Steady hog weights have been one factor in the cutout value finding some solid ground in the low-$70s during October and now into November.

November 8, 2016

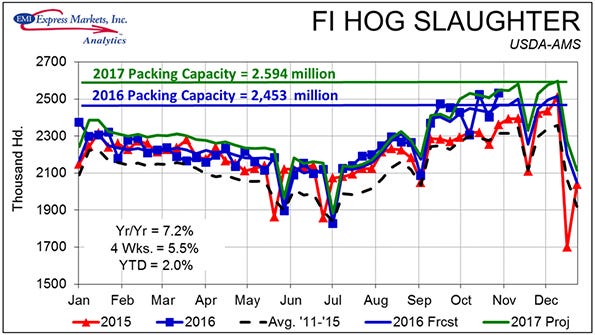

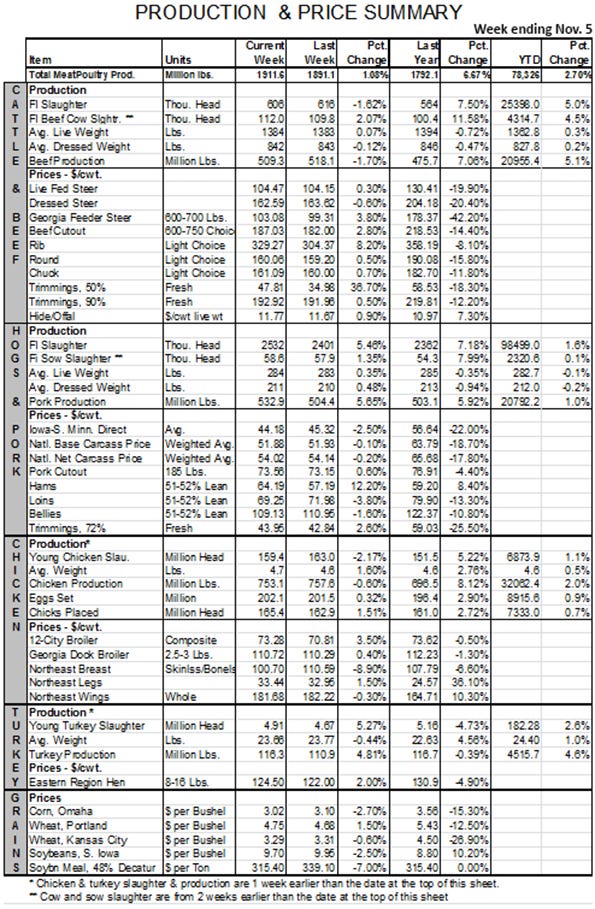

The record fall of 2016 continued last week with yet another record for weekly slaughter. Last week’s 2.532 million head broke the previous record of 2.5236 million that had stood for exactly two weeks. Both of these figures were well above the rated capacity of U.S. slaughter plants of 2.453 million head per week.

That figure, of course, comes from my survey of packers last summer on behalf of National Hog Farmer, and it is based on the assumption of 5.4 workdays per week. Packers are running well over that rate at present with at least one packer even running last Sunday. We say “at least” because we only knew of one and the Sunday numbers were included in the Monday total reported by USDA. Monday’s estimate of 460,000 head stands as an all-time record but it likely included 18,000-20,000 animals harvested on Sunday.

So these big numbers mean our fourth quarter forecasts are out the window, right? Not really. The big record-setting totals are both at least partially attributable to the disruptions of Hurricane Matthew. North Carolina plants picked up some hogs the week that ended Oct. 21 that were not harvested the week ending Oct. 14. Some operations were slowed or suspended in North Carolina the week ending Oct. 28, and those hogs (or efforts to catch up with hog supplies and product needs) were the reason for last week’s big run. If we add up actual slaughter since the week ending Sept. 9, it is only 12,500 head (0.058%) larger than our forecasts. The timing has been pretty variable, but the total has been spot on.

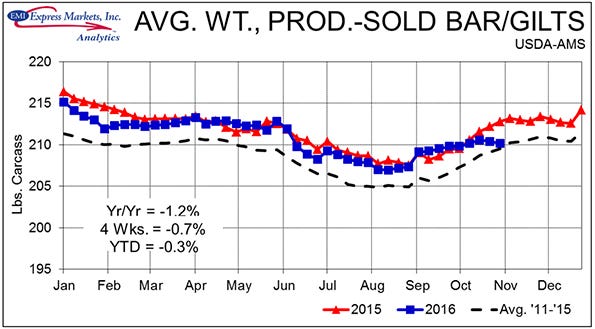

Packing plant workers and hog producers have worked hard to get these hogs through the system. So hard, in fact, that we believe hog numbers are ultra-current at the present time. Now none of this was done with completely altruistic motives. Packing plant workers usually expect to work extra hours in the fourth quarter and have been paid well for those extra hours this year. Pork producers knew they needed to keep current but falling prices provided a huge incentive to get hogs moved to slaughter in a timely manner, especially when hog prices were doing little more than covering feed prices. The combined effort has left hogs 2.6 pounds lighter than we expected them to be last week, reducing supplies by more than 1.2% from where they would have been if “normal” weight increases had been observed.

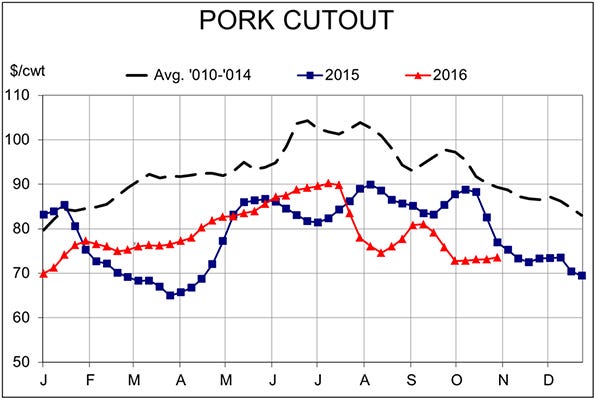

Steady hog weights have been one factor in the cutout value finding some solid ground in the low-$70s during October and now into November. That is pretty remarkable given the size of market hog supplies and the normal tendency for the cutout to decline by about $6.60 from Oct. 1 to Nov. 5. Last year, this was the period during which the pork and hog markets fell apart. This year, the bleeding has stopped getting worse — at least for the moment.

The other factor that has stabilized pork markets is low prices themselves. The negative relationship between price and quantity consumed means that consumers will buy more when prices are low. That’s a good thing since prices are low because the quantity supplied is high. But the consumer response to low prices (i.e. taking more product off the market) helps to stabilize those low prices. We will likely see the same thing when October export data are released in early December: Lower prices helped overcome the disadvantage of a strong dollar and very likely pushed more product into export markets. We don’t know that for sure yet but it certainly makes sense and helps explain the price stability we’ve seen in the face of huge supplies.

And speaking of exports: They were up from one year ago in September but not by much. The month’s shipments of 415.741 million pounds, carcass weight equivalent, were down slightly from those of August but were 3% larger than last year. Those shipments brought the year-to-date total to 3.779 billion pounds carcass weight, up 1.2% from one year ago. The year-on-year numbers continue to scratch and claw their way away from zero, and we still think they will end up +3 to +4% by year’s end. The value of pork muscle cut exports was up 3.8% from one year ago in September, leaving the year-to-date total for muscle cut value virtually unchanged from 2015.

Pork variety meat exports exceeded their year-ago level by 25.8% in September. The month’s 37,719 metric tons brought the year-to-date total to 332,220 mt, 13.8% more than one year ago when plant de-listings by China due to ractopamine were a significant roadblock for normal business dealings. September’s variety meat exports were valued at $65.117 million, 39.3% more than last year. The year-to-date total value of variety meat exports now stands at $540.505 million, 13% more than last year.

About the Author(s)

You May Also Like