June 8, 2015

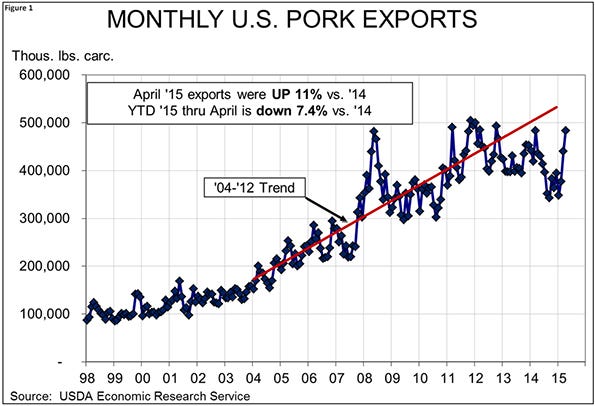

After a most disappointing start to 2015, U.S. pork exports showed signs of life in March, and have now roared upward in April. That’s my conclusion from last week’s April export data from the USDA that showed shipments of 483.362 million pounds, carcass weight equivalent. That total is 11% larger than one year ago and represents the best month for U.S. pork exports since October 2012. April’s total is the sixth largest ever! The year hasn’t been much to crow about but April was a dandy! See Figure 1.

April exports brought the total for 2015 to-date to 1.649 billion pounds, carcass weight. That figure is still 7.4% lower than one year ago. The peak of 2014 exports occurred in February and it was all downhill from there as U.S. prices rose sharply and then the stronger dollar added to those higher prices in the second half of the year.

While April was great, we doubt that the pace will continue as there was still some “compensatory” strength due to backlogged product finally finding its way out of U.S. ports. But the product moved and is now gone! That’s no small deal, as domestic markets continue to deal with higher-than-expected current supplies.

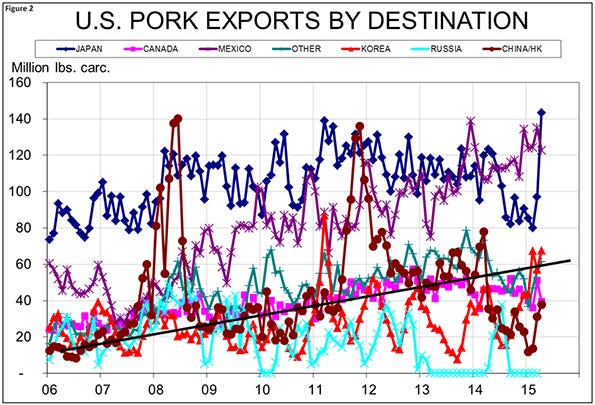

Just where did this product go? A bunch of it went to Japan. In fact, USDA data show that Japan took 143.3 million pounds, nearly 30% of the monthly total and a whopping 16.2% more than one year ago. The surge pushed Japan back to the No. 1 spot in the ranking of U.S. pork exports markets. That leadership position will likely not last long but it is a nice development given the fact that only high-value product (at least on average) moved to Japan. Exports to Japan still trail 2014 year-to-date by 10.3%, but a gain is a gain!

It’s not as if formerly No. 1 Mexico had a bad month. Shipments southward amounted to 122.743 million pounds in April, 15.2% higher than one year ago and the eighth largest monthly total on record. Mexico still leads Japan by over 100 million pounds (505.9 million to 405.6 million) carcass weight in the year-to-date comparison. Mexico’s total is 12.7% larger than one year ago through April.

Good month for China/Hong Kong

It was even a good month for China/Hong Kong where shipments increased by 6.2% relative to one year ago. Total China/Hong Kong exports of 37.8 million pounds were the largest since February 2014 and pushed the year-to-date total to 94.4 million pounds, carcass weight. That figure is still 60% lower than one year ago.

Korea and the Caribbean continue to perform well as U.S. pork customers in April. Shipments to South Korea (67.68 million pounds) were up 43% from one year ago. That is the second largest monthly total for South Korea, ranking below only March 2011’s hoof and mouth disease-fueled surge. April’s shipments put Korea over 42% larger, year-to-date, than in 2014.

Caribbean shipments have been significantly larger than one year ago all of 2015 and were 40.4% larger in April. The year-to-date total for Caribbean markets now stands at 30.79 million pounds, up 23.7% from last year.

The total value of U.S. pork exports improved 5.9% from March to $444.4 million. That figure is still 13% lower than one year ago and brings the year-to-date total to $1.623 billion, 14.7% below the level of January-to-April 2014.

Pork variety meat shipments continue to lag year-ago levels significantly. April variety meat exports of 562 million pounds were 12% lower than those of April 2014. Year-to-date variety meat shipments are now 6.8% smaller than in 2014. April’s variety meat value of $53.75 million is 26% lower than last year. The year-to-date variety meat value of $2.535 million is still down 12% from one year ago.

Expansion big topic

Last week’s World Pork Expo was a very successful event. Reasonably good weather and a record profit year in 2014 brought many producers, suppliers, processors and others to Des Moines for learning, fellowship and food. The National Pork Board’s bacon-wrapped corn dogs were a hit! There is much concern about porcine epidemic diarrhea virus’ third winter and the current situation with avian influenza. But there is a huge cloud on the horizon: EXPANSION. And the all-caps are no overstatement.

Everyone I talked to believes there is a significant expansion of the sow herd under way with numbers ranging from 100,000 to 200,000 (most toward the upper end) sows in the process of being added to the national herd. If the top end of that range is added to the March 1 inventory, it would put the December sow herd up 4.1% from last year. I doubt that the full number could get added by Dec. 1 but adding 200,000 to March’s 5.982 million head would make the March 1, 2016, herd 3.3% larger. Sow herd growth of 3 to 4% and a return to 2% litter size growth would put supplies the second half of 2016 up 5 to 6% from the ample levels we will see this year. I am quite concerned about the prices that such supplies might yield – and producers should be, too.

About the Author(s)

You May Also Like