An upside surge in U.S. and world economic activity is going to be very good for livestock producers in the United States.

December 23, 2016

If you’ve never heard the saying: “A rising tide lifts all boats”, you will likely hear it many times in the weeks and months ahead. I’m referring to an economic resurgence in the U.S. economy that will drive demand for all sorts of commodities, including red meat through the roof.

It all seemed to start with the Trump victory in the election for president of the United States. This has triggered all sorts of events and reactions, actually too numerous to mention in one column. The most obvious has been the explosion in the stock market and the huge rally in the U.S. dollar. The stock market is considered a six- to eight-month barometer of economic activity. The market is signaling that the U.S. economy will be accelerating by spring or early summer. The powerful move in the dollar is confirmation that the world currency markets pretty much agree that the U.S. economy is considered the best economy (for possible growth) in the world.

The point of this discussion is that an upside surge in U.S. and world economic activity is going to be very good for livestock producers in the United States. Beef, pork and poultry producers all stand to benefit greatly. This is not just talk either; we’re actually already experiencing this “revival” in meat demand. The week ending Dec. 17 witnessed a near-record large hog slaughter (2.502 million hogs) yet the pork cutout was up over $2 during the week. The surge in pork demand is now well documented in the form of large and aggressive foodservice demand and large and aggressive export demand. Mexico has been buying hams from the U.S. market at breakneck speed since the election. In the face of record large hog slaughter, pork loins were described to be in tight supply as users bought aggressively. Their fear was that with the holidays and the disruption in kill, production would not be large enough to satisfy large orders so the aggressive buying bubbled to the surface. Typically, in most years, demand right before the holidays is very slow contributing to seasonally lower prices.

The fact is low prices cure low prices. Pork loin prices, as well as nearly every other pork cut (except hams), declined to historically low levels this fall. Historically low prices in tandem with major outside forces influencing economic growth have quickly shifted the demand curve for pork. This demand is not going to go away quickly or fade. In fact, it’s likely just getting started.

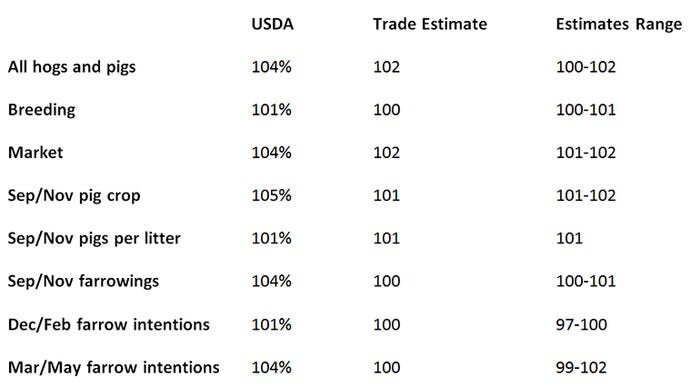

The quarterly hog and pig report, released during trading on Dec. 23, confirmed that expansion in the U.S. hog industry continued as of Dec. 1. In fact, the breeding herd, measured at 101% of last year, was larger than expected. In addition, farrowing intentions for the December-to-February period, at 101% of the previous year and for March-to-May at 104%, suggest that expansion will continue during the first half of 2017. The report also indicated that more sows farrowed during the September-to-November timeframe than reported in the September report. September-to-November farrowing were 104% of last year, resulting in a pig crop equaling 105% of last year’s fall pig crop. Thus, at first blush the report appears to indicate that improved demand for pork will be seriously challenged by record large production in 2017, surpassing record large production this year.

We’re advising clients to watch for a pullback in futures to the November consolidation with the November highs likely representing solid support on most price charts. TRhe numbers as reported by the USDA are listed below.

About the Author(s)

You May Also Like