November 9, 2015

To say that exports haven’t been much to write home about in 2015 would be an understatement, but September’s results (compared to last year) were stellar! Total pork exports increase nearly 18% versus one year ago. That is the largest year-on-year increase since March 2014 when foreign buyers joined the panic to get U.S. pork supplies before they were depleted by porcine epidemic diarrhea virus. Before that, the last time such a large year-on-year increase was January 2012.

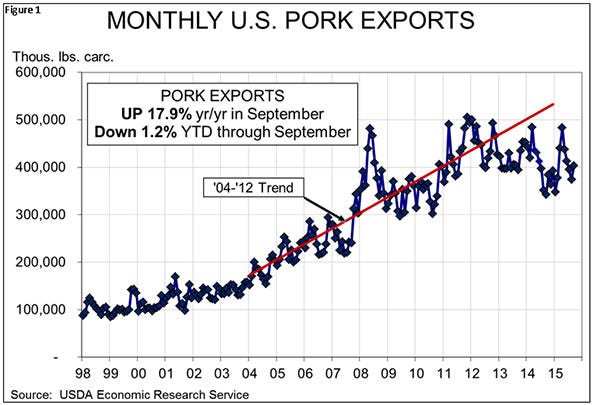

As can be seen in Figure 1, the stellar year-on-year numbers don’t really mean exports were huge in September. I have been saying for some time that the second half of 2015 is going to be better and will drive total year exports above the 2014 level. That’s not a lock at this point but it is a pretty good bet with the year-to-date total through September now just 1.2% smaller than last year. That figure was -21% in January and -15% in February, so this was a pretty big hole from which to climb out.

All this happened well before China’s announcement about relisting six U.S. packing plants and eight U.S. cold storage warehouses. It also happened while the dollar remained strong but relatively stable. I believe that this factor cannot be overlooked.

Brett Stuart of Global Agritrends pointed out last summer that the economic drivers during a currency swing are much different from the drivers after the swing, regardless of the total amount of the valuation change. While no exporting industry likes a stronger dollar, they will all adjust if the rate remains reasonably stable. During a rate-change episode, rapidly changing valuations play havoc with the timing of sales and purchases.

Export markets

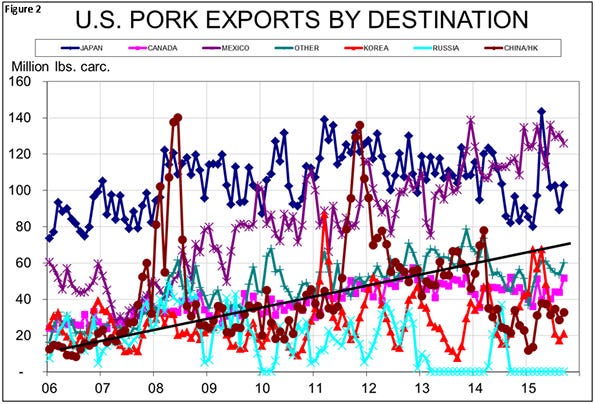

As for individual markets, sales volume to every major market except two improved in September. One of those exceptions was, of course, Russia which is not likely to purchase any U.S. pork any time soon. The other was Mexico but the decline was small and Mexico remains our largest – and most stable – export customer.

Year-to-date shipments to Mexico are still over 12% higher than one year ago and Korea has taken nearly 40% more U.S. pork than it did in 2014. Shipment to the Caribbean are up nearly 25% this year, but shipments to every other major market continue to lag the 2014 pace.

September did have a couple of bright spots, with China/Hong Kong taking nearly 52% more product than they did last year, Japan taking nearly 25% more and “other” markets buying nearly 35% more U.S. pork than during September 2014.

The value of U.S. pork exports continues to slowly gain on year-ago levels. September’s shipments were worth $394 million, just 7.8% less than one year ago. That year-on-year figure was -22% just two months ago. Year-to-date export value still lags 2014 levels by 16% but that comparison, too, continues to improve.

Variety meats

Pork variety meat shipments still lag year-ago levels significantly. September shipments of these price-sensitive items were down 11% from one year ago. Year-to-date variety meat exports are down 9.4% through September. September’s variety meat export value was down 34% from last year and year-to-date variety meat export values are down 24% from 2014. The strong U.S. dollar and the lack of approved plants to ship variety meats to China are big factors in variety meats’ struggle this year.

About the Author(s)

You May Also Like