A very interesting USDA report – and reaction to it

The impact of USDA's Hogs and Pigs Report was understandably negative, though that was surprisingly short lived considering the differences between actual figures and pre-report estimates.

January 2, 2017

By Steve Meyer, Express Markets Inc. Analytics

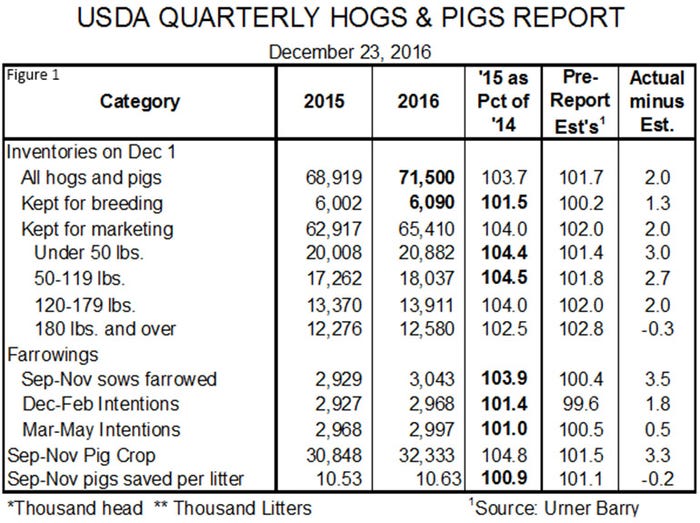

USDA’s December Hogs and Pigs report, released on Dec. 23, indicated there were significantly more hogs on U.S. operations on Dec. 1 than were expected by analysts. The key national data from the report appear in Figure 1. Note that virtually every inventory number is much larger than the average of analysts’ pre-report estimates gathered by Urner Barry.

We believe the report itself was bearish and Lean Hogs futures fell in late-day trading on Dec. 23 after the report’s release which, unusually, occurred while futures and options trading was still open.

While the report’s impact was understandably negative, we found the impact to be surprisingly small that day given the magnitude of the differences between actual figures and the pre-report estimates. That moderate response was made even more interesting by price increases on Lean Hogs future contracts through Dec. 30. The nearby February contract closed on Dec. 22 at $64.73, and finished last week at $66.15. July went into the report at $75.43 and closed Friday at $75.75. December 2017 rose from $61.25 to $61.57 over the same period. Why the strength in the fact of these big numbers?

First, domestic pork demand has been strong this year. Not as strong as in 2015 but very strong relative to any year before 2014. When we start comparing 2017 real per capita expenditures for pork to 2016, the year-on-year changes will begin to be much more positive reflecting, I believe, the true strength of pork demand. U.S. consumers have taken a huge amount of pork off the market at very strong retail prices. While many would say those retail prices should be lower, the fact that they are still high relative to history speaks volumes about demand — and provides plenty of room for wholesale and farm prices to rally.

Second, U.S. pork exports continue to gain on year-ago levels in spite of a strong dollar and the price disadvantage it creates for U.S. firms. October exports were 9% higher than one year ago making it the sixth straight month of year-on-year growth. The month’s shipments brought the year-to-date total to 4.230 billion pounds carcass weight, 2% more than one year ago. Perhaps more important, the value of October pork, pork variety meats and sausage casings exports exceeded their year-ago level by 16.4%. The year-to-date value of those items is now 2.9% larger than last year.

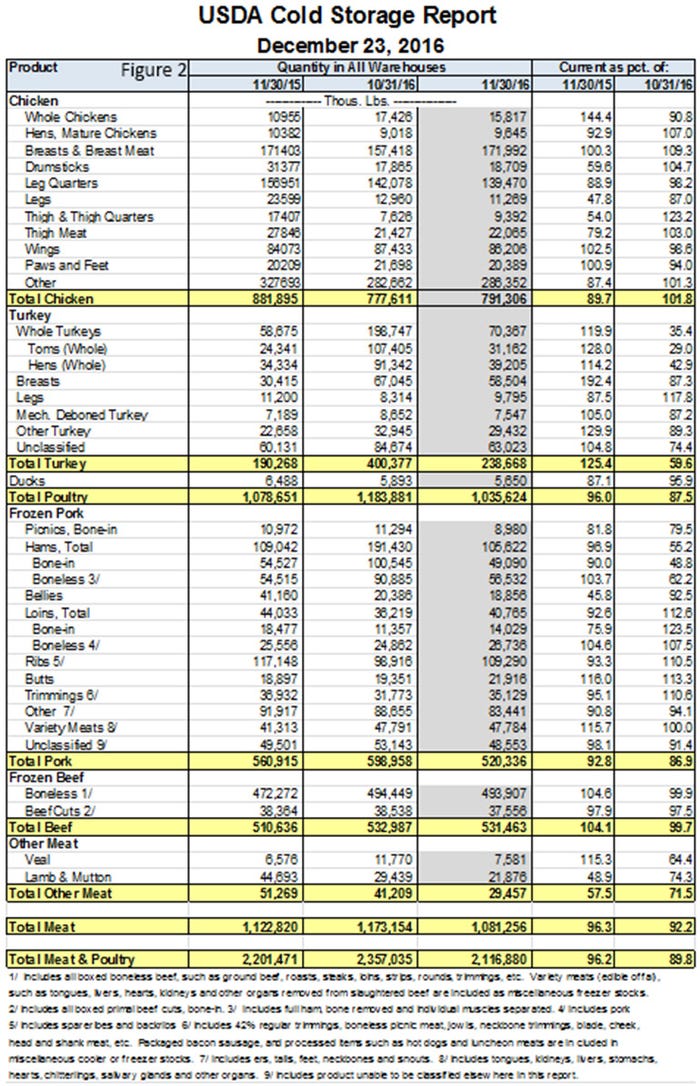

Third, the Hogs and Pigs report doesn’t provide the only information that is useful in ascertaining market conditions and outlook and another report released on Dec. 23 was bullish. Data from USDA’s monthly Cold Storage report appear in Figure 2. While much of the report was bullish showing lower stocks of other meats relative to one year ago or one month ago, the pork numbers are particularly encouraging. In spite of record-high production for September, October and November, pork stocks were down 7.2% from one year ago. In addition, in spite of 7.7% more pork being produced this year versus November 2015, frozen pork inventories fell by 13.1% during November. The only wholesale cut with higher stocks this year is butts and the increase, though 16% of last year’s level, is a measly 3.019 million pounds out of a total pork stockpile of 520.336 million pounds.

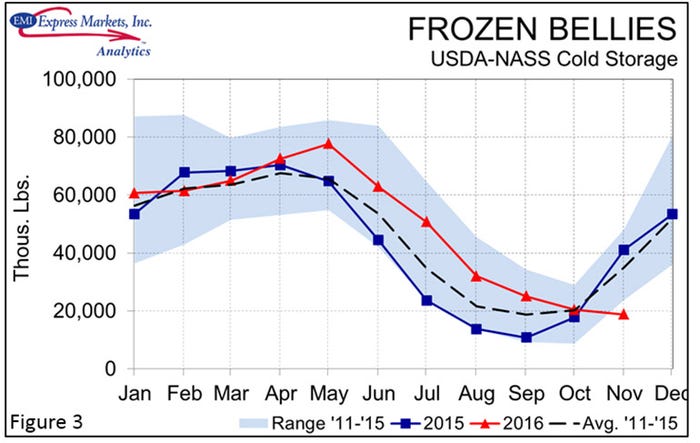

Most notable among the pork inventory figures is the one for bellies. The Nov. 30 total of 18.856 million pounds is down 54% from one year ago. See Figure 3. When bellies’ stocks dive this way, bellies’ prices usually soar and the soaring has begun. The belly primal value gained over 8% the week ending Dec. 24 to reach $107.63. That same price was $115.24 on Dec. 30. The belly primal accounts for 15.84% of USDA’s estimated carcass cutout value, meaning that the belly primal gain since the week of Dec. 16 added $2.50 per hundredweight to the cutout value. We think there is more to come in the bellies’ rally.

Going back to the Hogs and Pigs report, this one could perhaps be a sea change for USDA. They have struggled mightily to estimate the pig crop over the past couple of years with their average six-month-hence revision since June-August 2014 being 2.4%. The smallest revision during that time period was 0.1% and the largest was a whopping 4.3%. The revision to the March-May pig crop in this report was 2.5%.

The numbers in this report, though, are very large in both absolute terms and relative to expectations. It is possible that USDA has done some “recalibrating” and is now shooting high enough in their farrowings to prevent these large revisions six months down the road. The breeding herd inventory, at 1.5% larger than one year ago, did not surprise us as it agrees with what we are hearing in the countryside. And breeding herd growth is nowhere near over. Expect 1 to 1.5% growth this next year and into 2018 given the pending expansion of packing capacity.

Based on our interpretation of USDA’s estimates, we expect total 2017 slaughter to be 3.5% higher than that of 2016 but for prices to provide summer profits for average farrow-to-finish producers that roughly offset spring and fall losses given current corn and soybean meal prices.

You May Also Like