Russia’s remaining suppliers of imported pork have done well in positioning their products, but face some harsh realities in serving the Russian market.

February 8, 2017

By U.S. Meat Export Federation Staff

In 2012, the last year that most U.S. pork and pork variety meat was eligible for export to Russia, the U.S. industry shipped nearly 100,000 metrics tons valued at more than $280 million. At the time, this made Russia the sixth-largest destination for U.S. pork in both volume and value. Russia had also recently joined the World Trade Organization, a move that had the potential to create a more stable and consistent trading relationship.

The momentum was short-lived, however, as the Russian market soon closed to U.S. pork due to beta agonist-related restrictions. A year later, Russia re-opened to U.S. pork from hogs raised under a never-fed-beta-agonists program, but only two plants were approved to export to Russia. In August 2014, just as U.S. exports began to regain some momentum, Russia suspended imports of most food products from the United States and other nations that had imposed economic sanctions on Russia due to the conflict in Ukraine. As a result, U.S. pork was once again locked out of the Russian market.

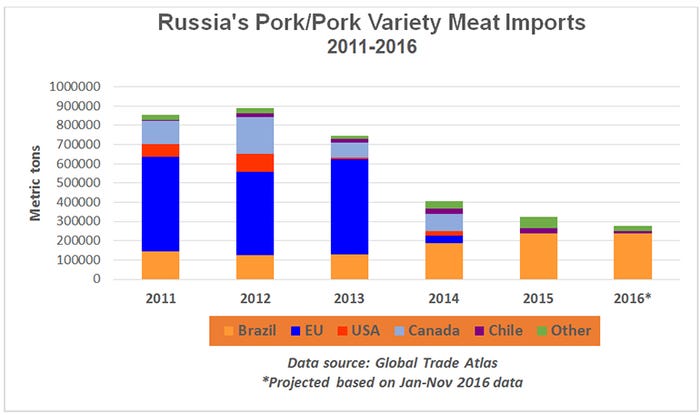

The U.S. Meat Export Federation continues to monitor market trends and conditions in Russia, which now takes most of its imported pork from Brazil. Prior to the August 2014 embargo, Russia had already halted imports from its largest supplier, the European Union, citing concerns about African swine fever. Russia’s imports of pork and pork fat exceeded 1 million mt every year from 2005 through 2012, with the EU accounting for an average of 60% of these imports. In 2016 (through November), Brazil captured 89% of Russia’s imported pork market, compared to 46% in 2014 and just 14% in 2012. Russia’s remaining 2016 imports were mostly supplied by Chile and Belarus.

Russia has long been Brazil’s top pork export market, and with its current captive share of Russia’s imported pork market Brazil’s 2016 exports to Russia totaled 242,000 — up slightly from 2015 and up nearly 80% from 2013. But with the recent changes in the Russian market, Brazil’s 2015 and 2016 exports to Russia were actually smaller than its annual shipments from 2002 through 2009.

Russia’s total pork imports are down about 70% from 2013. While this may, at first glance, suggest that progress is being made toward Russia’s stated goal of self-sufficiency in pork production, the decline is driven more by import restrictions and a decline in consumer purchasing power, according to Yuri Barutkin, a USMEF regional manager based in St. Petersburg.

“The Russian government has certainly emphasized the importance of self-sufficiency in pork and poultry production, and has provided a significant amount of support to domestic producers,” Barutkin explains. “But while Russia’s self-sufficiency gains are largely driven by import restrictions and to some degree by increased domestic production, declining meat consumption is also an important factor. The Russian economy is struggling through very difficult times, and contraction of the economy has resulted in a decline in Russians’ disposable income, which has had a strong impact on consumers’ buying habits.”

Barutkin says Russia’s remaining suppliers of imported pork have done well in positioning their products, but face some harsh realities in serving the Russian market.

“Brazilian and Chilean suppliers have capitalized on the fact that other major pork-exporting countries are absent from the Russian market,” he says. “However, they have certainly had to adjust their expectations in terms of price. While the Russian market is not especially competitive at this time, there is clearly a low ceiling on Russian consumers’ ability to pay.”

You May Also Like