The harvest capacity will grow more in one day than it has in any single year. It means room to grow for the pork industry but from what point.

September 4, 2017

Tuesday, Sept. 5, 2017, will be a red letter day in the history of the U.S. pork industry. The industry will see its harvest capacity grow by more on that one day than it has seen it grow and any single year within the memory of anyone alive today — and perhaps ever. The only reason I am not more certain of an “ever” designation is that we don’t have records of when the old plants opened in the late-1800s and early 1900s. Given those plants’ relatively small size, I think the statement is safe. The only other year that is close was 1995 when Smithfield Foods opened its mammoth plant in Tarheel, N.C. But that plant had a capacity of “just” 16,500 head per day on opening day and was not expanded to its full capacity of 32,000 per day for another three years.

The Triumph-Seaboard plant in Sioux City and the Clemens Food Group plant in Coldwater add 22,200 per day. Not all of that capacity will be operational on Day 1, of course, and I don’t expect either plant to be at full one-shift operations until sometime in late-winter or early spring, but congratulations to both firms for successfully navigating the construction process. Clemens has planned on Sept. 5 as an opening day since construction started. TSB’s plant was delayed from its originally announced July opening, but it beat a number of predictions from just a few weeks ago.

So what does this mean?

First, it means room to grow. But the question is “Grow from what point?” The owners of these two plants all have sows and have been adding sows to supply these plants for some time. So the growth baseline is perhaps as much as two years ago. At least a portion of the growth in hog numbers witnessed in 2016 and 2017 is the result of these plants and the smaller ones in Missouri and Minnesota opened in the past 12 months.

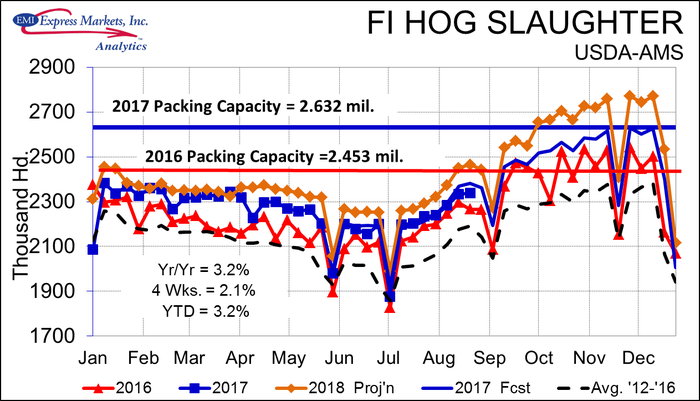

My calculations suggest that we may already have enough hogs on the way to fill these new plants (See Figure 1). Assuming an average of 5.4 full workdays per week, the new plants would leave the U.S. packing sector with the ability to “comfortably” harvest 2.632 million head per week. As you can see, EMI has slaughter reaching almost precisely that level this fall. The new plants will almost certainly not be in full operational mode by November so this 2.6 million per week will not be comfortable but neither will it be disastrous or, in my opinion, very negative. Last year’s slaughter versus capacity situation was much worse than what we will see this year.

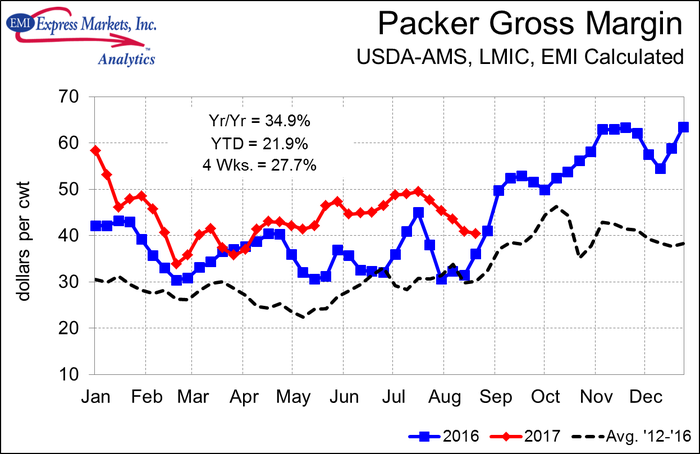

On the other hand, hog supplies this fall will not leave packers scrambling to keep lines running at optimum speed, so I do not expect much positive pressure on prices either. Packer margins have been very strong all year. Their recent decline stopped last week, and I expect them to begin growing seasonally (See Figure 2). I do not expect them to get anywhere near last fall’s record levels, but I do expect them to remain healthy.

Second, it means a lot more pork in both the short run and long run. While competition for hogs will, I think, be relatively benign, the amount of pork that packers will need to sell is swelling and will continue to swell next year. Getting them processed efficiently and in a timely manner does not mean you will like the price the product fetches. We’ve seen some of that pressure lately as the cutout value has fallen by roughly $20 per hundredweight (19%) since July 15. Not all of that is due to higher hog supplies (a “falling back to earth” for bellies has been a big reason, too) but hog numbers have certainly been a factor. It is important to note that the slide for hog prices has been almost precisely the same as for the cutout value — from $90 in July to just over $70 for the average price across all purchase methods on Aug. 31.

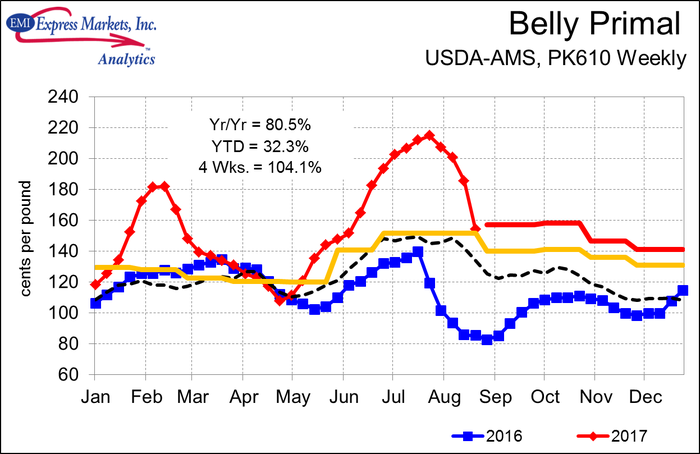

Are the recent cutout value and hog price and futures price collapses just the beginning for this fall? I don’t think so. I believe the cutout and hog price declines reflect a necessary correction of the bellies market. The bellies price decline of last spring and very tight bellies inventories lit off another bellies price explosion much as we’ve seen periodically over the past three years (See Figure 3). This one was decidedly louder than its predecessors, but the resulting record prices eventually strangled bellies featuring and usage and started the downward plunge. Bellies below $130 will attract some attention and add value to the carcass and hogs over the next few weeks. There will be some pressure on other cuts, but we think the worst is behind us.

As for the futures, readers of this column know that I consider the futures market to be a very emotional entity. Teenagers have nothing on the futures market, especially in this day of electronic trading. October and December Lean Hogs appear to be oversold. The bounce of the past three days supports that conclusion (or bias). My big concern is that funds (Swap Dealers and Managed Money) still hold large long positions in lean hogs. I have feared a big and fast selloff that would push fall Lean Hogs contracts even lower. This week’s bounce might slow such liquidation down. It still has to happen. The question is whether it will be orderly or a rush for the exits.

About the Author(s)

You May Also Like