source: Ron Plain, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like