We never worry about whether we can get rid of everything we produce, it will all move if it gets cheap enough. Demand is the item that is more difficult to measure and we only know its impact by looking in the rear view mirror.

February 12, 2018

Space — the final frontier

William Shatner used that line to introduce us to each new episode of Star Trek as we experienced the voyages of the starship, Enterprise.

For our pork industry, space — as in shackle space — seems to be the ultimate destination of perceived success. This is an important issue for the health of the entire commerce component as we expand to meet the perceived needs of growing world population and increasing wealth.

I shared in my last National Hog Farmer column the silent and persistent hint of demand that is occurring both in the United States and across the globe. We have our official conclusion to Demand (with a big “D”) for 2017 and it is impressive at 5% higher than 2016. Remember that demand is disappearance at a price. We never worry about whether we can get rid of everything we produce, it will all move if it gets cheap enough. Demand is the item that is more difficult to measure and we only know its impact by looking in the rear view mirror.

We study the supply side closely, monitoring every Hogs and Pigs Report with scrutiny. We measure demand by a historical evaluation of price relative to supply. I have said this before in some recent speeches, we may be living in one of the greatest periods of world demand since the Reagan administration. Demand is impressive and one of the components that has allowed an expansion of packer profits in the past few years to create an environment where more players want a part of the action.

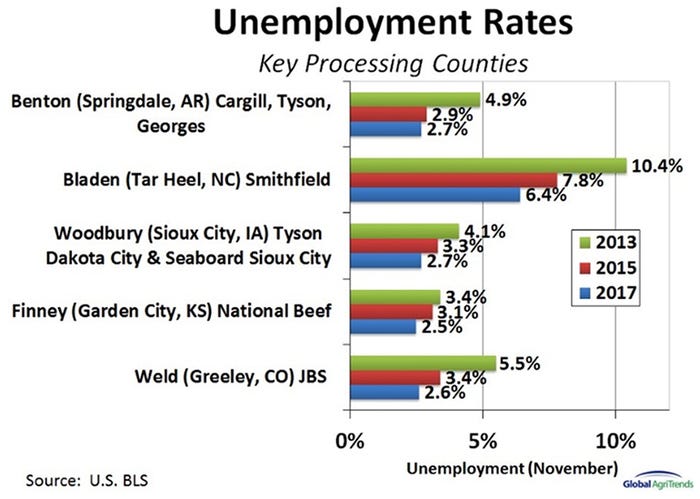

But this game may not be as easy as it looks. Perhaps this is a credit to the current matrix in the packing industry that have operated efficiently and profitably for an extended period. Take a peek at the graph below, courtesy of our friend, Brett Stuart, depicting the unemployment rates at some selected key processing locations. The tight labor market has at least two implications: 1) increased wages paid to fill vacancies and 2) the quality of the workforce — the diminished pool leads to limited selection of talent. Anecdotal evidence of this phenomenon may be why neither new plant is running at full tilt on a first shift right now; the rising tide of economic prosperity takes no prisoners.

I am still of the ilk that this — a tight labor market — is a “good” problem to have, much better than some of the other problems I can conjure up. It may cause you and the processors some headaches to secure quality, long-term labor, but having a fully employed population means more demand for your finished product.

Other observations

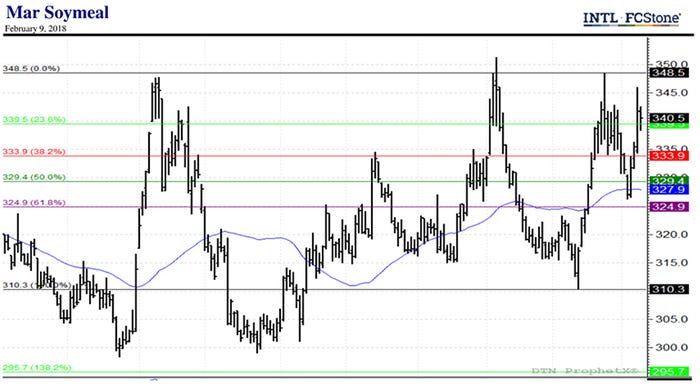

The April contract has had a precipitous fall from grace over the past several trading sessions (chart below). Recall, we had a similar price action last year when February expired with some life and then the April contract tanked into expiration. Could we be setting up for similar price action? The situation is much different this year. The bellies — the star of the cutout — have reached a level where freezer interest has traditionally kicked in. Last year, we held bellies “too high” and then crushed them into the spring. We seem to be much more sane on values this year and I would anticipate values stabilizing somewhere in the neighborhood of current trade values rather than deteriorating as we roll through March and April.

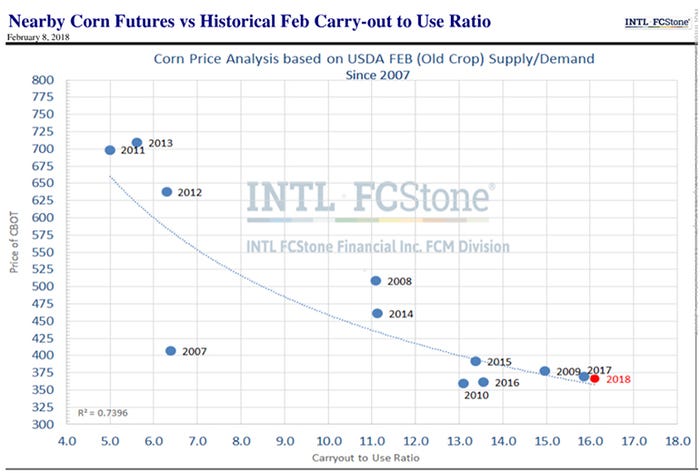

The USDA gave us a report last week that was a surprise to many of us as we evaluated the numbers and even more surprising with the price action. Corn exports were adjusted upward which decreased bottom line carryout numbers to a level below the range of expectations. This would normally lead to a bullish price action … nothing. Perhaps December of 2018 futures hovering just below $4 per bushel is a significant mental threshold that could not be overcome? The scatter chart of historical carryout-to-use ratios in relationship to price indicate that corn is reasonably priced right now, sitting atop of the line representing fair value.

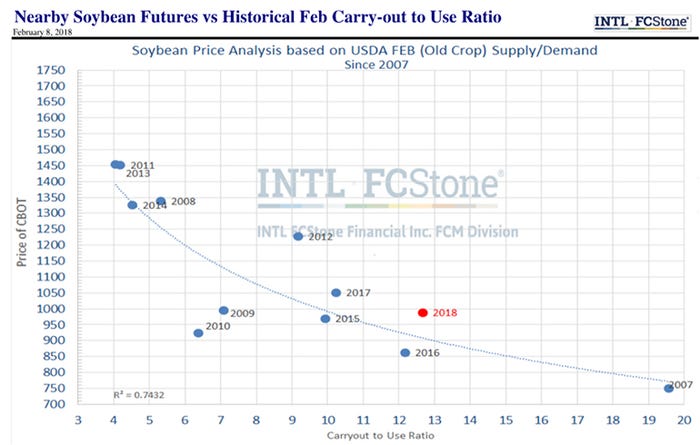

Similar (but opposite) surprises in the bean complex. Exports were lowered which added to the stocks carryout which should lead to a sharp break in prices. Instead, we rallied on the news. The scatter chart shows what you probably intuit — beans are priced “too high” relative to historical standards.

What does a guy do with this information? Perhaps make some new crop sales if you are producing beans, and certainly laying off the extended purchases of soybean meal seems prudent. Psssst. I just ran my 2018-19 balance sheet projections for corn and soybeans. If I am anywhere close to right, the carryout-to-use ratio for next year’s beans is in the 18% neighborhood. Take a look at what that would represent as fair value from a historical basis. That is a hint.

A couple other thoughts

A group of American veterinarians were recently in Eastern Europe for an analysis of African swine fever as it creeps closer to Germany. What are the eradication plans? How fast is it moving? What are the threats to the domestic hog supply? We will have a representative in our office this week and I will share the findings in my next column in this forum.

A poll of sorts. We have had significant debate in our office over the prospects of a summer hog rally. The camps are divided. Humor me, if you will, and send me an email with your views. Here are your options.

1. This is a gift. Fair market value from my extensive analysis shows summer hogs trading in the mid-$70s. Pork producers are nuts to walk away from today’s levels.

2. We traded higher last year on account of the belly market; I do not see the same fireworks this year. Low- to mid-$80s are a sane expectation for summer hogs.

3. Take a look at the wean pig values. This is crazy. We are going to trade in the $90s, guaranteed.

4. Happy days are here again. Demand will carry the day. Triple digit hogs are on queue for the summer. We may see live hog values trade higher than the cutout at some point this year. In the Star Trek theme, we are to boldly go where no man has gone before.

You can send me a number with or without a comment; I will share this information, also, in my next column.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

About the Author(s)

You May Also Like